1404 S 1050 W Orem, UT 84058

Lakeview NeighborhoodEstimated Value: $346,313 - $363,000

3

Beds

2

Baths

1,247

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 1404 S 1050 W, Orem, UT 84058 and is currently estimated at $355,078, approximately $284 per square foot. 1404 S 1050 W is a home located in Utah County with nearby schools including Vineyard Elementary School, Lakeridge Jr High School, and Mountain View High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 1, 2010

Sold by

Lehnardt Ruediger and Lehnardt Carel

Bought by

Lehnardt Ruediger K R and Carel Lehnardt L

Current Estimated Value

Purchase Details

Closed on

Jan 27, 2010

Sold by

Leeper Jamis

Bought by

Lehnardt Ruediger and Lehnardt Carel

Purchase Details

Closed on

Feb 14, 2003

Sold by

Hall Timothy C and Hall Kellie T

Bought by

Leeper Jamis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,157

Interest Rate

5.89%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 30, 2000

Sold by

Chambery Lc

Bought by

Hall Timothy C and Hall Kellie T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,990

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lehnardt Ruediger K R | -- | None Available | |

| Lehnardt Ruediger | -- | Inwest Title Services Inc | |

| Leeper Jamis | -- | Inwest Title Services Inc | |

| Hall Timothy C | -- | First American |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Leeper Jamis | $124,157 | |

| Previous Owner | Hall Timothy C | $115,990 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,532 | $183,370 | -- | -- |

| 2024 | $1,532 | $187,385 | $0 | $0 |

| 2023 | $1,449 | $190,410 | $0 | $0 |

| 2022 | $1,206 | $153,615 | $0 | $0 |

| 2021 | $1,136 | $219,100 | $26,300 | $192,800 |

| 2020 | $1,032 | $195,600 | $23,500 | $172,100 |

| 2019 | $954 | $188,000 | $24,000 | $164,000 |

| 2018 | $998 | $188,000 | $24,000 | $164,000 |

| 2017 | $848 | $85,525 | $0 | $0 |

| 2016 | $836 | $77,770 | $0 | $0 |

| 2015 | $850 | $74,800 | $0 | $0 |

| 2014 | $785 | $68,750 | $0 | $0 |

Source: Public Records

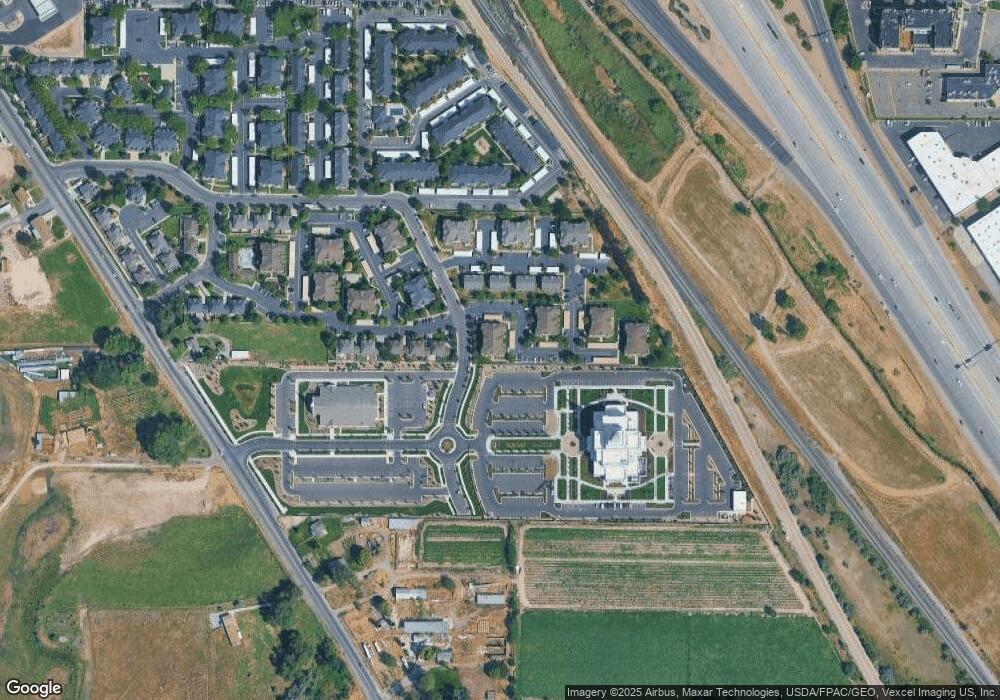

Map

Nearby Homes

- 1140 W 1390 S

- 1037 W 1360 S

- 1363 S 1150 W

- 1191 W 1275 S

- 1700 S Sandhill Rd Unit F401

- 1217 W 1860 S

- 1899 S 1030 W

- 467 W 1640 S

- 839 S 725 W

- 1463 W 730 S

- 1041 W 600 S

- The Mesa Plan at Lakeview Fields

- The Juniper Plan at Lakeview Fields

- The Newport Plan at Lakeview Fields

- The Hampton Plan at Lakeview Fields

- The Kensington Plan at Lakeview Fields

- 458 W 1840 S

- 302 W Hidden Hollow Dr

- 570 S 800 West St Unit 15

- 740 W 580 S

- 1412 S 1050 W

- 1396 S 1050 W

- 1412 S 1050 W Unit G-11

- 1406 S 1050 W

- 1406 S 1050 W Unit BLDG G

- 1414 S 1050 W

- 1398 S 1050 W

- 1414 S 1050 W Unit 12

- 1398 S 1050 W Unit 4

- 1410 S 1050 W

- 1402 S 1050 W

- 1394 S 1050 W

- 1408 S 1050 W

- 1400 S 1050 W

- 1392 S 1050 W

- 1048 W 1410 S

- 1040 W 1410 S

- 1032 W 1410 S

- 1105 W 1390 S

- 1042 W 1410 S