14075 14075 Sw 50th Ln # 14075 Unit 14075 Miramar, FL 33027

Miramar Patio Homes NeighborhoodEstimated Value: $414,000 - $504,000

--

Bed

3

Baths

1,601

Sq Ft

$296/Sq Ft

Est. Value

About This Home

This home is located at 14075 14075 Sw 50th Ln # 14075 Unit 14075, Miramar, FL 33027 and is currently estimated at $473,109, approximately $295 per square foot. 14075 14075 Sw 50th Ln # 14075 Unit 14075 is a home located in Broward County with nearby schools including Coral Cove Elementary School, New Renaissance Middle School, and Everglades High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Sadeek Tota Amna

Current Estimated Value

Purchase Details

Closed on

Oct 16, 2009

Sold by

Chase Home Finance Llc

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Oct 13, 2009

Sold by

Fundora Annie

Bought by

Chase Home Finance Llc

Purchase Details

Closed on

Jun 24, 2005

Sold by

Southern Homes Of Broward Ix Inc

Bought by

Gruezo Hildebrandt and Fundora Annie E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,900

Interest Rate

5.57%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sadeek Tota Amna | $179,000 | Attorney | |

| Federal Home Loan Mortgage Corp | -- | Attorney | |

| Chase Home Finance Llc | -- | Attorney | |

| Gruezo Hildebrandt | $219,900 | Gables Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gruezo Hildebrandt | $43,900 | |

| Previous Owner | Gruezo Hildebrandt | $175,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,551 | $410,440 | $50,780 | $359,660 |

| 2024 | $8,104 | $410,440 | $50,780 | $359,660 |

| 2023 | $8,104 | $351,710 | $0 | $0 |

| 2022 | $6,944 | $319,740 | $0 | $0 |

| 2021 | $6,402 | $290,680 | $0 | $0 |

| 2020 | $5,873 | $264,260 | $50,780 | $213,480 |

| 2019 | $5,987 | $266,570 | $50,780 | $215,790 |

| 2018 | $5,514 | $248,060 | $50,780 | $197,280 |

| 2017 | $5,078 | $227,700 | $0 | $0 |

| 2016 | $4,876 | $207,000 | $0 | $0 |

| 2015 | $4,550 | $188,190 | $0 | $0 |

| 2014 | $4,124 | $171,090 | $0 | $0 |

| 2013 | -- | $155,540 | $50,780 | $104,760 |

Source: Public Records

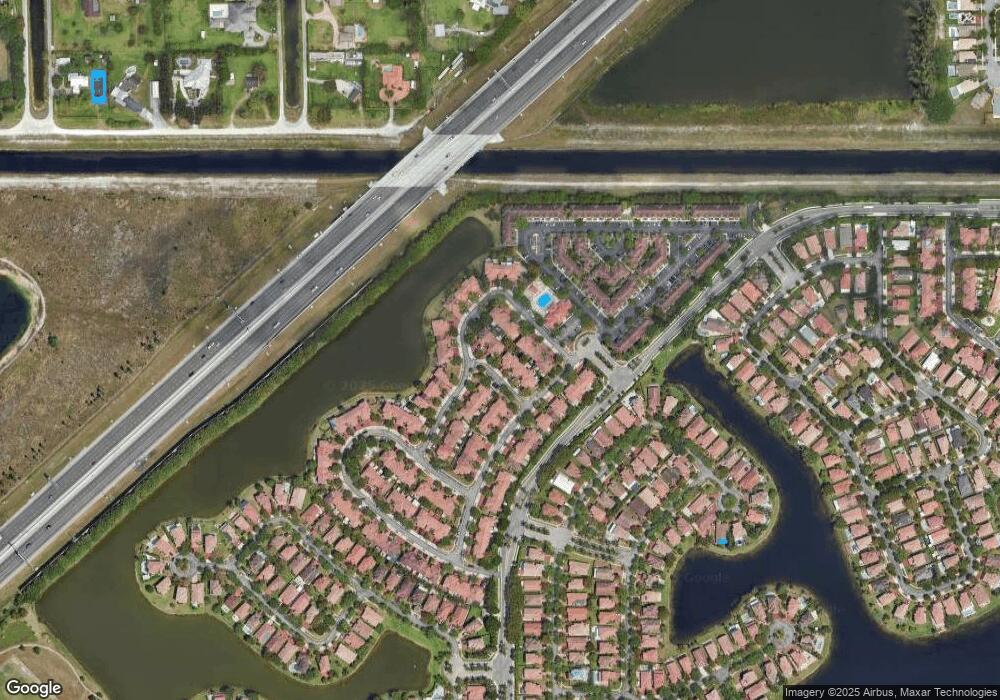

Map

Nearby Homes

- 14075 SW 50th Ln

- 14078 SW 50th Ct

- 14082 SW 50th Ct

- 5074 SW 140th Terrace

- 14098 SW 51st Ct

- 4921 SW 140th Terrace Unit 1

- 4917 SW 141st Ave Unit 4

- 4964 SW 140th Terrace Unit 8

- 14053 SW 49th St Unit 7

- 14111 SW 49th St Unit 8

- 4913 SW 141st Ave Unit 2

- 5046 SW 137th Terrace

- 13680 SW 50th Ct

- 4800 SW 141st Ave

- 14201 SW 48th Ct

- 5000 SW 136th Ave

- 5048 SW 136th Ave

- 13519 SW 50th Ct

- 8155 NW 201st St

- 7897 NW 200th Terrace

- 14079 SW 50th Ln

- 14071 SW 50th Ln

- 14067 SW 50th Ln

- 14083 SW 50th Ln

- 14059 SW 50th Ln

- 14087 SW 50th Ln

- 14063 14063 Sw 50th Ln

- 14078 SW 50th Ct Unit 1

- 14078 SW 50th Ct Unit 14078

- 14074 SW 50th Ct

- 14070 SW 50th Ct

- 14066 SW 50th Ct

- 14062 SW 50th Ct

- 14058 SW 50th Ct

- 5053 SW 141st Ave

- 14090 SW 50th Ct

- 14086 SW 50th Ct

- 14055 SW 50th Ln

- 5059 SW 141st Ave