141 E 820 S Centerville, UT 84014

Estimated Value: $339,000 - $385,000

3

Beds

2

Baths

1,314

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 141 E 820 S, Centerville, UT 84014 and is currently estimated at $359,952, approximately $273 per square foot. 141 E 820 S is a home located in Davis County with nearby schools including J A Taylor Elementary School, Centerville Jr High, and Viewmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2001

Sold by

Richard Jeremy J and Richard Jenny

Bought by

Chowen Suzanne M

Current Estimated Value

Purchase Details

Closed on

Jun 1, 1999

Sold by

Richard Jeremy J

Bought by

Richard Jeremy J and Richard Jenny

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,961

Interest Rate

6.84%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 16, 1996

Sold by

Riddle Shauna

Bought by

Huish Jackie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,000

Interest Rate

6.99%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chowen Suzanne M | -- | Equity Title Agency | |

| Richard Jeremy J | -- | Meridian Title Company | |

| Richard Jeremy J | -- | Meridian Title Company | |

| Huish Jackie L | -- | Security Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Richard Jeremy J | $125,961 | |

| Previous Owner | Huish Jackie L | $86,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,811 | $173,250 | $72,050 | $101,200 |

| 2024 | $1,837 | $178,750 | $55,000 | $123,750 |

| 2023 | $1,792 | $315,000 | $98,000 | $217,000 |

| 2022 | $1,795 | $173,800 | $52,800 | $121,000 |

| 2021 | $1,685 | $254,000 | $69,000 | $185,000 |

| 2020 | $1,486 | $224,000 | $64,500 | $159,500 |

| 2019 | $1,426 | $210,000 | $62,000 | $148,000 |

| 2018 | $1,272 | $185,000 | $58,000 | $127,000 |

| 2016 | $952 | $77,000 | $15,950 | $61,050 |

| 2015 | $925 | $70,510 | $15,950 | $54,560 |

| 2014 | $904 | $70,512 | $18,333 | $52,179 |

| 2013 | -- | $75,276 | $13,200 | $62,076 |

Source: Public Records

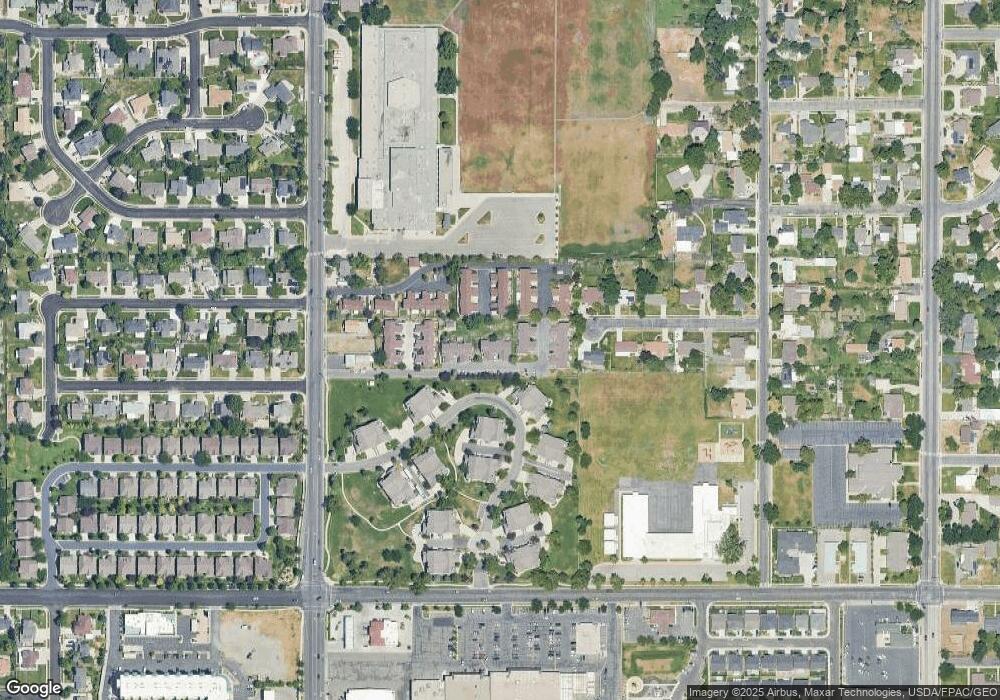

Map

Nearby Homes

- 16 W 780 S

- 967 S Courtyard Ln

- 83 W 850 S

- 96 Village Square Rd

- 345 E 600 S

- 951 Centerville Commons Way

- 243 E 1200 S

- 1420 N Main St

- 353 Florentine Ln

- 204 Lyman Ln

- 610 E Pages Ln

- 88 W 50 S Unit Q17

- 88 W 50 S Unit F9

- 88 W 50 S Unit A4

- 88 W 50 S Unit C-3

- 328 E 1100 S

- 1410 N 200 W

- 266 E Center St

- 725 E 600 S

- 360 E Center St

- 147 E 820 S

- 135 E 820 S Unit 18

- 129 E 820 S

- 153 E 820 S

- 159 E 820 S

- 165 E 820 S

- 123 E 820 S

- 171 E 820 S

- 117 E 820 S

- 144 E 735 S Unit 22

- 138 E 735 S Unit 21

- 180 E 735 S Unit 28

- 111 E 820 S

- 111 E 820 S Unit 14

- 893 Courtyard Ln Unit 54

- 108 E 735 S Unit 16

- 891 Courtyard Ln Unit 53

- 174 E 735 S Unit 27

- 80 E Courtyard Ln

- 80 E Courtyard Ln Unit 45