1412 Lyons Rd Amelia, OH 45102

Estimated Value: $315,000 - $412,000

3

Beds

3

Baths

2,264

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 1412 Lyons Rd, Amelia, OH 45102 and is currently estimated at $359,600, approximately $158 per square foot. 1412 Lyons Rd is a home located in Clermont County with nearby schools including Amelia Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2005

Sold by

Abn Amro Mortgage Group Inc

Bought by

Cooper Zane C and Cooper Linda K

Current Estimated Value

Purchase Details

Closed on

Apr 8, 2005

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Abn Amro Mortgage Group Inc

Purchase Details

Closed on

Aug 26, 2004

Sold by

Wakefield James L and Abn Amro Mortgage Group Inc

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Dec 1, 1995

Sold by

Sims Louis H

Bought by

Wakefield James L and Wakefield Katherine J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Interest Rate

7.44%

Mortgage Type

Balloon

Purchase Details

Closed on

Dec 1, 1988

Purchase Details

Closed on

Nov 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cooper Zane C | $115,500 | -- | |

| Abn Amro Mortgage Group Inc | -- | -- | |

| Federal Home Loan Mortgage Corporation | $160,000 | -- | |

| Wakefield James L | $165,000 | -- | |

| -- | $132,000 | -- | |

| -- | $132,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wakefield James L | $148,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,126 | $117,150 | $24,360 | $92,790 |

| 2023 | $6,135 | $117,150 | $24,360 | $92,790 |

| 2022 | $4,943 | $82,120 | $17,050 | $65,070 |

| 2021 | $4,889 | $82,120 | $17,050 | $65,070 |

| 2020 | $4,890 | $82,120 | $17,050 | $65,070 |

| 2019 | $3,932 | $71,470 | $17,710 | $53,760 |

| 2018 | $3,969 | $71,470 | $17,710 | $53,760 |

| 2017 | $3,507 | $71,470 | $17,710 | $53,760 |

| 2016 | $3,507 | $57,200 | $14,180 | $43,020 |

| 2015 | $3,294 | $57,200 | $14,180 | $43,020 |

| 2014 | $3,294 | $57,200 | $14,180 | $43,020 |

| 2013 | $3,108 | $53,660 | $14,880 | $38,780 |

Source: Public Records

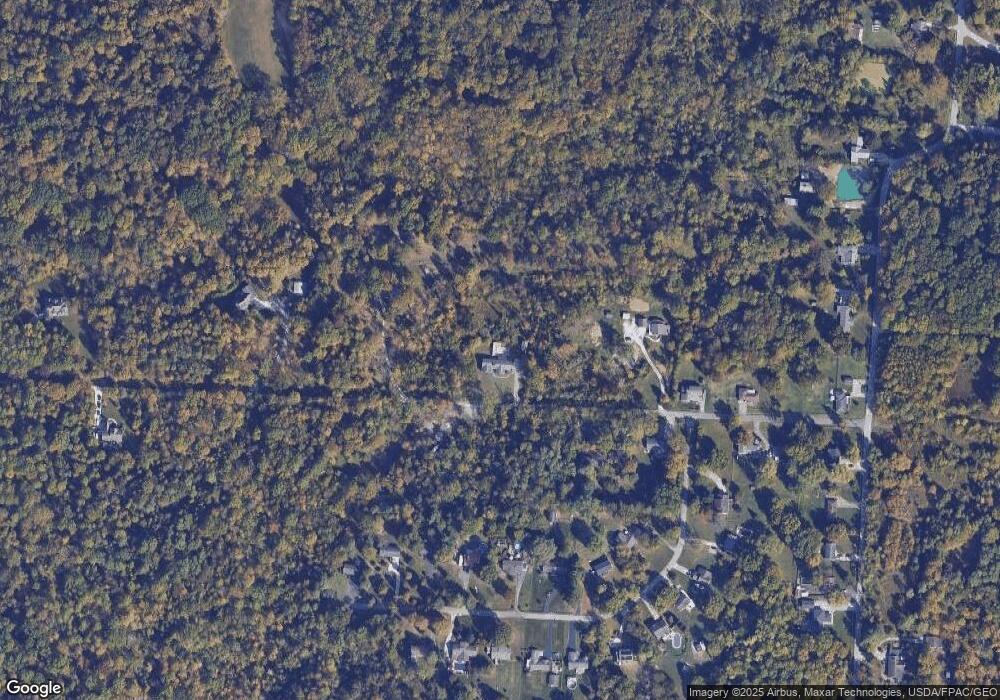

Map

Nearby Homes

- 50 Robin Way

- 1300 Riverwalk Dr

- 263 Deer Creek Dr

- 21 Mallard Dr

- 253 Deer Creek Dr

- 27 Heron Dr

- 11 Finch Ct

- 27 Locustwood Ct

- 3330 Huntsman Trace Unit 803C

- 1554 Denny Dr

- 288 Samplewood Ln

- 1700 White Birch

- 9 Woodside Park Dr

- 185 Woodside Park Dr

- 3396 Merwin 10 Mile Rd

- 0 Fagins Run Rd Unit 1866377

- 1969 Ohio 125

- 1821 Ohio 125

- 0 Ohio 125

- 9 Letitia Ave

Your Personal Tour Guide

Ask me questions while you tour the home.