1415 Vista Walk Unit C1415 Hoffman Estates, IL 60169

South Hoffman Estates NeighborhoodEstimated Value: $162,000 - $195,000

1

Bed

--

Bath

900

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 1415 Vista Walk Unit C1415, Hoffman Estates, IL 60169 and is currently estimated at $179,130, approximately $199 per square foot. 1415 Vista Walk Unit C1415 is a home located in Cook County with nearby schools including Neil Armstrong Elementary School, Dwight D Eisenhower Junior High School, and Hoffman Estates High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2020

Sold by

Johnson James B and Johnson Kristen

Bought by

Johnson James B and Johnson Kristen

Current Estimated Value

Purchase Details

Closed on

Nov 14, 2018

Sold by

Karry Kristen and Johnson James B

Bought by

Johnson James B and Johnson Kristen R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,512

Outstanding Balance

$56,653

Interest Rate

4.87%

Mortgage Type

New Conventional

Estimated Equity

$122,477

Purchase Details

Closed on

Feb 25, 1999

Sold by

Straube Dawn

Bought by

Karry Kristen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,500

Interest Rate

6.83%

Purchase Details

Closed on

Sep 30, 1993

Sold by

Ruffin Bernard and Ruffin Donna

Bought by

Straube Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,500

Interest Rate

6.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson James B | -- | None Available | |

| Johnson James B | -- | Carrington Title Partners Ll | |

| Karry Kristen | $54,500 | Land Title Group Inc | |

| Straube Dawn | $32,666 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnson James B | $89,512 | |

| Closed | Karry Kristen | $54,500 | |

| Previous Owner | Straube Dawn | $43,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,551 | $11,629 | $558 | $11,071 |

| 2023 | $2,438 | $11,629 | $558 | $11,071 |

| 2022 | $2,438 | $11,629 | $558 | $11,071 |

| 2021 | $1,241 | $7,034 | $879 | $6,155 |

| 2020 | $1,286 | $7,034 | $879 | $6,155 |

| 2019 | $1,296 | $7,856 | $879 | $6,977 |

| 2018 | $988 | $6,465 | $767 | $5,698 |

| 2017 | $990 | $6,465 | $767 | $5,698 |

| 2016 | $1,182 | $6,465 | $767 | $5,698 |

| 2015 | $1,270 | $6,578 | $669 | $5,909 |

| 2014 | $1,265 | $6,578 | $669 | $5,909 |

| 2013 | $1,214 | $6,578 | $669 | $5,909 |

Source: Public Records

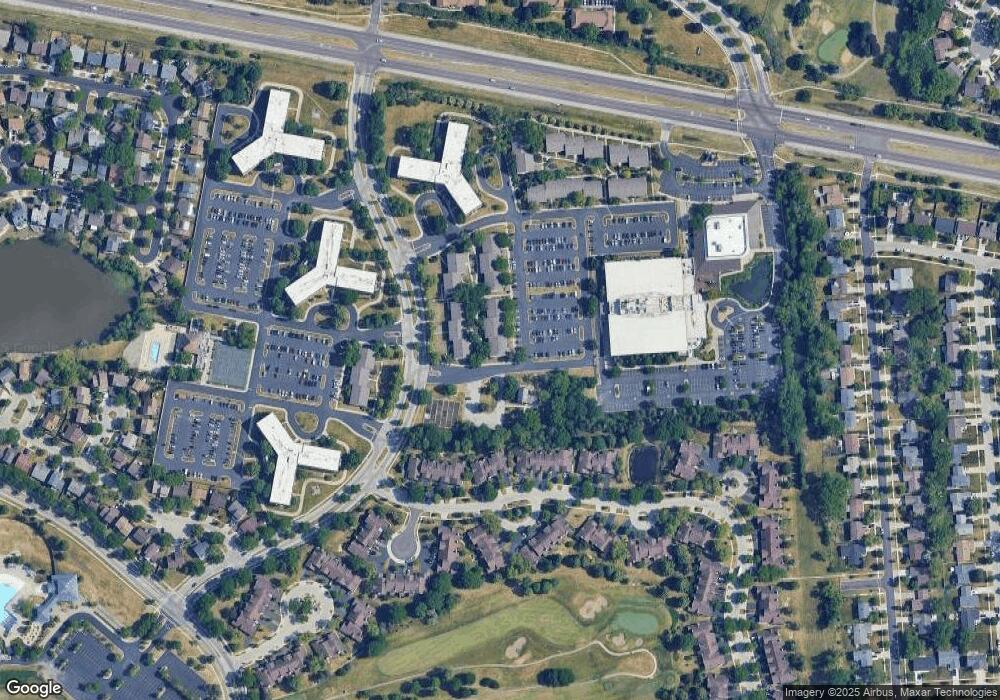

Map

Nearby Homes

- 1375 Rebecca Dr Unit 318

- 1475 Rebecca Dr Unit 217

- 1698 Pebble Beach Dr

- 1415 N Oakmont Rd

- 1763 Bristol Walk Unit 1763

- 1808 Fayette Walk Unit H

- 1704 Fayette Walk Unit B

- 1121 Southbridge Ln

- 1840 Huntington Blvd Unit 415

- 1840 Huntington Blvd Unit 412

- 1103 Southbridge Ln

- 1685 Cornell Dr

- 1672 Cornell Dr

- 1365 Blair Ln

- 1020 Denham Place Unit 1

- 1862 Stockton Dr Unit 3283

- 1360 Devonshire Ln

- 1352 W Oakmont Rd

- 1854 Huntington Blvd Unit C

- 1456 Della Dr

- 1415 Vista Walk Unit D

- 1415 Vista Walk Unit A1415

- 1415 Vista Walk Unit D1415

- 1415 Vista Walk Unit B1415

- 1415 Vista Walk Unit A

- 1425 Vista Walk Unit C1425

- 1425 Vista Walk Unit B1425

- 1425 Vista Walk Unit A1425

- 1425 Vista Walk Unit D1425

- 1425 Vista Walk Unit C

- 1425 Vista Walk Unit B

- 1420 Vista Walk Unit D1420

- 1420 Vista Walk Unit A1420

- 1420 Vista Walk Unit B1420

- 1420 Vista Walk Unit C1420

- 1420 Vista Walk Unit 2B

- 1420 Vista Walk Unit B

- 1420 Vista Walk Unit A

- 1420 Vista Walk Unit D

- 1430 Vista Walk Unit D1430