1416 Wabash Ave Unit 1416W Delaware, OH 43015

Estimated Value: $138,000 - $144,331

2

Beds

1

Bath

896

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 1416 Wabash Ave Unit 1416W, Delaware, OH 43015 and is currently estimated at $141,583, approximately $158 per square foot. 1416 Wabash Ave Unit 1416W is a home located in Delaware County with nearby schools including Laura Woodward Elementary School, John C. Dempsey Middle School, and Rutherford B. Hayes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2024

Sold by

Iverson Kevin

Bought by

Dershem Krista M and Dershem Scott D

Current Estimated Value

Purchase Details

Closed on

Oct 21, 2021

Sold by

Jmh Visions Llc

Bought by

Iverson Kevin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,900,000

Interest Rate

2.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 23, 2021

Sold by

Iverson Kevin and Iverson Breona

Bought by

Jmh Visions Llc

Purchase Details

Closed on

Jan 15, 2021

Sold by

Lasley Melissa A and Scoville Jeremiah

Bought by

Iverson Kevin

Purchase Details

Closed on

Jul 28, 2006

Sold by

Rivergate Property Group Llc

Bought by

Lasley Melissa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,100

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dershem Krista M | $139,000 | Crown Search Box | |

| Iverson Kevin | -- | Peak Title Agency | |

| Iverson Kevin | -- | Peak Title | |

| Jmh Visions Llc | -- | Ohio Real Title | |

| Iverson Kevin | $65,000 | None Available | |

| Lasley Melissa A | $79,100 | Focus Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Iverson Kevin | $6,900,000 | |

| Previous Owner | Iverson Kevin | $69,000 | |

| Previous Owner | Lasley Melissa A | $79,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,914 | $39,560 | $5,780 | $33,780 |

| 2023 | $1,918 | $39,560 | $5,780 | $33,780 |

| 2022 | $1,190 | $21,320 | $5,320 | $16,000 |

| 2021 | $1,216 | $21,320 | $5,320 | $16,000 |

| 2020 | $1,231 | $21,320 | $5,320 | $16,000 |

| 2019 | $1,070 | $16,800 | $4,200 | $12,600 |

| 2018 | $1,085 | $16,800 | $4,200 | $12,600 |

| 2017 | $1,075 | $15,400 | $2,800 | $12,600 |

| 2016 | $911 | $15,400 | $2,800 | $12,600 |

| 2015 | $916 | $15,400 | $2,800 | $12,600 |

| 2014 | $931 | $15,400 | $2,800 | $12,600 |

| 2013 | $1,425 | $23,450 | $3,500 | $19,950 |

Source: Public Records

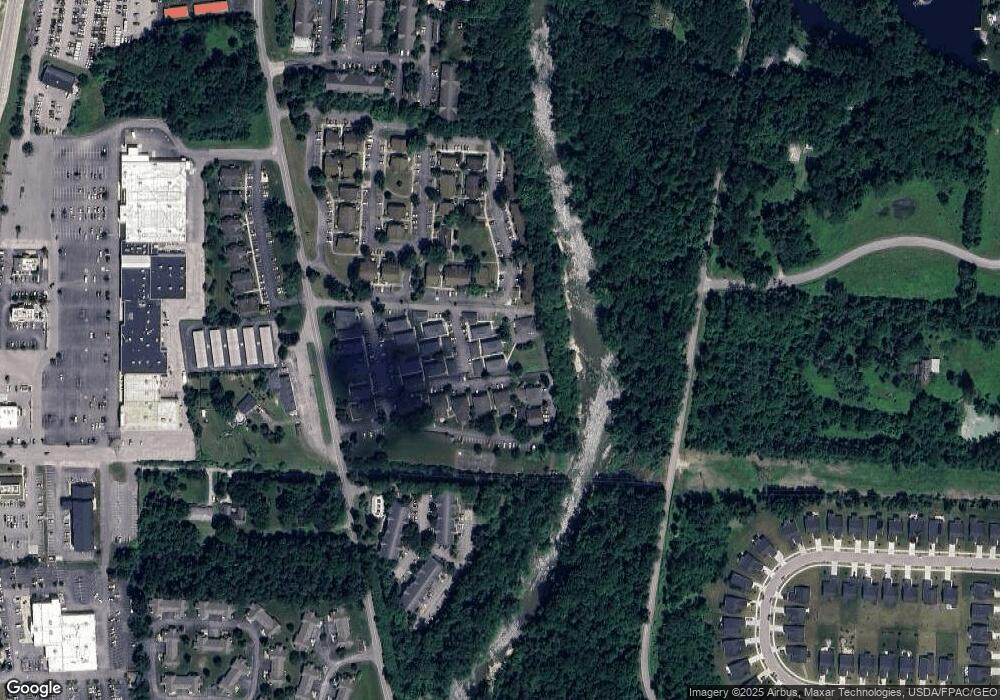

Map

Nearby Homes

- 1410 Stratford Rd

- 45 Elba Ct

- 860 Village Dr Unit 860

- 144 Wagner Way

- 857 Village Dr Unit 857

- 181 Campo St

- 45 Elba Crt

- 61 Corsica Way

- 582 Adrian Dr

- 50 Birch Row Dr

- 102 Corsica Way

- 130 Cottswold Dr

- 21 Birch Row Dr

- 19 Winter Pine Dr

- 626 Riverby Ln

- 13 Birch Row Dr

- 5 Spring Lake Ct

- 36 Ravine Ridge Dr

- 8 Winter Pine Dr

- 25 Ravine Ridge Dr

- 1420 Wabash Ave Unit 1420W

- 1422 Wabash Ave Unit 1422W

- 1408 Wabash Ave Unit 1408W

- 1418 Wabash Ave Unit 1418W

- 1410 Wabash Ave

- 1430 Wabash Ave Unit 1430W

- 1428 Wabash Ave Unit 1428W

- 1412 Wabash Ave Unit 1412W

- 1414 Wabash Ave Unit 1414W

- 1426 Wabash Ave Unit 1426W

- 1424 Wabash Ave Unit 1424W

- 610 River Oaks Dr Unit 610

- 620 River Oaks Dr

- 620 River Oaks Dr Unit B

- 520 River Oaks Dr

- 810 River Oaks Dr Unit 810

- 640 River Oaks Dr Unit 640

- 1413 Wabash Ave

- 510 River Oaks Dr

- 630 River Oaks Dr Unit 19C