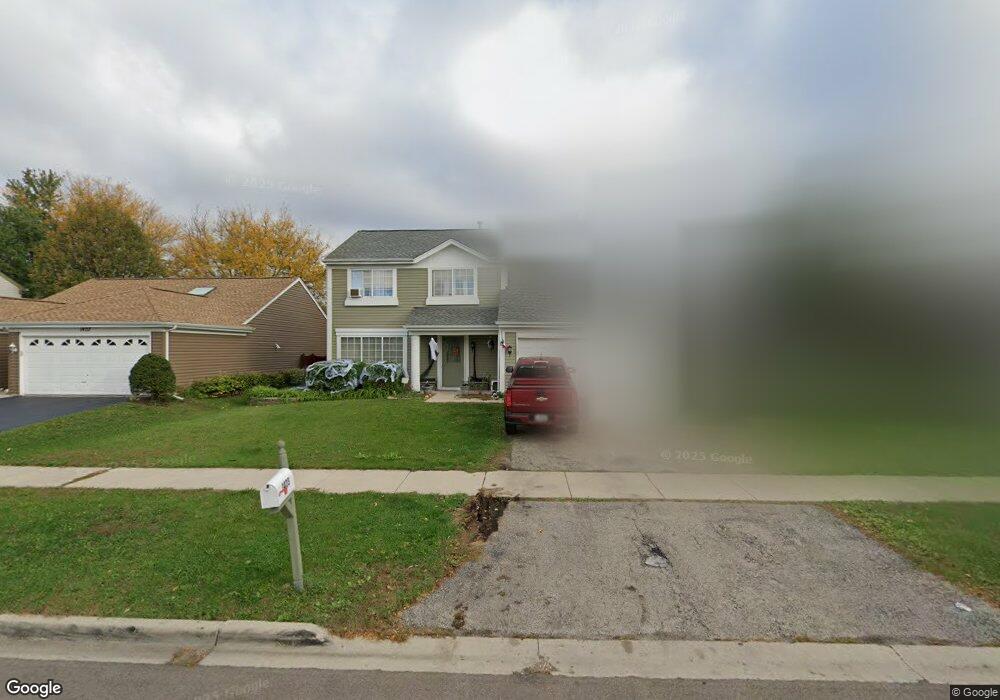

1423 Golden Oaks Pkwy Aurora, IL 60506

Edgelawn Randall NeighborhoodEstimated Value: $343,066 - $353,000

4

Beds

3

Baths

1,508

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 1423 Golden Oaks Pkwy, Aurora, IL 60506 and is currently estimated at $349,267, approximately $231 per square foot. 1423 Golden Oaks Pkwy is a home located in Kane County with nearby schools including Smith Elementary School, Jewel Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2007

Sold by

Wallace Alex and Wallace Phyllis A

Bought by

Reyes Lazaro and Salgado Esther

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,850

Outstanding Balance

$122,910

Interest Rate

6.28%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$226,357

Purchase Details

Closed on

May 23, 2002

Sold by

Phillippe Donald Ross and Phillippe Tina Marie

Bought by

Wallace Alex and Wallace Phyllis A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,478

Interest Rate

6.95%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reyes Lazaro | $226,500 | First American Title | |

| Wallace Alex | $181,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reyes Lazaro | $203,850 | |

| Previous Owner | Wallace Alex | $178,478 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,632 | $91,758 | $18,563 | $73,195 |

| 2023 | $6,337 | $81,985 | $16,586 | $65,399 |

| 2022 | $6,090 | $74,804 | $15,133 | $59,671 |

| 2021 | $5,815 | $69,643 | $14,089 | $55,554 |

| 2020 | $5,843 | $68,415 | $13,087 | $55,328 |

| 2019 | $5,612 | $63,388 | $12,125 | $51,263 |

| 2018 | $5,507 | $61,163 | $11,215 | $49,948 |

| 2017 | $5,469 | $59,143 | $10,334 | $48,809 |

| 2016 | $5,300 | $55,890 | $8,858 | $47,032 |

| 2015 | $4,539 | $48,589 | $7,617 | $40,972 |

| 2014 | $4,539 | $45,272 | $7,326 | $37,946 |

| 2013 | $4,539 | $46,066 | $7,221 | $38,845 |

Source: Public Records

Map

Nearby Homes

- 1532 Golden Oaks Pkwy

- 910 Southbridge Dr

- 461 Sullivan Rd

- 1035 Newcastle Ln

- 795 N Elmwood Dr

- 781 N Elmwood Dr

- 1815 Brighton Cir

- 972 Westgate Dr

- 1351 Monomoy St Unit D

- 833 N Randall Rd Unit C4

- 1389 Monomoy St Unit B2

- 1104 New Haven Ave

- 740 N Elmwood Dr

- 967 Sapphire Ln

- 959 Sapphire Ln

- 963 Sapphire Ln

- 960 Sapphire Ln

- 964 Sapphire Ln

- 1421 Heather Dr

- 1513 Elder Dr

- 1427 Golden Oaks Pkwy

- 1421 Golden Oaks Pkwy

- 1124 Pin Oak Trail

- 1136 Pin Oak Trail

- 1431 Golden Oaks Pkwy

- 1112 Pin Oak Trail

- 1419 Golden Oaks Pkwy

- 1148 Pin Oak Trail Unit 2

- 1424 Golden Oaks Pkwy

- 1428 Golden Oaks Pkwy Unit 2

- 1433 Golden Oaks Pkwy

- 1420 Golden Oaks Pkwy Unit 2

- 1160 Pin Oak Trl

- 1100 Pin Oak Trail

- 1432 Golden Oaks Pkwy

- 1416 Golden Oaks Pkwy

- 1172 Pin Oak Trail

- 1435 Golden Oaks Pkwy Unit 2

- 1127 Pin Oak Trail

- 1139 Pin Oak Trail