1423 Pegwood Dr Unit 1423 Columbus, OH 43229

Forest Park West NeighborhoodEstimated Value: $148,000 - $174,000

2

Beds

2

Baths

878

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 1423 Pegwood Dr Unit 1423, Columbus, OH 43229 and is currently estimated at $163,595, approximately $186 per square foot. 1423 Pegwood Dr Unit 1423 is a home located in Franklin County with nearby schools including Forest Park Elementary School, Woodward Park Middle School, and Northland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2020

Sold by

Brugler Linda J

Bought by

Bailey Jennifer Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,500

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 30, 1999

Sold by

Rau Lyle W and Rau Hatsue M

Bought by

Brugger Linda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.28%

Purchase Details

Closed on

Sep 3, 1993

Bought by

Rau Lyle W and Rau Hatsue M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bailey Jennifer Ann | $114,000 | Great American Title Agency | |

| Brugger Linda J | $91,000 | Chicago Title West | |

| Rau Lyle W | $79,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bailey Jennifer Ann | $77,500 | |

| Previous Owner | Brugger Linda J | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,097 | $46,730 | $9,630 | $37,100 |

| 2023 | $2,070 | $46,725 | $9,625 | $37,100 |

| 2022 | $1,521 | $29,330 | $3,780 | $25,550 |

| 2021 | $1,524 | $29,330 | $3,780 | $25,550 |

| 2020 | $1,071 | $29,330 | $3,780 | $25,550 |

| 2019 | $786 | $21,700 | $2,800 | $18,900 |

| 2018 | $756 | $21,700 | $2,800 | $18,900 |

| 2017 | $794 | $21,700 | $2,800 | $18,900 |

| 2016 | $803 | $20,870 | $3,260 | $17,610 |

| 2015 | $729 | $20,870 | $3,260 | $17,610 |

| 2014 | $731 | $20,870 | $3,260 | $17,610 |

| 2013 | $392 | $21,945 | $3,430 | $18,515 |

Source: Public Records

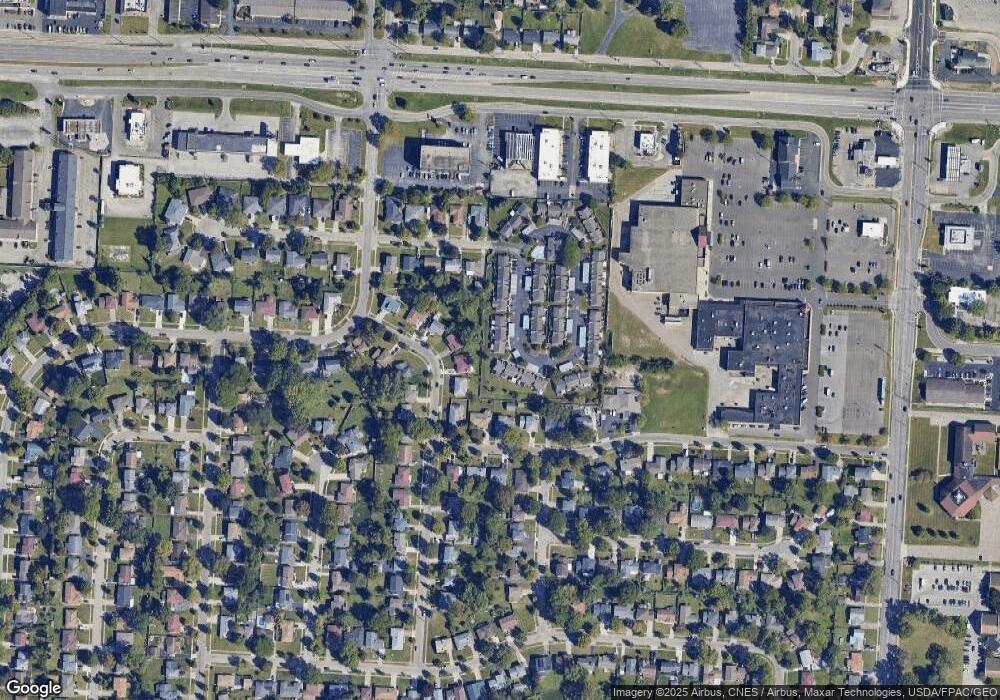

Map

Nearby Homes

- 1390 E Dublin Granville Rd

- 1492 Cottonwood Dr

- 1687 Brookfield Square S

- 6035 Karl Rd

- 1752 Pine Tree St S Unit H

- 1743 Pine Tree St N Unit A

- 1171 Newbury Dr

- 1722 Blue Ash Place

- 1288 Oakfield Dr N

- 5548 Roche Dr

- 5480 Rockwood Ct Unit R1

- 1549 Alpine Dr

- 5579 Norcross Rd

- 5485 Tamarack Blvd

- 6211 Parkdale Dr

- 1881 Brimfield Rd

- 5415 Vinewood Ct

- 5650 N Meadows Blvd

- 1914 Walden Dr

- 1493 Boxwood Dr

- 1421 Pegwood Dr

- 1427 Pegwood Dr

- 1419 Pegwood Dr Unit 1419

- 1429 Pegwood Dr

- 1431 Pegwood Dr

- 1417 Pegwood Dr

- 1433 Pegwood Dr

- 1414 Pegwood Dr

- 1412 Pegwood Dr Unit 1412

- 1411 Pegwood Dr

- 1435 Pegwood Dr Unit 1435

- 5790 Loganwood Rd

- 5794 Loganwood Rd

- 1410 Pegwood Dr

- 1409 Pegwood Dr Unit 1409

- 1437 Pegwood Dr

- 5801 Thada Ln

- 5805 Thada Ln Unit 5805

- 1406 Pegwood Dr Unit 1406

- 5803 Thada Ln Unit 5803