1424 Oakridge Cir Unit 14245 Decatur, GA 30033

North Druid Woods NeighborhoodEstimated Value: $298,000 - $311,000

2

Beds

2

Baths

1,412

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 1424 Oakridge Cir Unit 14245, Decatur, GA 30033 and is currently estimated at $304,420, approximately $215 per square foot. 1424 Oakridge Cir Unit 14245 is a home located in DeKalb County with nearby schools including Oak Grove Elementary School, Henderson Middle School, and Lakeside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2018

Sold by

Shingleton

Bought by

Wayne King D and King Ellen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Outstanding Balance

$76,046

Interest Rate

3.99%

Mortgage Type

New Conventional

Estimated Equity

$228,374

Purchase Details

Closed on

Jun 14, 2013

Sold by

Stavrolakis Rachel G

Bought by

Shingelton Hugh M and Shingleton Lucy K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,750

Interest Rate

3.53%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 10, 1999

Sold by

Lafave Eloise L

Bought by

Stavrolakis Rachel G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wayne King D | $180,500 | -- | |

| Shingelton Hugh M | $125,000 | -- | |

| Stavrolakis Rachel G | $164,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wayne King D | $90,000 | |

| Previous Owner | Shingelton Hugh M | $118,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $952 | $119,880 | $20,000 | $99,880 |

| 2024 | $1,049 | $120,920 | $20,000 | $100,920 |

| 2023 | $1,049 | $108,040 | $20,000 | $88,040 |

| 2022 | $1,003 | $90,680 | $17,680 | $73,000 |

| 2021 | $1,003 | $96,200 | $17,680 | $78,520 |

| 2020 | $1,004 | $81,800 | $17,680 | $64,120 |

| 2019 | $925 | $72,200 | $16,560 | $55,640 |

| 2018 | $1,502 | $76,960 | $17,680 | $59,280 |

| 2017 | $783 | $50,000 | $17,680 | $32,320 |

| 2016 | $739 | $50,000 | $17,680 | $32,320 |

| 2014 | $2,309 | $44,600 | $17,680 | $26,920 |

Source: Public Records

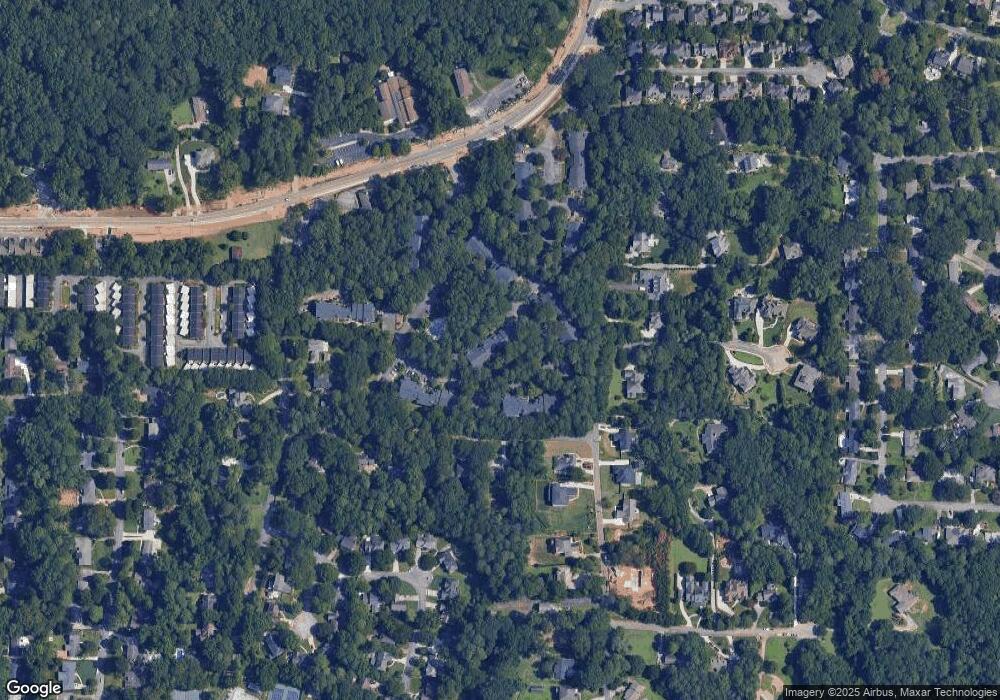

Map

Nearby Homes

- 1414 Oakridge Cir Unit 1414

- 1514 Oakridge Ct

- 2928 Lavista Rd

- 1560 Oak Park Cove Unit 2

- 2924 Lavista Rd

- 2893 Lavista Rd

- 1581 Oak Park Cove

- 2635 Pangborn Rd

- 2731 Hilo Ct

- 2702 Pangborn Rd

- 2700 Hawaii Ct

- 1484 Leafmore Place

- 3170 Lavista Rd

- 1356 Vista Leaf Dr

- 2404 Watermark

- 1607 Oak Grove Rd

- 2444 Oak Grove Heights

- 1424 Oakridge Cir Unit 1424

- 1426 Oakridge Cir Unit 1426

- 1426 Oakridge Cir

- 1426 Oakridge Cir Unit 146

- 1428 Oakridge Cir Unit 1420

- 1422 Oakridge Cir

- 1422 Oakridge Cir Unit 1422

- 1430 Oakridge Cir

- 1430 Oakridge Cir

- 1420 Oakridge Cir

- 1432 Oakridge Cir

- 1434 Oakridge Cir

- 1418 Oakridge Cir

- 1413 Oakridge Cir

- 1417 Oakridge Cir

- 1421 Oakridge Cir

- 1447 Oakridge Cir Unit 1447

- 1447 Oakridge Cir

- 1451 Oakridge Cir

- 1443 Oakridge Cir