1426 Crown Point Ct Beavercreek, OH 45434

Estimated Value: $141,000 - $203,000

3

Beds

2

Baths

1,400

Sq Ft

$114/Sq Ft

Est. Value

About This Home

This home is located at 1426 Crown Point Ct, Beavercreek, OH 45434 and is currently estimated at $160,155, approximately $114 per square foot. 1426 Crown Point Ct is a home located in Greene County with nearby schools including Main Elementary School, Jacob Coy Middle School, and Beavercreek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2021

Sold by

Wist Wanda L

Bought by

Lee Rachelle Nannette

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,500

Outstanding Balance

$85,322

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$74,833

Purchase Details

Closed on

Jun 10, 2010

Sold by

Bruder Alvin H and Bruder Alice L

Bought by

Wist Wanda L

Purchase Details

Closed on

Apr 29, 2010

Sold by

Bruder Alice L

Bought by

Bruder Alvin H

Purchase Details

Closed on

Jun 25, 1999

Sold by

Nancy Mac Donald

Bought by

Stanley Jennifer E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,650

Interest Rate

7.43%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lee Rachelle Nannette | $105,000 | Hallmark Title | |

| Wist Wanda L | $72,000 | None Available | |

| Bruder Alvin H | -- | Attorney | |

| Stanley Jennifer E | $74,900 | Summit Land Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lee Rachelle Nannette | $94,500 | |

| Previous Owner | Stanley Jennifer E | $72,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,471 | $37,110 | $7,000 | $30,110 |

| 2023 | $2,471 | $37,110 | $7,000 | $30,110 |

| 2022 | $2,206 | $29,250 | $7,000 | $22,250 |

| 2021 | $2,163 | $29,250 | $7,000 | $22,250 |

| 2020 | $2,179 | $29,250 | $7,000 | $22,250 |

| 2019 | $1,704 | $20,880 | $4,380 | $16,500 |

| 2018 | $1,508 | $20,880 | $4,380 | $16,500 |

| 2017 | $1,625 | $20,880 | $4,380 | $16,500 |

| 2016 | $1,625 | $21,790 | $4,380 | $17,410 |

| 2015 | $1,616 | $21,790 | $4,380 | $17,410 |

| 2014 | $1,592 | $21,790 | $4,380 | $17,410 |

Source: Public Records

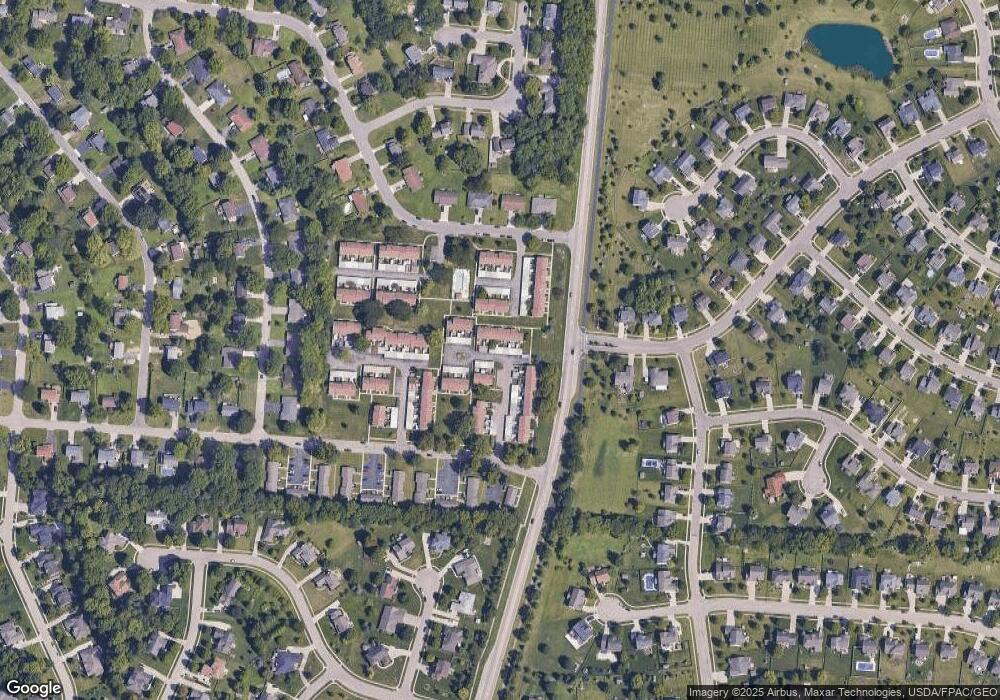

Map

Nearby Homes

- 1361 Obetz Dr Unit A

- 2331 Eastwind Dr

- 2245 Tourney Trail

- 1535 Stretch Dr

- 2507 Obetz Dr

- 2162 Sulky Trail

- 2154 Sulky Trail

- 2073 Lincolnshire Dr

- 1210 Lomeda Ln

- 1360 Backridge Ct

- 1482 Fudge Dr

- 1238 Freedom Point

- 1359 Fudge Dr

- 1051 Forest Dr

- 2853 Oriole Dr

- 2162 Owen E

- 2418 Owen W

- 2570 Mardella Dr

- 2851 Crone Rd

- 895 Alpha Rd

- 1424 Crown Point Ct

- 1428 Crown Point Ct

- 1422 Crown Point Ct

- 1430 Crown Point Ct

- 1420 Crown Point Ct

- 1432 Crown Point Ct

- 1436 Crown Point Ct

- 1427 Crown Point Ct

- 1429 Crown Point Ct

- 1416 Crown Point Ct

- 1438 Crown Point Ct

- 1427 Old Town Ct

- 1425 Old Town Ct

- 1429 Old Town Ct

- 1404 Old Town Ct

- 1414 Crown Point Ct

- 1431 Old Town Ct

- 1440 Crown Point Ct Unit 1442

- 1433 Old Town Ct

- 1406 Old Town Ct