143 Preston D Unit 1430 Boca Raton, FL 33434

Century Village-Boca Raton NeighborhoodEstimated Value: $84,000 - $98,000

1

Bed

2

Baths

806

Sq Ft

$111/Sq Ft

Est. Value

About This Home

This home is located at 143 Preston D Unit 1430, Boca Raton, FL 33434 and is currently estimated at $89,106, approximately $110 per square foot. 143 Preston D Unit 1430 is a home located in Palm Beach County with nearby schools including Whispering Pines Elementary School, Eagles Landing Middle School, and Olympic Heights Community High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 3, 2025

Sold by

Hardwick Bonita Jean

Bought by

Hardwick Bonita Jean and Hardwick Jamica Aisha

Current Estimated Value

Purchase Details

Closed on

Aug 26, 2020

Sold by

Chaussky Michael and Chaussky Anna

Bought by

Hardwick Bonita Jean

Purchase Details

Closed on

May 27, 2005

Sold by

Link Renee

Bought by

Chaussky Michael

Purchase Details

Closed on

Sep 22, 2001

Sold by

Glaser Myra

Bought by

Link Renee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$24,608

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hardwick Bonita Jean | -- | None Listed On Document | |

| Hardwick Bonita Jean | $54,000 | Attorney | |

| Chaussky Michael | $84,000 | Accurate Title Agency Inc | |

| Link Renee | $26,000 | Seacrest Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Link Renee | $24,608 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,590 | $73,780 | -- | -- |

| 2024 | $1,590 | $67,073 | -- | -- |

| 2023 | $1,491 | $60,975 | $0 | $0 |

| 2022 | $1,297 | $55,432 | $0 | $0 |

| 2021 | $1,107 | $50,393 | $0 | $50,393 |

| 2020 | $870 | $46,398 | $0 | $46,398 |

| 2019 | $843 | $45,000 | $0 | $45,000 |

| 2018 | $752 | $39,000 | $0 | $39,000 |

| 2017 | $711 | $35,000 | $0 | $0 |

| 2016 | $694 | $20,497 | $0 | $0 |

| 2015 | $637 | $18,634 | $0 | $0 |

| 2014 | $601 | $16,940 | $0 | $0 |

Source: Public Records

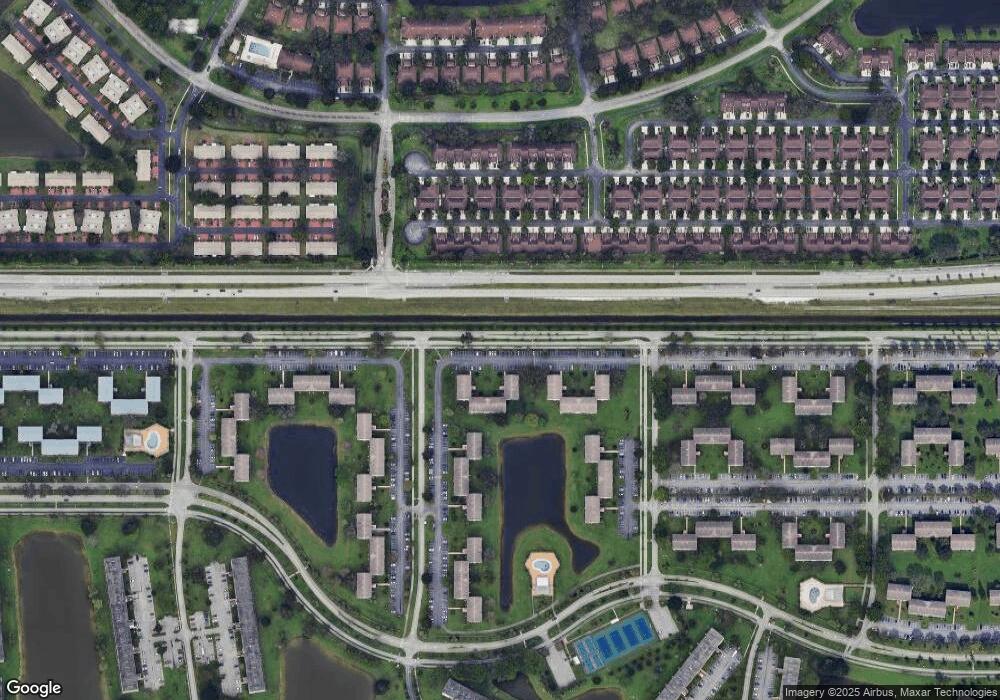

Map

Nearby Homes

- 142 Preston D Unit 1420

- 246 Preston F Unit 246

- 160 Preston D

- 233 Preston F Unit 233

- 251 Preston F Unit 2510

- 227 Preston F Unit 227 F

- 167 Preston D Unit 167D

- 191 Preston E Unit 191

- 187 Preston E Unit 1870

- 278 Preston G Unit G

- 280 Preston G Unit G

- 4093 Wolverton E Unit 4093

- 2092 Wolverton E

- 303 Preston H Unit 303

- 1056 Rexford C

- 319 Preston H Unit H

- 2085 Wolverton E Unit 2085

- 270 Suffolk F

- 4054 Rexford C

- 4082 Wolverton E Unit 4082

- 130 Preston D

- 144 Preston D

- 159 Preston D Unit 1590

- 159 Preston D Unit 159

- 129 Preston D Unit D

- 129 Preston D Unit 1290

- 143 Preston D Unit 143D

- 143 Preston D

- 145 Preston D Unit 145D

- 145 Preston D Unit 1450

- 158 Preston D Unit 1580

- 158 Preston D

- 157 Preston D

- 160 Preston D Unit 160D

- 128 Preston D

- 146 Preston D Unit 1460

- 131 Preston D Unit 1310

- 156 Preston D Unit 1560

- 132 Preston D Unit 132