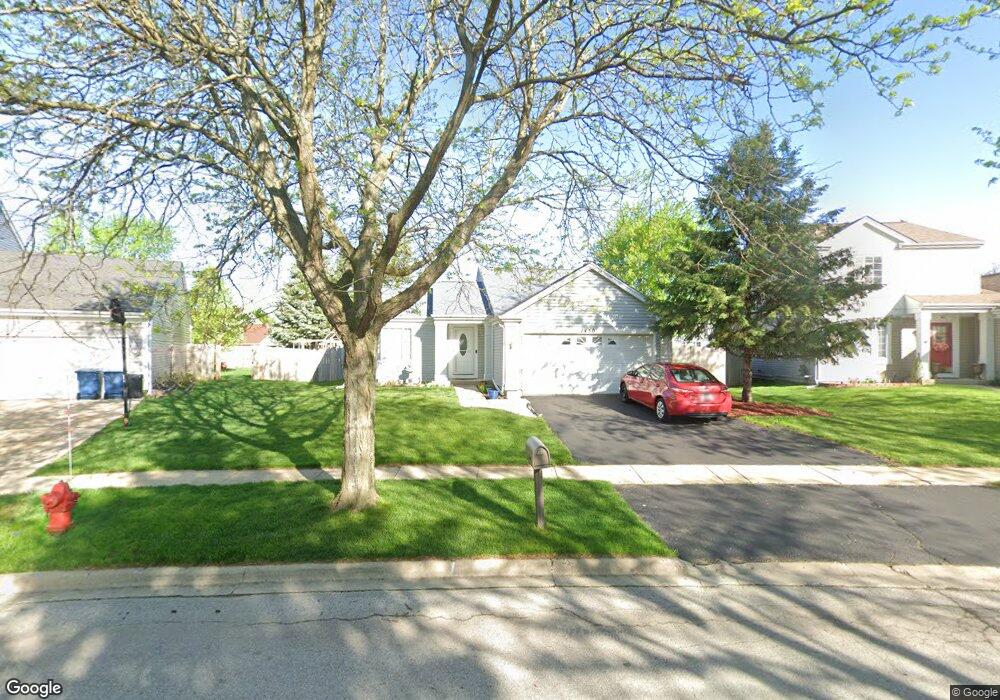

1430 Bent Oak Trail Aurora, IL 60506

Edgelawn Randall NeighborhoodEstimated Value: $328,000 - $346,000

2

Beds

2

Baths

1,440

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 1430 Bent Oak Trail, Aurora, IL 60506 and is currently estimated at $334,750, approximately $232 per square foot. 1430 Bent Oak Trail is a home located in Kane County with nearby schools including Smith Elementary School, Jewel Middle School, and West Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2019

Sold by

Orduna Alicia A

Bought by

Sluis Michael D and Orduna Lisa I

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Outstanding Balance

$141,238

Interest Rate

4.8%

Mortgage Type

New Conventional

Estimated Equity

$193,512

Purchase Details

Closed on

Sep 29, 1998

Sold by

Klocek Edward J

Bought by

Orduna Vidal T and Orduna Alicia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

6.97%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sluis Michael D | $200,000 | Chicago Title Insurance Co | |

| Orduna Vidal T | $135,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sluis Michael D | $160,000 | |

| Previous Owner | Orduna Vidal T | $125,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,254 | $86,989 | $18,563 | $68,426 |

| 2023 | $5,972 | $77,724 | $16,586 | $61,138 |

| 2022 | $5,746 | $70,916 | $15,133 | $55,783 |

| 2021 | $5,484 | $66,024 | $14,089 | $51,935 |

| 2020 | $5,933 | $69,375 | $13,087 | $56,288 |

| 2019 | $5,210 | $64,277 | $12,125 | $52,152 |

| 2018 | $4,673 | $57,812 | $11,215 | $46,597 |

| 2017 | $5,337 | $57,853 | $10,334 | $47,519 |

| 2016 | $5,200 | $54,946 | $8,858 | $46,088 |

| 2015 | -- | $48,345 | $7,617 | $40,728 |

| 2014 | -- | $44,193 | $7,326 | $36,867 |

| 2013 | -- | $44,698 | $7,221 | $37,477 |

Source: Public Records

Map

Nearby Homes

- 1532 Golden Oaks Pkwy

- 910 Southbridge Dr

- 1035 Newcastle Ln

- 795 N Elmwood Dr

- 972 Westgate Dr

- 781 N Elmwood Dr

- 1815 Brighton Cir

- 833 N Randall Rd Unit C4

- 461 Sullivan Rd

- 1351 Monomoy St Unit D

- 1389 Monomoy St Unit B2

- 1104 New Haven Ave

- 967 Sapphire Ln

- 959 Sapphire Ln

- 963 Sapphire Ln

- 740 N Elmwood Dr

- 960 Sapphire Ln

- 964 Sapphire Ln

- 1421 Heather Dr

- 742 N Glenwood Place

- 1440 Bent Oak Trail

- 1420 Bent Oak Trail

- 1452 Golden Oaks Pkwy

- 1450 Bent Oak Trail

- 1456 Golden Oaks Pkwy

- 1410 Bent Oak Trail

- 1444 Golden Oaks Pkwy

- 1431 Bent Oak Trail

- 1460 Golden Oaks Pkwy

- 1421 Bent Oak Trail

- 1441 Bent Oak Trail

- 1460 Bent Oak Trail

- 1400 Bent Oak Trail

- 1440 Golden Oaks Pkwy

- 1391 Bent Oak Trail

- 1175 Red Oak Trail

- 1183 Red Oak Trail

- 1390 Bent Oak Trail

- 1436 Golden Oaks Pkwy

- 1201 Lone Oak Trail