1430 Larrys Dr Stevens Point, WI 54482

Estimated Value: $281,000 - $333,000

Studio

--

Bath

--

Sq Ft

0.8

Acres

About This Home

This home is located at 1430 Larrys Dr, Stevens Point, WI 54482 and is currently estimated at $295,086. 1430 Larrys Dr is a home located in Portage County with nearby schools including Washington Elementary School, P.J. Jacobs Junior High School, and Stevens Point Area Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2022

Sold by

Domaszek Grace T

Bought by

Darr Ryan E and Darr Sarah M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,400

Outstanding Balance

$193,323

Interest Rate

5.22%

Mortgage Type

New Conventional

Estimated Equity

$101,763

Purchase Details

Closed on

Aug 16, 2022

Sold by

Darlene Bahun

Bought by

Domaszek Grace T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,400

Outstanding Balance

$193,323

Interest Rate

5.22%

Mortgage Type

New Conventional

Estimated Equity

$101,763

Purchase Details

Closed on

May 25, 2022

Sold by

Domaszek Grace T

Bought by

Bahun Darlene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Darr Ryan E | $220,000 | Guaranty Title | |

| Domaszek Grace T | -- | Mccarty Law Llp | |

| Bahun Darlene | -- | Mccarty Law Llp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Darr Ryan E | $202,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $27 | $155,400 | $16,000 | $139,400 |

| 2023 | $2,541 | $155,400 | $16,000 | $139,400 |

| 2022 | $2,547 | $155,400 | $16,000 | $139,400 |

| 2021 | $2,450 | $155,400 | $16,000 | $139,400 |

| 2020 | $2,530 | $155,400 | $16,000 | $139,400 |

| 2019 | $2,351 | $155,400 | $16,000 | $139,400 |

| 2018 | $2,143 | $124,100 | $15,200 | $108,900 |

| 2017 | $1,974 | $124,100 | $15,200 | $108,900 |

| 2016 | $1,987 | $124,100 | $15,200 | $108,900 |

| 2015 | $1,990 | $124,100 | $15,200 | $108,900 |

| 2014 | $2,017 | $124,100 | $15,200 | $108,900 |

Source: Public Records

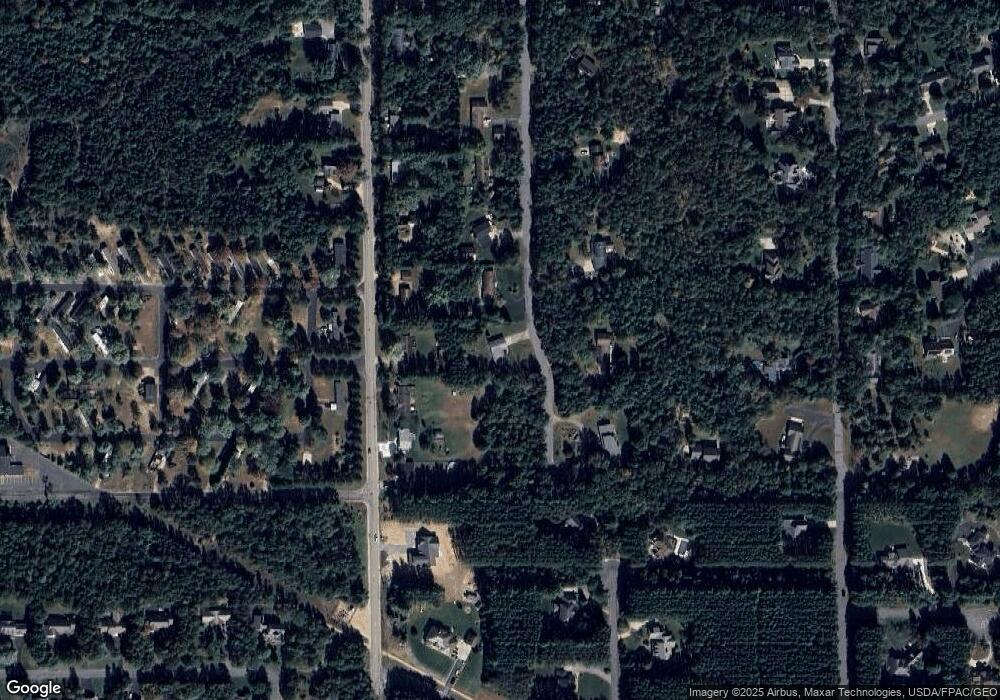

Map

Nearby Homes

- 1403 N Sky Line Dr

- Lot 1 Somerset Dr

- Lot 31 Red Tail Hawk Dr

- 4809 Partridge Way

- Lot 6 Two Sisters Ct

- Lot 2 Highway 10 NW

- 4050 Kennedy Dr

- 152 Maple Bluff Rd

- 5486 Forest Creek Rd

- 172 Evelyn Ct

- 203 Joe St

- 5573 Forest Creek Rd

- 5580 Forest Creek Rd

- 204 Leonard St

- 220 Leonard St

- 3707 E Maria Dr

- 212 Leonard St

- 5581 Forest Creek Rd

- Bentlee Plan at Stevens Point

- Fern Plan at Stevens Point

Your Personal Tour Guide

Ask me questions while you tour the home.