1431 Kiowa Trail Elizabeth, CO 80107

Ponderosa Park NeighborhoodEstimated Value: $874,000 - $937,000

4

Beds

3

Baths

3,390

Sq Ft

$266/Sq Ft

Est. Value

About This Home

This home is located at 1431 Kiowa Trail, Elizabeth, CO 80107 and is currently estimated at $901,592, approximately $265 per square foot. 1431 Kiowa Trail is a home located in Elbert County with nearby schools including Elizabeth High School and Legacy Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2019

Sold by

Arnold Greg

Bought by

Miller James M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Outstanding Balance

$383,068

Interest Rate

3.65%

Mortgage Type

New Conventional

Estimated Equity

$518,524

Purchase Details

Closed on

May 18, 2015

Sold by

Donn Carsen R and Donn Patricia A

Bought by

Arnold Greg

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$410,875

Interest Rate

3.73%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 20, 2001

Sold by

Taylor William Mark and Taylor Deborah Sheets

Bought by

Donn Carsen R and Donn Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,000

Interest Rate

6.89%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller James M | $635,000 | North American Title | |

| Arnold Greg | $480,000 | 8Z Title | |

| Donn Carsen R | $335,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller James M | $435,000 | |

| Previous Owner | Arnold Greg | $410,875 | |

| Previous Owner | Donn Carsen R | $268,000 | |

| Closed | Donn Carsen R | $50,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,856 | $50,930 | $9,060 | $41,870 |

| 2023 | $3,856 | $50,930 | $9,060 | $41,870 |

| 2022 | $3,478 | $43,520 | $9,730 | $33,790 |

| 2021 | $3,564 | $44,770 | $10,010 | $34,760 |

| 2020 | $3,338 | $41,690 | $7,150 | $34,540 |

| 2019 | $3,340 | $41,690 | $7,150 | $34,540 |

| 2018 | $2,974 | $36,720 | $8,640 | $28,080 |

| 2017 | $2,976 | $36,720 | $8,640 | $28,080 |

| 2016 | $2,646 | $32,020 | $9,350 | $22,670 |

| 2015 | $2,542 | $32,020 | $9,350 | $22,670 |

| 2014 | $2,542 | $29,740 | $9,150 | $20,590 |

Source: Public Records

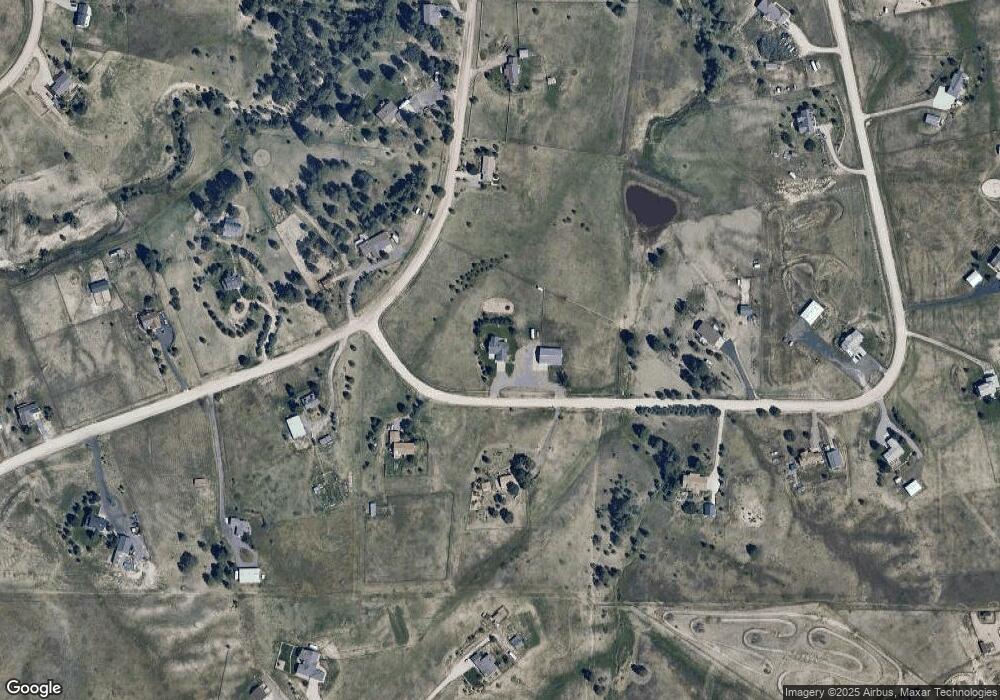

Map

Nearby Homes

- 1434 Arabian Trail

- 34856 Mustang Trail

- 2385 Arabian Trail

- 2452 Shetland Trail

- 2035 Savage Rd

- 2314 Savage Rd

- 121 County Road 146

- 39817 Bradley St

- 39827 Bradley St

- 39818 Bradley St

- 39868 Bradley St

- 39838 Bradley St

- 39837 Bradley St

- 39846 Gibson St

- 39856 Gibson St

- 36023 Winchester Rd

- 36888 View Ridge Dr

- 36684 Mossberg Ct

- 36545 Winchester Rd

- 2642 Savage Rd

- 1456 Kiowa Trail

- 1503 Kiowa Trail

- 1418 Kiowa Trail

- 1494 Kiowa Trail

- 35492 Cherokee Trail

- 35433 Cherokee Trail

- 1595 Kiowa Trail

- 35370 Cherokee Trail

- 1532 Kiowa Trail

- 35550 Cherokee Trail

- 35547 Cherokee Trail

- 35252 Wagon Wheel Trail

- 35355 Cherokee Trail

- 1677 Kiowa Trail

- 1580 Kiowa Trail

- 35605 Cherokee Trail

- 35221 Wagon Wheel Trail

- 35312 Cherokee Trail

- 35610 Cherokee Trail

- 35281 Cherokee Trail