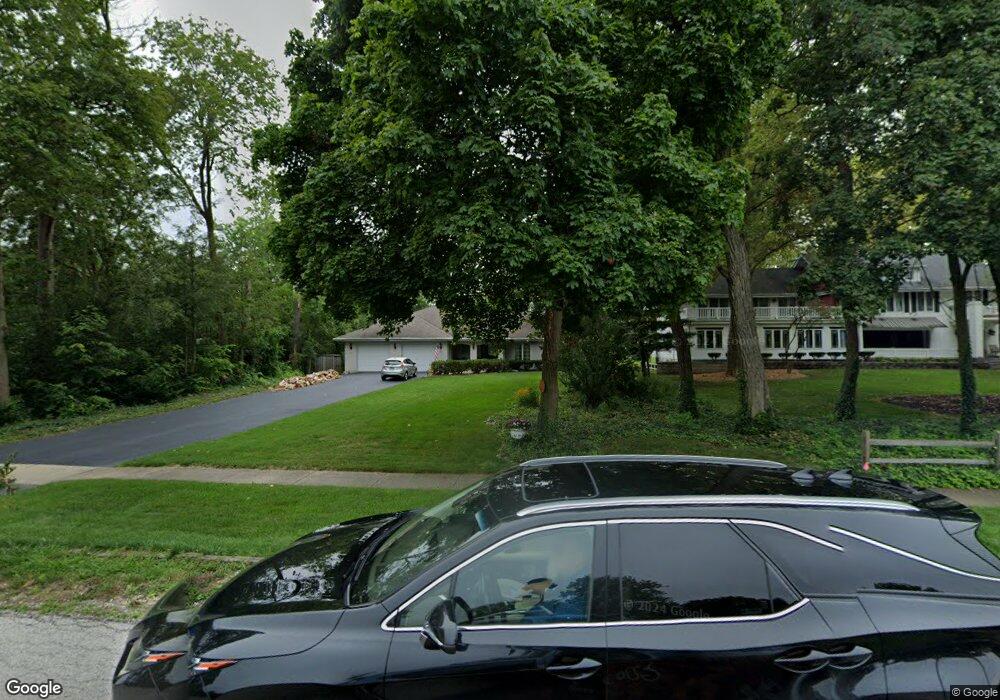

14324 Long Ave Midlothian, IL 60445

Estimated Value: $395,000 - $538,000

4

Beds

3

Baths

3,078

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 14324 Long Ave, Midlothian, IL 60445 and is currently estimated at $460,290, approximately $149 per square foot. 14324 Long Ave is a home located in Cook County with nearby schools including Kerkstra Elementary School, Jack Hille Middle School, and Oak Forest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2019

Sold by

Kunkel Pamela N

Bought by

Donlon John Joseph

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Outstanding Balance

$117,398

Interest Rate

4.37%

Mortgage Type

New Conventional

Estimated Equity

$342,892

Purchase Details

Closed on

Jul 1, 2005

Sold by

Chicago Title Land Trust Co

Bought by

Moore James C and Moore Nancy K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$475,000

Interest Rate

6.25%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Donlon John Joseph | $290,000 | Chicago Title Insurance Comp | |

| Moore James C | $475,000 | Cti |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Donlon John Joseph | $135,000 | |

| Previous Owner | Moore James C | $475,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,440 | $38,000 | $10,480 | $27,520 |

| 2024 | $12,440 | $38,000 | $10,480 | $27,520 |

| 2023 | $11,798 | $38,000 | $10,480 | $27,520 |

| 2022 | $11,798 | $28,862 | $4,585 | $24,277 |

| 2021 | $11,507 | $28,862 | $4,585 | $24,277 |

| 2020 | $11,128 | $28,862 | $4,585 | $24,277 |

| 2019 | $14,831 | $34,069 | $3,930 | $30,139 |

| 2018 | $11,896 | $34,069 | $3,930 | $30,139 |

| 2017 | $14,086 | $34,069 | $3,930 | $30,139 |

| 2016 | $11,599 | $32,929 | $3,275 | $29,654 |

| 2015 | $11,907 | $32,929 | $3,275 | $29,654 |

| 2014 | $11,546 | $32,929 | $3,275 | $29,654 |

| 2013 | $11,193 | $33,601 | $3,275 | $30,326 |

Source: Public Records

Map

Nearby Homes

- 14601 Linder Ave

- 14511 Central Ct Unit M2

- 14533 Walden Ct Unit PH4

- 14533 Walden Ct Unit G2

- 13933 James Dr Unit 816

- 13933 James Dr Unit 822

- 5130 Midlothian Turnpike Unit 1207

- 14725 Laramie Ave

- 14817 El Vista Ave

- 14641 Lavergne Ave

- 14852 Park Ave

- 14409 Lamon Ave

- 14411 Lamon Ave

- 13748 Le Claire Ave

- 5440 138th St

- 14655 Lamon Ave Unit 2N

- 15020 Park Ave

- 14913 Sheila Ct

- 14340 Kilpatrick Ave

- 14144 Kilpatrick Ave

- 14400 Long Ave

- 14318 Long Ave

- 14318 Long Ave

- 14408 Long Ave

- 14325 Linder Ave

- 14401 Linder Ave

- 14319 Linder Ave

- 14407 Linder Ave

- 14416 Long Ave

- 14313 Linder Ave

- 14300 Long Ave

- 14413 Linder Ave

- 14307 Linder Ave

- 14420 Long Ave

- 14417 Linder Ave

- 14301 Linder Ave

- 14340 Linder Ave

- 14336 Linder Ave

- 14344 Linder Ave

- 14332 Linder Ave

Your Personal Tour Guide

Ask me questions while you tour the home.