1435 Vista Walk Unit D1435 Hoffman Estates, IL 60169

South Hoffman Estates NeighborhoodEstimated Value: $169,000 - $184,000

1

Bed

--

Bath

830

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 1435 Vista Walk Unit D1435, Hoffman Estates, IL 60169 and is currently estimated at $175,344, approximately $211 per square foot. 1435 Vista Walk Unit D1435 is a home located in Cook County with nearby schools including Neil Armstrong Elementary School, Dwight D Eisenhower Junior High School, and Hoffman Estates High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 4, 2024

Sold by

Balase Hugo L and Balase Evelyn D

Bought by

Balase Family Revocable Living Trust and Balase

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2021

Sold by

Sarillo Anthony M and Sarillo Linda I

Bought by

Balase Hugo L and Balase Evelyn D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,720

Interest Rate

2.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 14, 2019

Sold by

Spataro Joseph

Bought by

Sarillo Anthony M and Sarillo Linda I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,850

Interest Rate

3.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Balase Family Revocable Living Trust | -- | None Listed On Document | |

| Balase Hugo L | $116,000 | Attorneys Ttl Guaranty Fund | |

| Sarillo Anthony M | $85,200 | Greater Illinois Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Balase Hugo L | $92,720 | |

| Previous Owner | Sarillo Anthony M | $61,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,459 | $10,724 | $515 | $10,209 |

| 2023 | $1,356 | $10,724 | $515 | $10,209 |

| 2022 | $1,356 | $10,724 | $515 | $10,209 |

| 2021 | $2,173 | $6,486 | $810 | $5,676 |

| 2020 | $2,122 | $6,486 | $810 | $5,676 |

| 2019 | $2,121 | $7,244 | $810 | $6,434 |

| 2018 | $1,944 | $5,962 | $707 | $5,255 |

| 2017 | $1,909 | $5,962 | $707 | $5,255 |

| 2016 | $1,776 | $5,962 | $707 | $5,255 |

| 2015 | $1,948 | $6,066 | $617 | $5,449 |

| 2014 | $1,914 | $6,066 | $617 | $5,449 |

| 2013 | $1,865 | $6,066 | $617 | $5,449 |

Source: Public Records

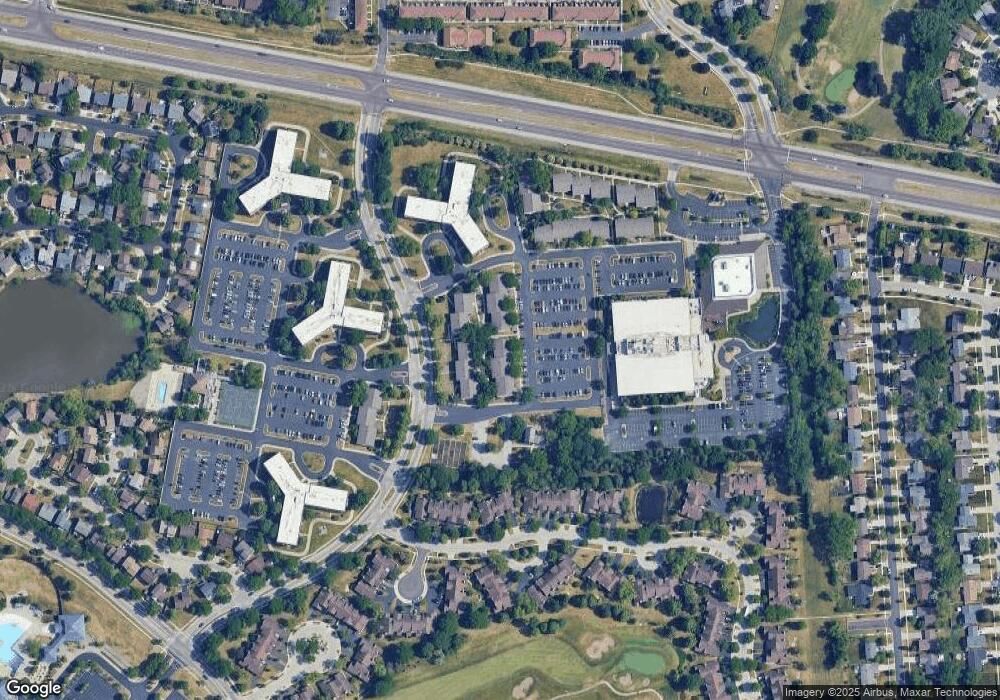

Map

Nearby Homes

- 1375 Rebecca Dr Unit 318

- 1475 Rebecca Dr Unit 217

- 1698 Pebble Beach Dr

- 1415 N Oakmont Rd

- 1763 Bristol Walk Unit 1763

- 1808 Fayette Walk Unit H

- 1704 Fayette Walk Unit B

- 1121 Southbridge Ln

- 1840 Huntington Blvd Unit 415

- 1840 Huntington Blvd Unit 412

- 1103 Southbridge Ln

- 1685 Cornell Dr

- 1672 Cornell Dr

- 1365 Blair Ln

- 1020 Denham Place Unit 1

- 1862 Stockton Dr Unit 3283

- 1360 Devonshire Ln

- 1352 W Oakmont Rd

- 1854 Huntington Blvd Unit C

- 1456 Della Dr

- 1435 Vista Walk Unit A1435

- 1435 Vista Walk Unit B1435

- 1435 Vista Walk Unit C1435

- 1435 Vista Walk Unit 2C

- 1435 Vista Walk

- 1435 Vista Ln Unit 2C

- 1435 Vista Walk Unit 1D

- 1425 Vista Walk Unit C1425

- 1425 Vista Walk Unit B1425

- 1425 Vista Walk Unit A1425

- 1425 Vista Walk Unit D1425

- 1425 Vista Walk Unit C

- 1425 Vista Walk Unit B

- 1445 Vista Walk Unit B

- 1445 Vista Walk Unit C1445

- 1445 Vista Walk Unit D1445

- 1445 Vista Walk Unit A1445

- 1445 Vista Walk Unit B1445

- 1445 Vista Walk Unit A

- 1440 Vista Walk Unit C