1437 NW 113th Way Pembroke Pines, FL 33026

Pembroke Lakes NeighborhoodEstimated Value: $461,000 - $467,000

3

Beds

3

Baths

1,672

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 1437 NW 113th Way, Pembroke Pines, FL 33026 and is currently estimated at $464,232, approximately $277 per square foot. 1437 NW 113th Way is a home located in Broward County with nearby schools including Pembroke Lakes Elementary School, Walter C. Young Middle School, and Charles W Flanagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2015

Sold by

Derynda John L

Bought by

Castro Engels G and Castro Mariana Paola

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$191,468

Outstanding Balance

$153,976

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$310,256

Purchase Details

Closed on

Aug 12, 2010

Sold by

Balarezo Isabel

Bought by

Derynda John L and John L Derynda Revocable Living Trust

Purchase Details

Closed on

Dec 1, 1993

Sold by

Available Not

Bought by

Available Not

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,275

Interest Rate

6.99%

Purchase Details

Closed on

Oct 14, 1993

Sold by

Long Milton L

Bought by

Martinez Anthony

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,275

Interest Rate

6.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castro Engels G | $195,000 | Attorney | |

| Derynda John L | $8,700 | None Available | |

| Available Not | $10,000 | -- | |

| Martinez Anthony | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castro Engels G | $191,468 | |

| Previous Owner | Martinez Anthony | $30,000 | |

| Previous Owner | Martinez Anthony | $83,275 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,446 | $240,440 | -- | -- |

| 2024 | $5,312 | $233,670 | -- | -- |

| 2023 | $5,312 | $226,870 | $0 | $0 |

| 2022 | $5,070 | $220,270 | $0 | $0 |

| 2021 | $4,987 | $213,860 | $0 | $0 |

| 2020 | $4,947 | $210,910 | $0 | $0 |

| 2019 | $3,524 | $206,170 | $0 | $0 |

| 2018 | $3,387 | $202,330 | $0 | $0 |

| 2017 | $3,342 | $198,170 | $0 | $0 |

| 2016 | $3,322 | $194,100 | $0 | $0 |

| 2015 | $3,466 | $149,910 | $0 | $0 |

| 2014 | $3,156 | $136,290 | $0 | $0 |

| 2013 | -- | $124,380 | $27,720 | $96,660 |

Source: Public Records

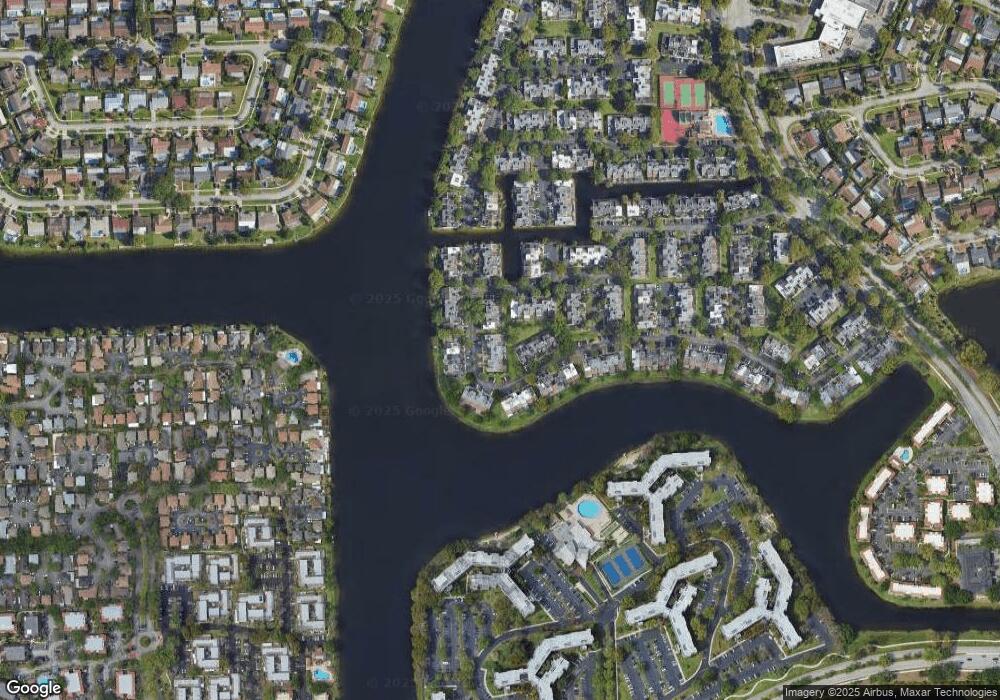

Map

Nearby Homes

- 11336 NW 15th St

- 1100 Colony Point Cir Unit 504

- 1100 Colony Point Cir Unit 205

- 1100 Colony Point Cir Unit 208

- 1100 Colony Point Cir Unit 215

- 1100 Colony Point Cir Unit 3105

- 1100 Colony Point Cir Unit 201

- 1100 Colony Point Cir Unit 119

- 1101 Colony Point Cir Unit 220

- 1101 Colony Point Cir Unit 218

- 1101 Colony Point Cir Unit 307

- 1101 Colony Point Cir Unit 108

- 1101 Colony Point Cir Unit 403

- 1101 Colony Point Cir Unit 207

- 1101 Colony Point Cir Unit 123

- 1101 Colony Point Cir Unit 206

- 1101 Colony Point Cir Unit 422

- 11331 NW 15th Ct

- 1351 NW 114th Ave

- 11248 NW 15th Ct

- 1431 NW 113th Way

- 1425 NW 113th Way

- 1419 NW 113th Way

- 1455 NW 113th Way Unit 1455

- 1455 NW 113th Way

- 1455 NW 113th Way

- 1461 NW 113th Way

- 11333 NW 14th Ct

- 1436 NW 113th Way

- 1467 NW 113th Way

- 11329 NW 14th Ct

- 1430 NW 113th Way

- 1442 NW 113th Way

- 1442 NW 113th Way

- 1442 NW 113th Way

- 1442 NW 113th Way Unit 1442

- 1424 NW 113th Way

- 1448 NW 113th Way