1440 Hollow Run Unit 1440144 Dayton, OH 45459

Estimated Value: $143,000 - $159,000

2

Beds

2

Baths

987

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 1440 Hollow Run Unit 1440144, Dayton, OH 45459 and is currently estimated at $150,356, approximately $152 per square foot. 1440 Hollow Run Unit 1440144 is a home located in Montgomery County with nearby schools including Primary Village North, Driscoll Elementary School, and Tower Heights Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2016

Sold by

Reed David M

Bought by

Gregg Brian C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,750

Outstanding Balance

$22,001

Interest Rate

3.97%

Mortgage Type

New Conventional

Estimated Equity

$128,355

Purchase Details

Closed on

Dec 28, 2012

Sold by

Tracy Keith T

Bought by

Reed David M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,100

Interest Rate

3.3%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

May 15, 2007

Sold by

Peterson Bruce D and Peterson Melodye

Bought by

Tracy Keith T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,900

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 27, 1999

Sold by

Young Tracy J and Rowland Charles M

Bought by

Peterson Bruce D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,650

Interest Rate

6.94%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 2, 1997

Sold by

Codispoti William D

Bought by

Young Tracy J and Rowland Ii Charles M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gregg Brian C | $57,500 | None Available | |

| Reed David M | $62,000 | None Available | |

| Tracy Keith T | $73,900 | Attorney | |

| Peterson Bruce D | $60,000 | -- | |

| Young Tracy J | $54,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gregg Brian C | $51,750 | |

| Previous Owner | Reed David M | $34,100 | |

| Previous Owner | Tracy Keith T | $73,900 | |

| Previous Owner | Peterson Bruce D | $58,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,309 | $39,550 | $9,520 | $30,030 |

| 2023 | $2,309 | $39,550 | $9,520 | $30,030 |

| 2022 | $1,718 | $23,260 | $5,600 | $17,660 |

| 2021 | $1,723 | $23,260 | $5,600 | $17,660 |

| 2020 | $1,720 | $23,260 | $5,600 | $17,660 |

| 2019 | $1,579 | $19,030 | $5,600 | $13,430 |

| 2018 | $1,401 | $19,030 | $5,600 | $13,430 |

| 2017 | $1,385 | $19,030 | $5,600 | $13,430 |

| 2016 | $1,418 | $18,390 | $5,600 | $12,790 |

| 2015 | $1,420 | $18,390 | $5,600 | $12,790 |

| 2014 | $1,403 | $18,390 | $5,600 | $12,790 |

| 2012 | -- | $21,100 | $5,600 | $15,500 |

Source: Public Records

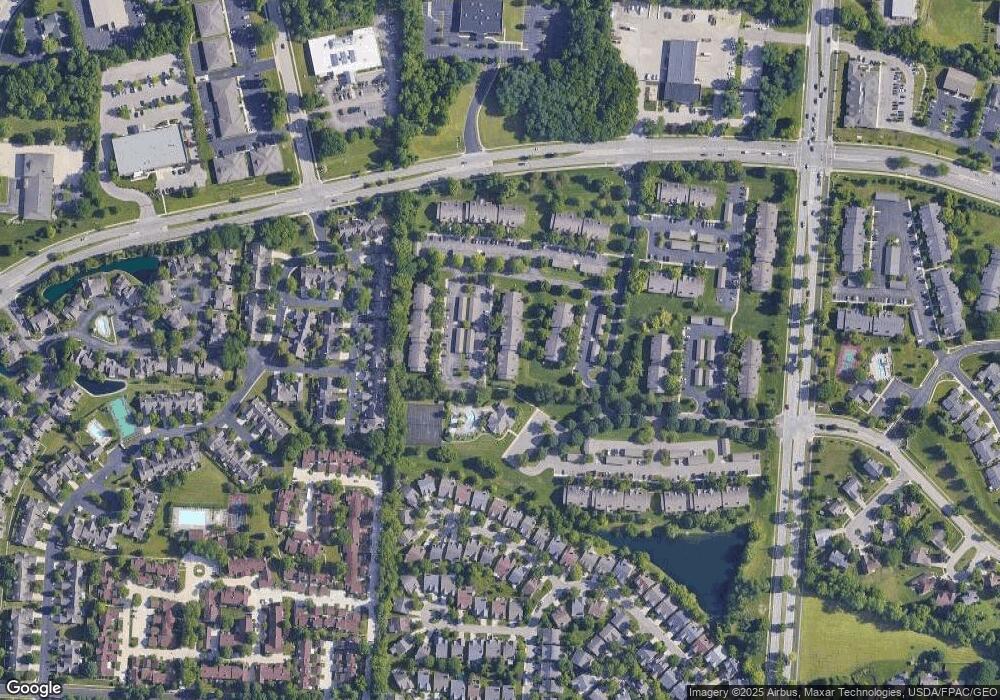

Map

Nearby Homes

- 1400 Lake Pointe Way Unit 4

- 6610 Green Branch Dr

- 1511 Lake Pointe Way Unit 6

- 6620 Green Branch Dr Unit 8

- 1237 Chevington Ct Unit 1515

- 6694 Wareham Ct

- 6650 Wareham Ct Unit 5

- 6625 Hedington Square

- 6892 Tifton Green Trail Unit 74

- 6839 Cedar Cove Dr Unit 3993

- 6839 Cedar Cove Dr Unit 93

- 6611 Brigham Square Unit 2

- 6184 Quinella Way Unit 185

- 1953 Baldwin Dr

- 6161 Quinella Way Unit 208

- 6102 Singletree Ln

- 1973 Home Path Ct

- 1462 Carriage Trace Blvd Unit 215

- 1630 Piper Ln Unit 103

- 1630 Piper Ln

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 1

- 1440 Hollow Run Unit 2

- 1440 Hollow Run Unit 1440144

- 1440 Hollow Run Unit 6

- 1440 Hollow Run Unit 4

- 1440 Hollow Run Unit 14406

- 1440 Hollow Run Unit 7

- 1440 Hollow Run

- 1440 Hollow Run Unit 144012

- 1440 Hollow Run Unit 11