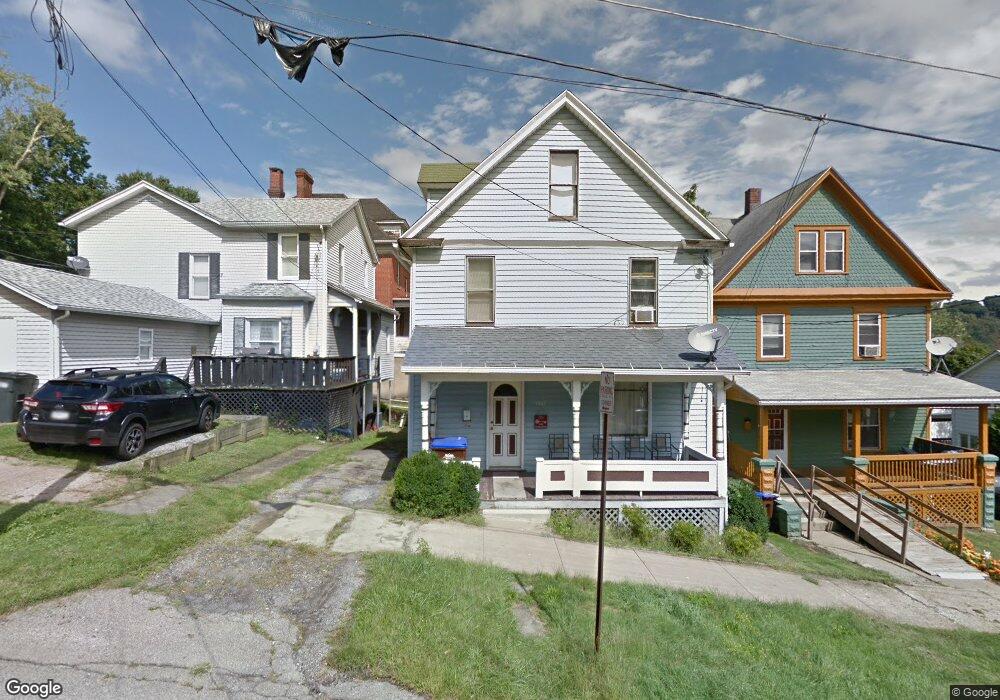

1442 Chestnut St Franklin, PA 16323

Estimated Value: $78,149 - $101,000

3

Beds

1

Bath

1,353

Sq Ft

$69/Sq Ft

Est. Value

About This Home

This home is located at 1442 Chestnut St, Franklin, PA 16323 and is currently estimated at $93,787, approximately $69 per square foot. 1442 Chestnut St is a home located in Venango County with nearby schools including Franklin Area High School, Franklin School - Age Child Development Center, and St Patrick Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2016

Sold by

First United Presbyterian Church Of Fran

Bought by

Fox Theresa Rose

Current Estimated Value

Purchase Details

Closed on

Jul 12, 2006

Sold by

Beneficial Consumer Discout Co

Bought by

First United Presbyterian Church

Purchase Details

Closed on

Jan 24, 2006

Sold by

Kline Harold B and Kline Harold Buzby

Bought by

Beneficial Consumer Discount Co and Beneficial Mortgage Company Of Pennsylva

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fox Theresa Rose | -- | None Available | |

| First United Presbyterian Church | $12,900 | None Available | |

| Beneficial Consumer Discount Co | $5,000 | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,376 | $36,250 | $2,820 | $33,430 |

| 2024 | $1,285 | $36,250 | $2,820 | $33,430 |

| 2023 | $1,285 | $36,250 | $2,820 | $33,430 |

| 2022 | $1,285 | $36,250 | $2,820 | $33,430 |

| 2021 | $1,278 | $36,250 | $2,820 | $33,430 |

| 2020 | $1,278 | $36,250 | $2,820 | $33,430 |

| 2019 | $1,278 | $36,250 | $2,820 | $33,430 |

| 2018 | $1,278 | $36,250 | $2,820 | $33,430 |

| 2017 | -- | $36,250 | $2,820 | $33,430 |

| 2016 | $1,219 | $36,250 | $2,820 | $33,430 |

| 2015 | -- | $36,250 | $2,820 | $33,430 |

| 2014 | -- | $36,250 | $2,820 | $33,430 |

Source: Public Records

Map

Nearby Homes

- 521 15th St

- 1440 Chestnut St

- 517 15th St

- 1436 Chestnut St

- 513 15th St

- 1443 Chestnut St

- 1432 Chestnut St

- 605 15th St

- 1430 1/2 Chestnut St

- 1437 Chestnut St

- 509 15th St

- 1430 Chestnut St

- 1441 Chestnut St

- 607 15th St

- 1441 Buffalo St

- 1439 Buffalo St

- 1431 Chestnut St

- 1435 Buffalo St

- 505 15th St

- 611 15th St