Estimated Value: $145,128 - $276,000

--

Bed

--

Bath

1,324

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 1457 Elizabeth St, Crete, IL 60417 and is currently estimated at $210,782, approximately $159 per square foot. 1457 Elizabeth St is a home located in Will County with nearby schools including Crete Elementary School, Crete-Monee Middle School, and Crete-Monee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2025

Sold by

Genevieve Floyd Living Trust and Peterson Jennifer K

Bought by

Peterson Jennifer K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Outstanding Balance

$124,079

Interest Rate

6.5%

Mortgage Type

New Conventional

Estimated Equity

$86,703

Purchase Details

Closed on

Mar 21, 2022

Sold by

Genevieve Floyd

Bought by

Genevieve Floyd Living Trust

Purchase Details

Closed on

Jun 11, 2008

Sold by

Erickson Harry E and Erickson Marlene G

Bought by

Floyd Donald and Floyd Genevieve

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

5.96%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peterson Jennifer K | -- | Proper Title | |

| Genevieve Floyd Living Trust | -- | Mw Brady Law Firm Pc | |

| Floyd Donald | $175,000 | Atg |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peterson Jennifer K | $125,000 | |

| Previous Owner | Floyd Donald | $55,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,910 | $53,451 | $11,399 | $42,052 |

| 2023 | $1,910 | $47,729 | $10,179 | $37,550 |

| 2022 | $2,094 | $42,418 | $9,046 | $33,372 |

| 2021 | $2,828 | $38,837 | $8,282 | $30,555 |

| 2020 | $2,938 | $36,398 | $7,762 | $28,636 |

| 2019 | $3,041 | $34,209 | $7,295 | $26,914 |

| 2018 | $3,300 | $40,358 | $7,138 | $33,220 |

| 2017 | $3,418 | $37,179 | $6,576 | $30,603 |

| 2016 | $3,421 | $36,939 | $6,534 | $30,405 |

| 2015 | $3,472 | $35,950 | $6,359 | $29,591 |

| 2014 | $3,472 | $36,313 | $6,423 | $29,890 |

| 2013 | $3,472 | $38,052 | $6,731 | $31,321 |

Source: Public Records

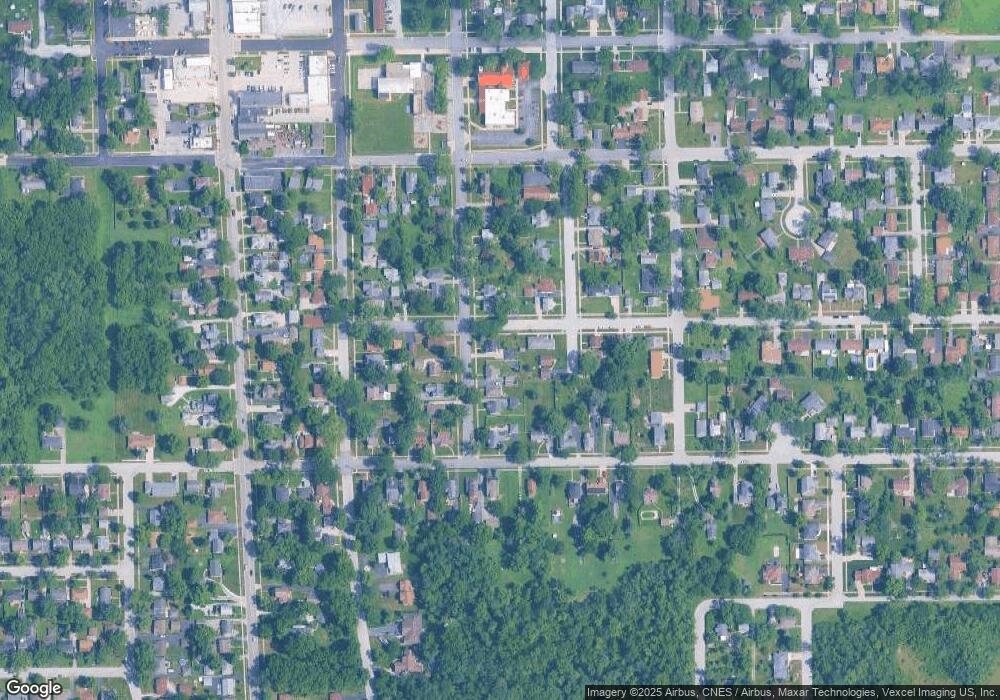

Map

Nearby Homes

- 432 Herman St

- 1361 Elizabeth St

- 1378 East St

- 1321 Wood St

- 520 Craig Ave

- 381 W Exchange St

- 1610 Hewes St

- 574 Herman St

- 20 Joe Orr Ct

- 514 North St

- 1512 Vincennes St

- 1322 Benton St

- 1402 apx W Exchange St

- 280 W Exchange St

- 1404 (apx) W Exchange St

- 1400 (apx) W Exchange St

- 1307 Dairy Ln

- 378 Oakwood Dr

- 354 Oakwood Dr

- 249 Milburn Ave

- 1463 Elizabeth St

- 1447 Elizabeth St

- 420 Hubbard Ln

- 420 Hubbard Ln

- 1467 Elizabeth St

- 1460 Park St

- 1460 Park St

- 1443 Elizabeth St

- 1448 Park St

- 1456 Elizabeth St

- 1462 Elizabeth St

- 1468 Elizabeth St

- 419 Herman St

- 1444 Elizabeth St

- 1444 Park St

- 429 Herman St

- 1472 Elizabeth St

- 1437 Elizabeth St

- 1434 Elizabeth St