1458 Lambrays Ct Sparks, NV 89436

Los Altos Parkway NeighborhoodEstimated Value: $658,291 - $692,000

3

Beds

3

Baths

2,296

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 1458 Lambrays Ct, Sparks, NV 89436 and is currently estimated at $669,323, approximately $291 per square foot. 1458 Lambrays Ct is a home located in Washoe County with nearby schools including Miguel Sepulveda Elementary School, Sky Ranch Middle School, and Edward C Reed High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2017

Sold by

Brecke Matthew and Brecke Tracy M

Bought by

Brecke Matthew A and Brecke Tracy M

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2012

Sold by

Brecke Matthew and Brecke Tracy M

Bought by

Brecke Tracy M and Brecke Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$151,592

Interest Rate

3.33%

Mortgage Type

New Conventional

Estimated Equity

$517,731

Purchase Details

Closed on

Aug 12, 2009

Sold by

Koelzer Kirk O

Bought by

Brecke Matthew A and Trojan Tracy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,288

Interest Rate

5.3%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 29, 2006

Sold by

The Vineyard Investors Llc

Bought by

Koelzer Kirk O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$379,245

Interest Rate

6.62%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brecke Matthew A | -- | None Available | |

| Brecke Tracy M | -- | Western Title Company | |

| Brecke Matthew A | $232,500 | Western Title Inc Ridge | |

| Koelzer Kirk O | $474,500 | Stewart Title Of Northern Nv |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brecke Tracy M | $220,000 | |

| Closed | Brecke Matthew A | $228,288 | |

| Previous Owner | Koelzer Kirk O | $379,245 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,487 | $162,942 | $39,305 | $123,637 |

| 2024 | $3,487 | $158,942 | $34,650 | $124,292 |

| 2023 | $2,460 | $160,741 | $43,295 | $117,446 |

| 2022 | $3,288 | $131,403 | $33,670 | $97,733 |

| 2021 | $3,193 | $123,971 | $26,985 | $96,986 |

| 2020 | $3,098 | $125,537 | $28,525 | $97,012 |

| 2019 | $3,008 | $121,569 | $26,530 | $95,039 |

| 2018 | $2,920 | $112,467 | $19,495 | $92,972 |

| 2017 | $2,835 | $109,054 | $18,655 | $90,399 |

| 2016 | $2,763 | $110,157 | $17,780 | $92,377 |

| 2015 | $2,757 | $108,426 | $16,660 | $91,766 |

| 2014 | $2,678 | $96,788 | $14,420 | $82,368 |

| 2013 | -- | $70,493 | $10,990 | $59,503 |

Source: Public Records

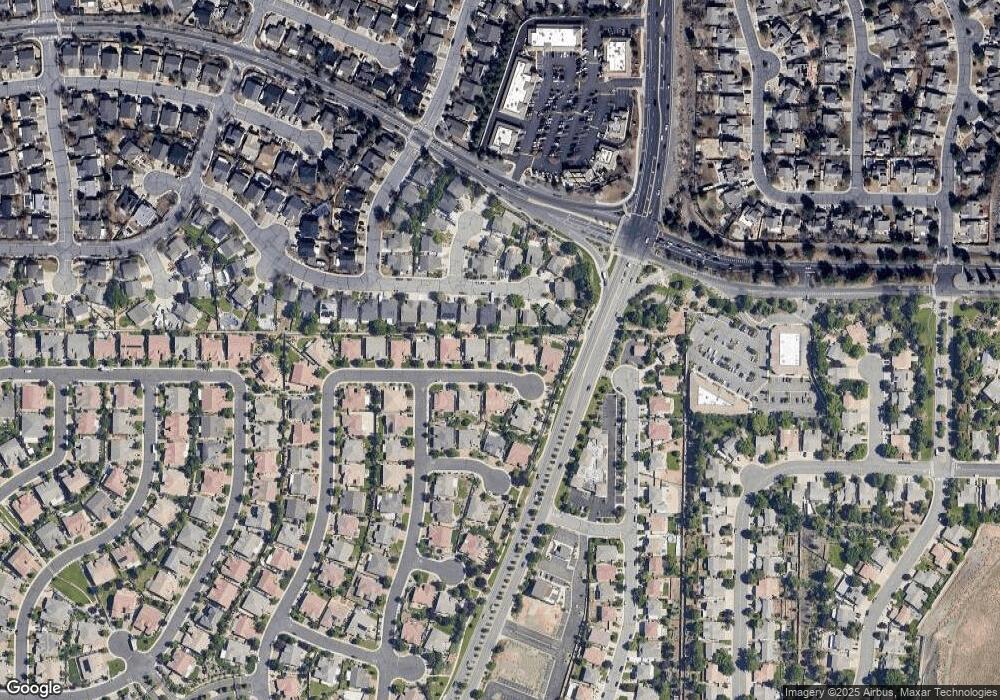

Map

Nearby Homes

- 1388 Lambrays Ln

- 5105 Santa Anita Dr

- 1304 Lambrusca Dr

- 5276 Santa Rosa Ave

- 1215 Ebling Dr

- 3693 Vista Blvd

- 1560 Freeman Way

- 1716 Canyon Terrace Dr

- 4788 Ravello Dr

- 1550 Istrice Rd

- 1685 Southview Dr

- 5049 Keams Ct

- 4950 San Diego Ct

- 4748 Pradera St

- 4675 Firtree Ln

- 5780 Camino Verde Dr Unit 105

- 4515 Whitney Cir

- 2084 Great Bluffs Ln Unit Homesite 5132

- 2094 Great Bluffs Ln Unit Homesite 5133

- 7129 Singing Tree Rd Unit Homesite 5121

- 1444 Lambrays Ct

- 1472 Lambrays Ct

- 1475 Rincon Dr

- 1465 Rincon Dr

- 1485 Rincon Dr

- 1455 Rincon Dr

- 1430 Lambrays Ct

- 1457 Lambrays Ct

- 1443 Lambrays Ct

- 1445 Rincon Dr

- 1495 Rincon Dr

- 1479 Lambrays Ct

- 1416 Lambrays Ln

- 1473 Lambrays Ct

- 1429 Lambrays Ct

- 1435 Rincon Dr

- 1444 Lambrays Ln

- 5106 Ladera Ct

- 1476 Rincon Dr

- 1442 Chevalier Ct