14608 Chaumont Ct Draper, UT 84020

Estimated Value: $768,145 - $922,000

1

Bed

2

Baths

3,666

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 14608 Chaumont Ct, Draper, UT 84020 and is currently estimated at $840,786, approximately $229 per square foot. 14608 Chaumont Ct is a home located in Salt Lake County with nearby schools including Oak Hollow School, Draper Park Middle School, and Corner Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2012

Sold by

Us Bank National Association

Bought by

Malmrose Roger D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,250

Outstanding Balance

$184,691

Interest Rate

3.84%

Mortgage Type

New Conventional

Estimated Equity

$656,095

Purchase Details

Closed on

Aug 25, 2011

Sold by

Moore Viola

Bought by

Us Bank National Association and Gsr Mortgage Loan Trust 2007-5F

Purchase Details

Closed on

Jul 17, 2007

Sold by

Hawkins Homes & Communities Llc

Bought by

Moore Viola

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$615,372

Interest Rate

6.51%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Malmrose Roger D | -- | Bonneville Superior Title | |

| Us Bank National Association | $430,000 | Etitle Insurance Agency | |

| Moore Viola | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Malmrose Roger D | $269,250 | |

| Previous Owner | Moore Viola | $615,372 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,246 | $638,100 | $159,900 | $478,200 |

| 2024 | $3,246 | $620,100 | $154,700 | $465,400 |

| 2023 | $3,175 | $602,000 | $151,200 | $450,800 |

| 2022 | $3,228 | $591,300 | $148,200 | $443,100 |

| 2021 | $3,779 | $469,200 | $120,300 | $348,900 |

| 2020 | $3,110 | $461,300 | $110,000 | $351,300 |

| 2019 | $2,986 | $432,800 | $94,900 | $337,900 |

| 2018 | $0 | $398,100 | $94,900 | $303,200 |

| 2017 | $2,586 | $366,900 | $83,100 | $283,800 |

| 2016 | $2,623 | $361,700 | $88,300 | $273,400 |

| 2015 | $3,383 | $431,900 | $94,500 | $337,400 |

| 2014 | $3,322 | $414,300 | $91,800 | $322,500 |

Source: Public Records

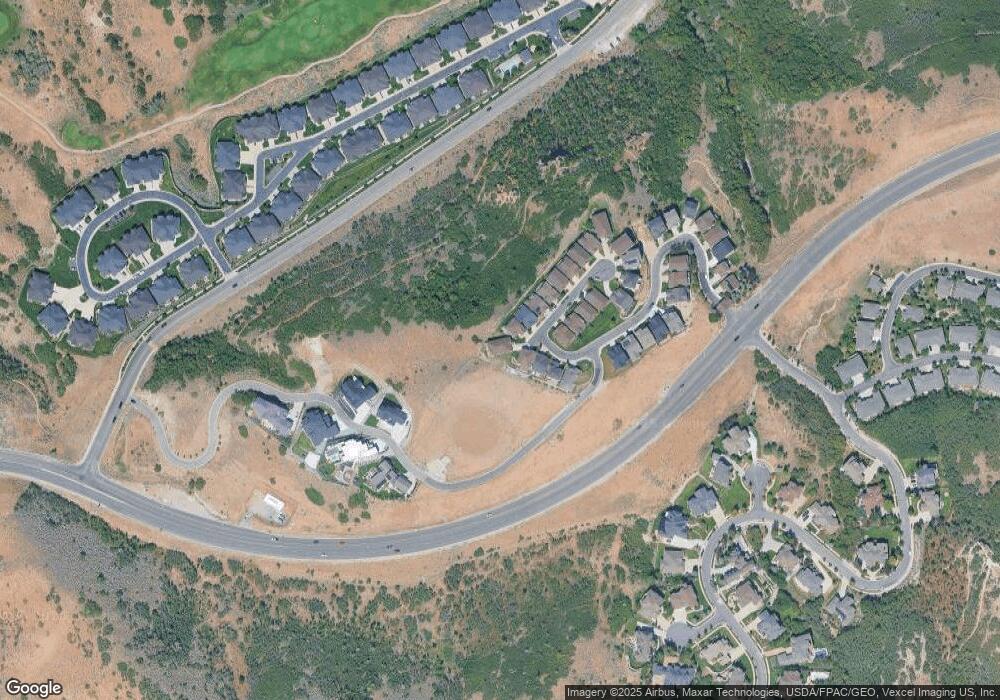

Map

Nearby Homes

- 14599 S Chaumont Ct

- 909 E Rosebud Ct

- 1293 E Fawn Pointe Ct Unit 29

- 14618 Gallatin Ln

- 1297 E Fawn Pointe Ct

- 14794 S Vintage View Ln

- 13164 S City Point Cove Unit 1

- 498 W Maidengrass Way

- 1314 E Victor Ln

- 14793 S Vintage View Ln Unit 14

- 492 W Maidengrass Way

- 14669 S Faulkridge Ct Unit 106

- 13189 S City Point Cove E Unit 4

- 15211 S Eagle Dr Unit 141

- 15219 S Eagle Dr Unit 141

- 2202 E Eagle Dr Unit 141

- 2196 E Eagle Dr Unit 141

- 15193 S Eagle Dr Unit 141

- 15183 S Eagle Dr Unit 141

- 15202 S Eagle Crest Dr Unit 140

- 14608 S Chaumont Ct

- 14606 S Chaumont Ct

- 1178 Delacroix Dr

- 1178 E Delacroix Dr Unit 136

- 1178 E Delacroix Dr Unit 136

- 1178 E Delacroix Dr

- 14602 S Chaumont Ct

- 14602 S Chaumont Ct Unit 133

- 1182 E Delacroix Dr

- 14598 Chaumont Ct

- 14598 S Chaumont Ct Unit 136

- 14598 S Chaumont Ct

- 1186 E Delacroix Dr

- 14611 S Chaumont Ct

- 14611 Chaumont Ct

- 14592 S Chaumont Ct

- 14592 Chaumont Ct

- 1192 E Delacroix Dr

- 1192 E Delacroix Dr Unit 139

- 14603 S Chaumont Ct Unit 133