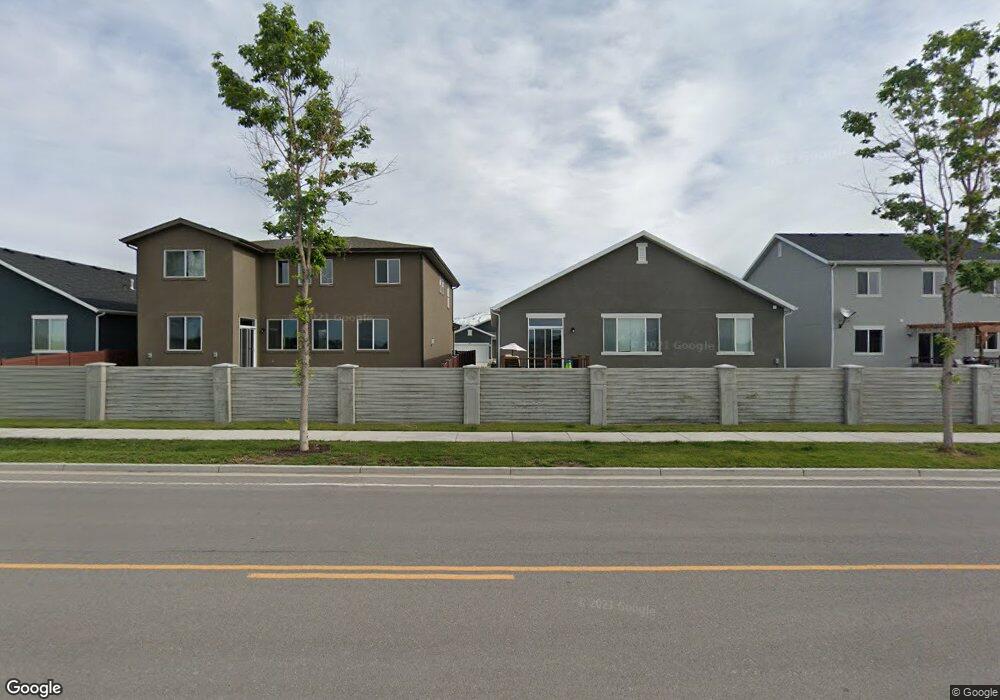

147 E 425 N Unit 101 Vineyard, UT 84059

Estimated Value: $586,000 - $651,000

3

Beds

2

Baths

3,066

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 147 E 425 N Unit 101, Vineyard, UT 84059 and is currently estimated at $613,464, approximately $200 per square foot. 147 E 425 N Unit 101 is a home located in Utah County with nearby schools including Orem Junior High School, Mountain View High School, and Freedom Preparatory Academy - Vineyard.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2023

Sold by

Armenta Victor B

Bought by

Armenta Family Trust

Current Estimated Value

Purchase Details

Closed on

Nov 30, 2017

Sold by

Armenta Victor B

Bought by

Armenta Victor B and Armenta Stephanie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,913

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 28, 2017

Sold by

Woodsidehomes Of Utah Llc

Bought by

Armenta Victor B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,913

Interest Rate

3.94%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Armenta Family Trust | -- | None Listed On Document | |

| Armenta Victor B | -- | Us Title Insurance Agency | |

| Armenta Victor B | -- | Us Title Insurance Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Armenta Victor B | $300,913 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,065 | $306,020 | -- | -- |

| 2024 | $3,065 | $287,485 | $0 | $0 |

| 2023 | $2,812 | $294,690 | $0 | $0 |

| 2022 | $2,784 | $283,690 | $0 | $0 |

| 2021 | $2,465 | $385,100 | $151,400 | $233,700 |

| 2020 | $2,308 | $360,200 | $137,600 | $222,600 |

| 2019 | $2,051 | $329,800 | $128,400 | $201,400 |

| 2018 | $2,050 | $303,000 | $116,200 | $186,800 |

| 2017 | $1,229 | $97,900 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 141 E 425 N Unit LOT100

- 157 E 425 N

- 148 E 460 N

- 133 E 425 N

- 156 E 460 N

- 156 E 460 N Unit 73

- 138 W 460 North St

- 138 E 460 N

- 132 E 460 N

- 152 E 425 N

- 125 E 425 N Unit 98

- 144 E 425 N

- 158 E 425 N

- 158 E 425 N Unit LOT 15

- 136 E 425 N Unit LOT 18

- 124 E 460 N

- 175 E 425 N

- 128 E 425 N Unit LOT 19

- 128 E 425 N

- 174 W 460 North St