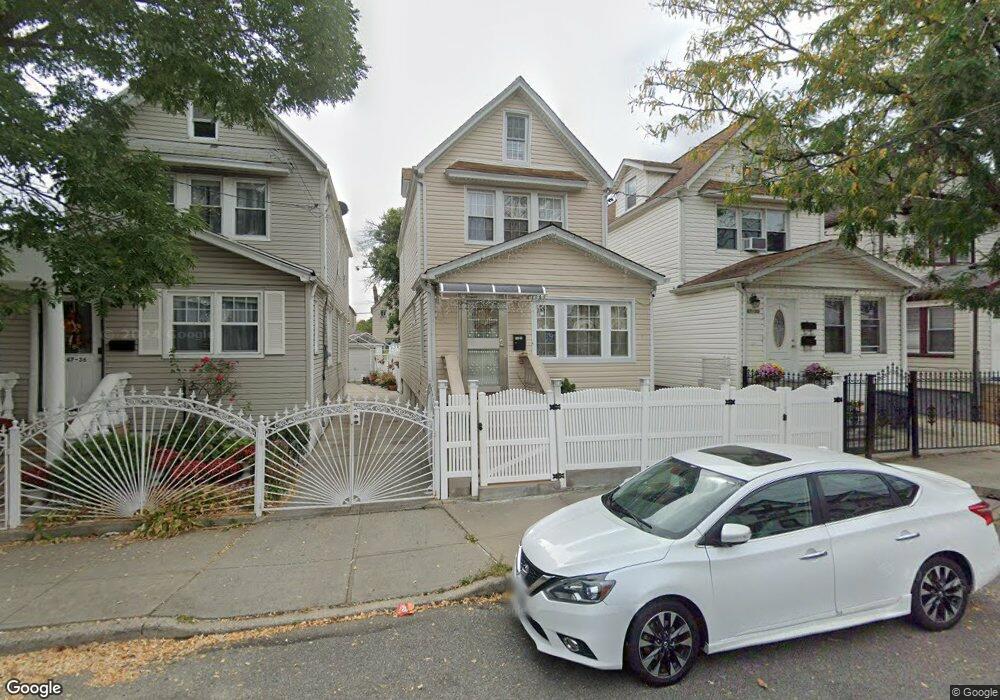

14734 110th Rd Jamaica, NY 11435

Jamaica NeighborhoodEstimated Value: $688,000 - $751,000

3

Beds

1

Bath

1,440

Sq Ft

$500/Sq Ft

Est. Value

About This Home

This home is located at 14734 110th Rd, Jamaica, NY 11435 and is currently estimated at $720,402, approximately $500 per square foot. 14734 110th Rd is a home located in Queens County with nearby schools including P.S. 160 Walter Francis Bishop and Junior High School 8 Richard S Grossley.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2018

Sold by

Royal Holding Group Llc

Bought by

Herman Neil R and Vibart David

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$494,505

Outstanding Balance

$417,836

Interest Rate

3.99%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$302,566

Purchase Details

Closed on

Jun 29, 2017

Sold by

Armstrong Albert D and Idlett Benjamin

Bought by

Royal Holding Group Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

3.94%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 24, 2012

Sold by

Armstrong Albert D

Bought by

Armstrong Jr Albert D and Tompkins Doreen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Herman Neil R | $540,000 | -- | |

| Royal Holding Group Llc | $230,000 | -- | |

| Armstrong Jr Albert D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Herman Neil R | $494,505 | |

| Previous Owner | Royal Holding Group Llc | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,509 | $22,451 | $5,659 | $16,792 |

| 2024 | $4,509 | $22,451 | $6,656 | $15,795 |

| 2023 | $4,318 | $21,497 | $5,971 | $15,526 |

| 2022 | $4,196 | $33,300 | $11,100 | $22,200 |

| 2021 | $4,173 | $30,960 | $11,100 | $19,860 |

| 2020 | $3,960 | $29,820 | $11,100 | $18,720 |

| 2019 | $3,914 | $29,940 | $11,100 | $18,840 |

| 2018 | $3,652 | $17,914 | $9,180 | $8,734 |

| 2017 | $2,925 | $17,517 | $7,923 | $9,594 |

| 2016 | $1,031 | $17,517 | $7,923 | $9,594 |

| 2015 | $532 | $15,591 | $9,530 | $6,061 |

| 2014 | $532 | $15,591 | $9,391 | $6,200 |

Source: Public Records

Map

Nearby Homes

- 10966 153rd St

- 14620 111th Ave

- 15317 110th Rd

- 109-55 153rd St

- 111-41 Sutphin Blvd

- 111-32 147th St

- 153-27 110th Ave

- 145 Central Park N Unit 6C

- 145 Central Park N Unit 2-A

- 155-07 110th Ave

- 110-36 156th St

- 111-28 146th St

- 147-47 Ferndale Ave

- 109-49 155th St

- 111-15 Inwood St

- 150-12 109th Ave

- 110-39 156th St

- 10906 Liverpool St

- 15027 Linden Blvd

- 11137 156th St

- 14734 110th Rd

- 14734 110th Rd

- 14734 110th Rd

- 147-32 110th Rd

- 14732 110th Rd

- 14736 110th Rd

- 14730 110th Rd

- 14740 110th Rd

- 14728 110th Rd

- 14726 110th Rd

- 14726 110th Rd

- 14744 110th Rd

- 11026 Sutphin Blvd

- 14811 111th Ave

- 11044 Sutphin Blvd

- 14809 111th Ave

- 14724 110th Rd

- 14813 111th Ave

- 11046 Sutphin Blvd

- 14807 111th Ave