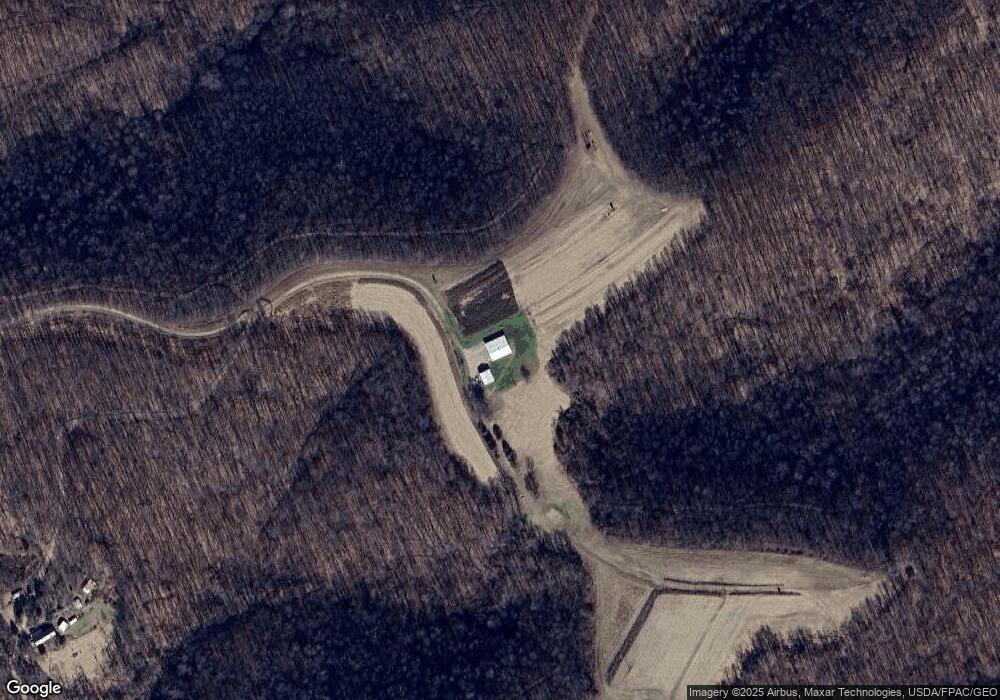

1474 Monroe Rd Peebles, OH 45660

Estimated Value: $294,000 - $1,610,764

3

Beds

1

Bath

880

Sq Ft

$1,299/Sq Ft

Est. Value

About This Home

This home is located at 1474 Monroe Rd, Peebles, OH 45660 and is currently estimated at $1,143,255, approximately $1,299 per square foot. 1474 Monroe Rd is a home located in Adams County with nearby schools including Peebles Elementary School and Peebles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 3, 2021

Sold by

Schmackers Geraldine M Successor Trustee

Bought by

David Samuel Thayer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.11%

Purchase Details

Closed on

Apr 26, 2021

Sold by

Brown Ralph E and Ralph E Brown Family Trust

Bought by

Brown Mark Steven and Brown Jacqueline R

Purchase Details

Closed on

Aug 14, 2020

Sold by

Schmackers James G Trustee

Bought by

Schmackers Geraldine M Successor Tr

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

2.96%

Purchase Details

Closed on

Dec 19, 1997

Sold by

Schmackers James D

Bought by

Schmackers James G

Purchase Details

Closed on

Oct 1, 1978

Bought by

Schmackers James D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| David Samuel Thayer | $1,300,000 | -- | |

| Brown Mark Steven | -- | None Available | |

| Brown Thomas E | -- | None Available | |

| Schmackers Geraldine M Successor Tr | -- | -- | |

| Schmackers James G | -- | -- | |

| Schmackers James D | $67,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | David Samuel Thayer | -- | |

| Previous Owner | David Samuel Thayer | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,266 | $226,350 | $175,910 | $50,440 |

| 2023 | $2,495 | $226,350 | $175,910 | $50,440 |

| 2022 | $2,530 | $175,040 | $132,830 | $42,210 |

| 2021 | $2,388 | $175,040 | $132,830 | $42,210 |

| 2020 | $2,441 | $175,040 | $132,830 | $42,210 |

| 2019 | $2,442 | $175,040 | $132,830 | $42,210 |

| 2018 | $2,031 | $152,220 | $115,500 | $36,720 |

| 2017 | $1,999 | $152,220 | $115,500 | $36,720 |

| 2016 | $1,995 | $152,220 | $115,500 | $36,720 |

| 2015 | $1,674 | $134,200 | $104,830 | $29,370 |

| 2014 | $1,674 | $134,200 | $104,830 | $29,370 |

Source: Public Records

Map

Nearby Homes

- 0 Beech Fork Rd Unit 5157055

- 0 Beech Fork Rd Unit 225044315

- 12808 Ohio 348

- 12808 Ohio 348

- 0 St Rt 348 Unit 1855893

- 9 Coon Hollow Rd

- acres Coon Hollow Rd

- 5740 St Rt 781

- Ohio 348

- 0 Coon Hollow Rd Unit 947967

- 2316 White Oak Rd

- 4345 Mt Unger Rd

- 0 Golley Rd

- 0 Golley Rd Unit 1864016

- 2030 Cedar Mills Rd

- 2991 Cedar Mills Rd

- 2472 Rocky Fork Rd

- 2603 Cassel Run Rd

- 0 Oppy Hill Rd

- 230 Newman Aly