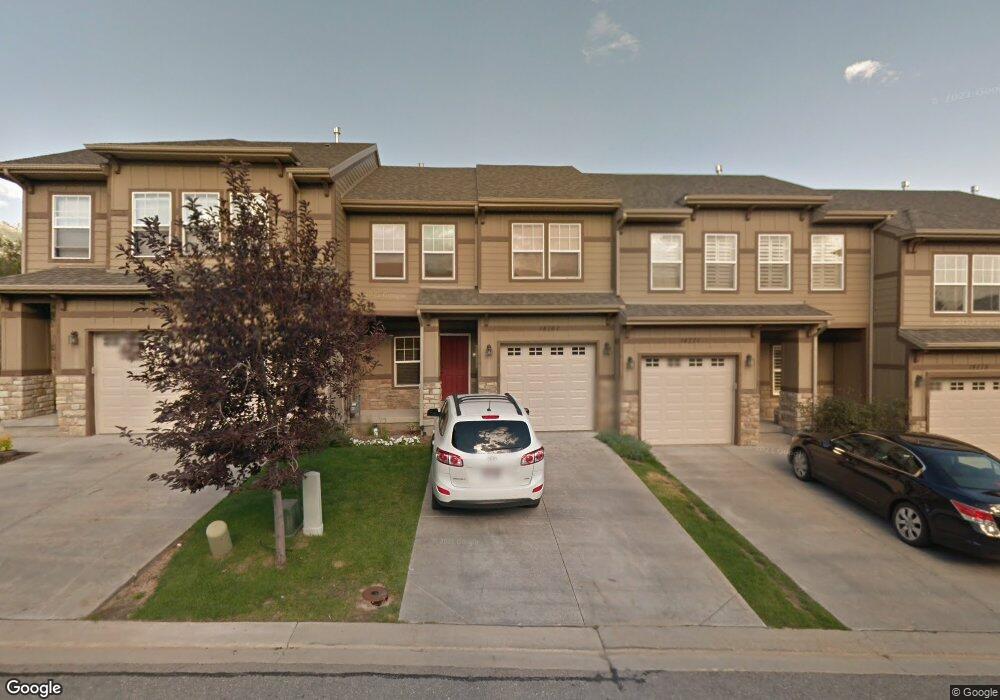

14767 Falkland Cove Draper, UT 84020

Estimated Value: $467,000 - $478,468

3

Beds

4

Baths

2,084

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 14767 Falkland Cove, Draper, UT 84020 and is currently estimated at $473,117, approximately $227 per square foot. 14767 Falkland Cove is a home located in Salt Lake County with nearby schools including Ridgeline Elementary School, Timberline Middle School, and Lone Peak High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2024

Sold by

Ostrander Christopher Eric Bruce and Ostrander Wendy Lou

Bought by

Wendy And Chris Ostrander Family Trust and Ostrander

Current Estimated Value

Purchase Details

Closed on

Feb 9, 2021

Sold by

Worghington Amber Lee

Bought by

Ostrander Christopher Eric Bruce and Ostrander Wendy Lou

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,200

Interest Rate

2.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 24, 2018

Sold by

Argyle Amber L

Bought by

Argyle Amber L and Schriver Nancy

Purchase Details

Closed on

Jul 31, 2013

Sold by

Bateman Joshua Merrill

Bought by

Bateman Amber Lee

Purchase Details

Closed on

Aug 24, 2006

Sold by

Stoneleigh Heights Llc

Bought by

Bateman Amber Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,883

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wendy And Chris Ostrander Family Trust | -- | None Listed On Document | |

| Ostrander Christopher Eric Bruce | -- | Security Title & Abstract | |

| Worthington Amber Lee | -- | Security Title & Abstract | |

| Argyle Amber L | -- | Accommodation | |

| Bateman Amber Lee | -- | None Available | |

| Bateman Amber Lee | -- | Us Title Utah |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ostrander Christopher Eric Bruce | $273,200 | |

| Previous Owner | Bateman Amber Lee | $181,883 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,225 | $235,400 | $62,900 | $365,100 |

| 2024 | $2,225 | $233,255 | $0 | $0 |

| 2023 | $2,116 | $222,585 | $0 | $0 |

| 2022 | $2,313 | $221,925 | $0 | $0 |

| 2021 | $1,536 | $265,100 | $39,800 | $225,300 |

| 2020 | $1,572 | $265,100 | $39,800 | $225,300 |

| 2019 | $1,516 | $265,100 | $39,800 | $225,300 |

| 2018 | $1,349 | $224,000 | $33,600 | $190,400 |

| 2017 | $1,327 | $117,205 | $0 | $0 |

| 2016 | $1,328 | $110,000 | $0 | $0 |

| 2015 | $1,409 | $110,000 | $0 | $0 |

| 2014 | $1,227 | $100,100 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 14767 S Invergarry Ct

- 14775 S Falkland Cove

- 14747 S Haddington Rd

- 2208 E Snow Blossom Way

- 14781 S Glamis Ct

- 14678 S Silver Blossom Way

- 14712 S Glacial Peak Dr

- 14798 S Glacial Peak Dr

- 14634 S Snow Blossom Way Unit 822

- 14673 S Ravine Rock Way E Unit 720

- 1945 E Seven Oaks Ln

- 14749 S Springtime Rd Unit 620

- 14997 Eagle Crest Dr

- 14648 S Springtime Rd

- 2438 E Lone Hill Dr

- 15057 S Winged Bluff Ln

- 2493 E Lone Hill Dr

- 2508 E Lone Hill Dr

- 14849 S Saddle Leaf Ct

- 15151 S Eagle Chase Dr

- 14767 S Falkland Cove

- 14771 S Falkland Cove

- 14771 Falkland Cove

- 14763 Falkland Cove

- 14763 S Falkland Cove

- 14775 Falkland Cove

- 14779 S Falkland Cove

- 14779 Falkland Cove

- 14768 Invergarry Ct

- 14772 S Invergarry Ct

- 14764 S Invergarry Ct

- 14772 Invergarry Ct

- 14764 Invergarry Ct

- 14776 S Invergarry Ct

- 14776 Invergarry Ct

- 14764 S Falkland Cove

- 14768 Falkland Cove

- 14768 S Falkland Cove

- 14772 Falkland Cove

- 14764 Falkland Cove