Estimated Value: $226,000 - $241,000

3

Beds

1

Bath

1,198

Sq Ft

$196/Sq Ft

Est. Value

About This Home

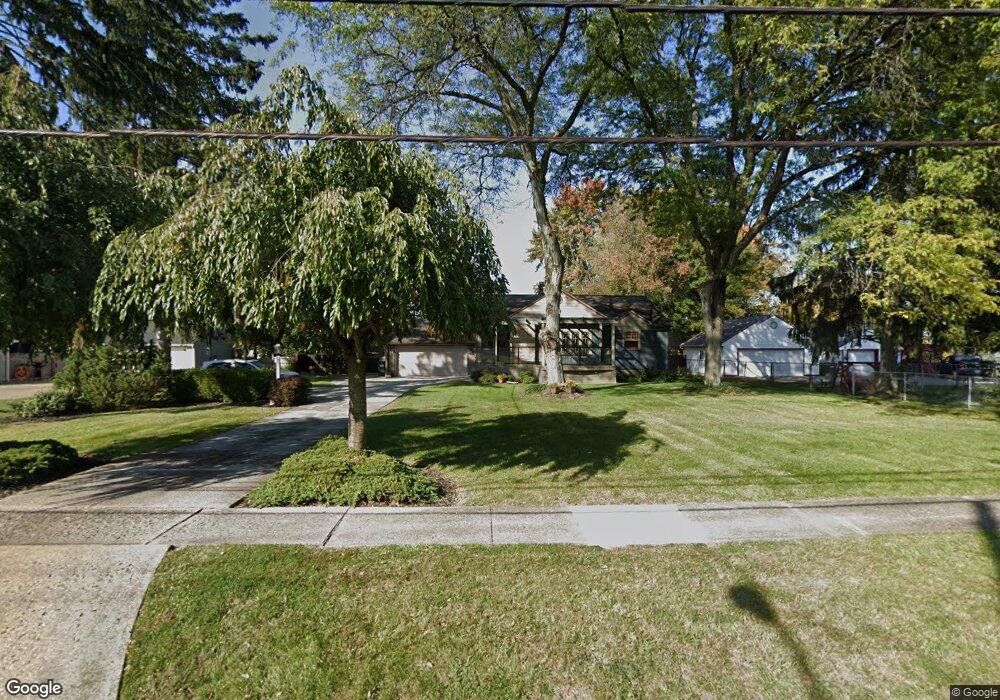

This home is located at 148 West St, Berea, OH 44017 and is currently estimated at $234,406, approximately $195 per square foot. 148 West St is a home located in Cuyahoga County with nearby schools including Grindstone Elementary School, Berea-Midpark Middle School, and Berea-Midpark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 24, 1998

Sold by

Loomis Joel A and Loomis Susan K

Bought by

Hritz Timothy D and Hritz Patricia A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.18%

Purchase Details

Closed on

Jul 12, 1990

Sold by

Loomis Susan

Bought by

Loomis Joel A

Purchase Details

Closed on

May 22, 1990

Sold by

Winkbauer Emily F

Bought by

Loomis Susan

Purchase Details

Closed on

Jul 24, 1986

Sold by

Winklbauer Emily F

Bought by

Winkbauer Emily F

Purchase Details

Closed on

Jun 3, 1981

Sold by

Winklbauer Frank and Winklbauer Emily F

Bought by

Winklbauer Emily F

Purchase Details

Closed on

Jan 1, 1975

Bought by

Winklbauer Frank and Winklbauer Emily F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hritz Timothy D | $127,000 | Executive Title Agency Corp | |

| Loomis Joel A | -- | -- | |

| Loomis Susan | -- | -- | |

| Winkbauer Emily F | -- | -- | |

| Winklbauer Emily F | -- | -- | |

| Winklbauer Frank | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hritz Timothy D | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,306 | $74,410 | $19,600 | $54,810 |

| 2023 | $3,938 | $57,020 | $17,400 | $39,620 |

| 2022 | $3,913 | $57,020 | $17,400 | $39,620 |

| 2021 | $3,880 | $57,020 | $17,400 | $39,620 |

| 2020 | $3,705 | $48,300 | $14,740 | $33,570 |

| 2019 | $3,607 | $138,000 | $42,100 | $95,900 |

| 2018 | $3,267 | $48,300 | $14,740 | $33,570 |

| 2017 | $3,204 | $40,050 | $14,040 | $26,010 |

| 2016 | $3,147 | $39,630 | $14,040 | $25,590 |

| 2015 | $2,974 | $39,630 | $14,040 | $25,590 |

| 2014 | $2,974 | $39,630 | $14,040 | $25,590 |

Source: Public Records

Map

Nearby Homes

- 216 Kraft St

- 209 Gibson St

- 160 Marian Ln Unit 6A

- 300 West St

- 211 W Bridge St

- 287 Edgewood Dr

- 146 Marian Ln

- 388 Fairwood Cir

- 404 Crescent Dr

- 516 Fair St

- 57 Riverside Dr

- 628 Lindbergh Blvd

- 49 Monroe St

- 550 Race St

- 93 W 5th Ave

- 647 Tampico Ct Unit 7

- 549 Wyleswood Dr

- 275 Quarrystone Ln

- 487 Karen Dr

- 23002 Chandlers Ln Unit 223

Your Personal Tour Guide

Ask me questions while you tour the home.