14845 Olympic View Loop Rd NW Silverdale, WA 98383

Olympic View NeighborhoodEstimated Value: $771,000 - $1,057,020

1

Bed

1

Bath

984

Sq Ft

$949/Sq Ft

Est. Value

About This Home

This home is located at 14845 Olympic View Loop Rd NW, Silverdale, WA 98383 and is currently estimated at $933,505, approximately $948 per square foot. 14845 Olympic View Loop Rd NW is a home located in Kitsap County with nearby schools including Cougar Valley Elementary School, Central Kitsap Middle School, and Central Kitsap High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2012

Sold by

Pendras Peter R

Bought by

Xu Ke Kurt and Xu Dianne M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$327,600

Outstanding Balance

$225,447

Interest Rate

3.53%

Mortgage Type

New Conventional

Estimated Equity

$708,058

Purchase Details

Closed on

Dec 8, 2011

Sold by

Pendras Peter R

Bought by

Pendras Peter R and Estate Of Leonora E Pendras

Purchase Details

Closed on

Dec 29, 1997

Sold by

Pendras Leonora E

Bought by

Leonora Pendras Family Ltd Partnership

Purchase Details

Closed on

Dec 18, 1959

Sold by

Deardorf George R

Bought by

Pendras Richard and Pendras Leonora C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Xu Ke Kurt | $4,097 | Fidelity National Title | |

| Pendras Peter R | -- | None Available | |

| Leonora Pendras Family Ltd Partnership | -- | -- | |

| Pendras Richard | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Xu Ke Kurt | $327,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $8,142 | $889,720 | $666,610 | $223,110 |

| 2025 | $8,142 | $889,720 | $666,610 | $223,110 |

| 2024 | $7,916 | $889,720 | $666,610 | $223,110 |

| 2023 | $5,892 | $655,860 | $489,270 | $166,590 |

| 2022 | $5,621 | $551,520 | $408,290 | $143,230 |

| 2021 | $5,396 | $503,780 | $371,170 | $132,610 |

| 2020 | $5,394 | $510,840 | $387,430 | $123,410 |

| 2019 | $5,559 | $510,840 | $387,430 | $123,410 |

| 2018 | $6,560 | $469,870 | $404,200 | $65,670 |

| 2017 | $5,849 | $469,870 | $404,200 | $65,670 |

| 2016 | $6,318 | $469,870 | $404,200 | $65,670 |

| 2015 | $6,048 | $469,870 | $404,200 | $65,670 |

| 2014 | -- | $425,890 | $367,460 | $58,430 |

| 2013 | -- | $425,890 | $367,460 | $58,430 |

Source: Public Records

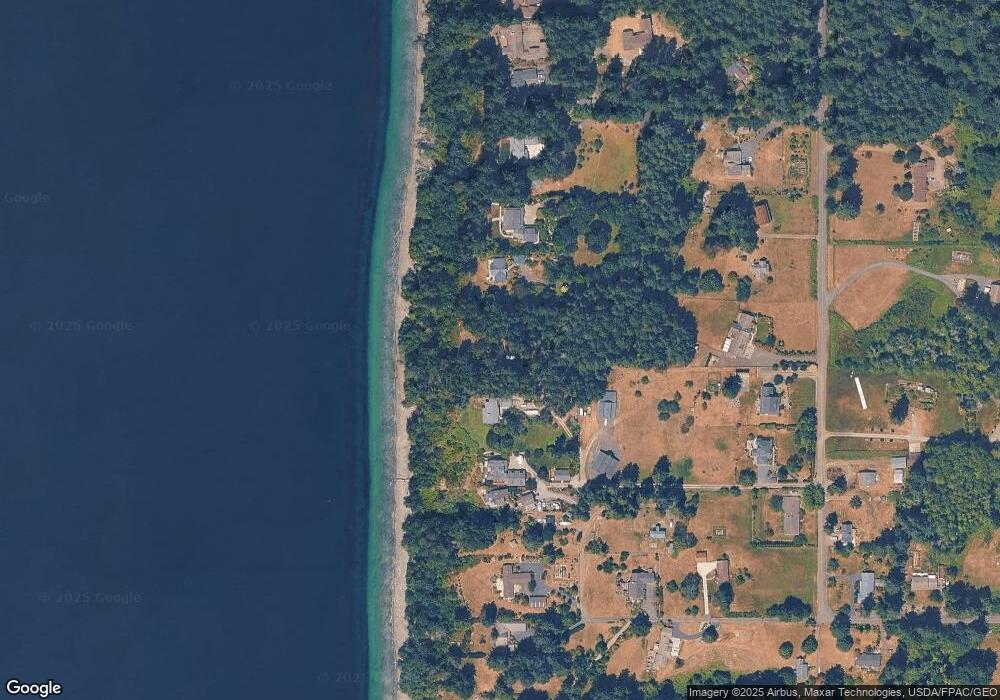

Map

Nearby Homes

- 14925 Olympic View Loop Rd NW

- 13855 Olympic View Rd NW

- 5527 NW Lause Way

- 17257 Olympic View Rd NW

- 931 Whitney Rd

- 225 NKA Dietz Dr

- 777 NW Anderson Hill Rd

- 901 Whitney Rd

- 3761 NW Trigger Ave

- 4293 NW Westgate Rd

- 171 Whitney Rd

- 15800 Clear Creek Rd NW

- 3303 NW Half Mile Rd

- 10763 Armada Ave NW

- 10624 Treasure Dr NW Unit 106

- 10625 Treasure Dr NW

- 10625 Treasure Dr NW Unit 123

- 10637 Treasure Dr NW Unit 121

- 10637 Treasure Dr NW

- 10656 Treasure Dr NW Unit 107

- 6873 NW Brothers View Ln

- 6855 NW Brothers View Ln

- 14837 Olympic View Loop Rd NW

- 14535 Olympic View Loop Rd NW

- 14537 Olympic View Loop Rd NW

- 7030 NW Olympic View Ct

- 7059 NW Olympic View Ct

- 14605 Olympic View Loop Rd NW

- 14605 Olympic View Loop Rd NW

- 7010 NW Olympic View Ct

- 7026 NW Olympic View Ct

- 14685 Olympic View Loop Rd NW

- 14575 Olympic View Loop Rd NW

- 14849 Olympic View Loop Rd NW

- 14831 Olympic View Loop Rd NW

- 14555 Olympic View Loop Rd NW

- 6980 NW Olympic View Ct

- 6872 NW Brothers View Ln

- 7035 NW Olympic View Ct

- 14851 Olympic View Loop Rd NW