1490 Courtyard Place Dayton, OH 45458

Estimated Value: $615,000 - $659,000

3

Beds

3

Baths

2,327

Sq Ft

$273/Sq Ft

Est. Value

About This Home

This home is located at 1490 Courtyard Place, Dayton, OH 45458 and is currently estimated at $635,212, approximately $272 per square foot. 1490 Courtyard Place is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2011

Sold by

Fox Richard and Fox Dianne L

Bought by

Keith Tammy Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$193,719

Interest Rate

4.63%

Mortgage Type

New Conventional

Estimated Equity

$441,493

Purchase Details

Closed on

May 25, 2005

Sold by

Zengel Enterprises Inc

Bought by

Fox Richard C and Fox Dianne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,850

Interest Rate

5.5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 11, 2003

Sold by

Richley Rodney R and Richley Janette A

Bought by

Zengel Enterprises Inc

Purchase Details

Closed on

Aug 30, 2001

Sold by

Yankee Trace Dev Inc

Bought by

Zengel Enterprises Inc and Richley Rodney R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keith Tammy Elizabeth | $350,000 | Evans Title Agency Inc | |

| Fox Richard C | $65,000 | Chicago Title Insurance Co | |

| Zengel Enterprises Inc | -- | Chicago Title Insurance Co | |

| Zengel Enterprises Inc | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Keith Tammy Elizabeth | $280,000 | |

| Previous Owner | Fox Richard C | $365,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,220 | $200,560 | $34,130 | $166,430 |

| 2023 | $12,220 | $200,560 | $34,130 | $166,430 |

| 2022 | $11,895 | $154,270 | $26,250 | $128,020 |

| 2021 | $11,926 | $154,270 | $26,250 | $128,020 |

| 2020 | $11,910 | $154,270 | $26,250 | $128,020 |

| 2019 | $11,506 | $132,750 | $26,250 | $106,500 |

| 2018 | $10,267 | $132,750 | $26,250 | $106,500 |

| 2017 | $10,155 | $132,750 | $26,250 | $106,500 |

| 2016 | $9,954 | $122,640 | $26,250 | $96,390 |

| 2015 | $9,858 | $122,640 | $26,250 | $96,390 |

| 2014 | $9,858 | $122,640 | $26,250 | $96,390 |

| 2012 | -- | $117,250 | $23,350 | $93,900 |

Source: Public Records

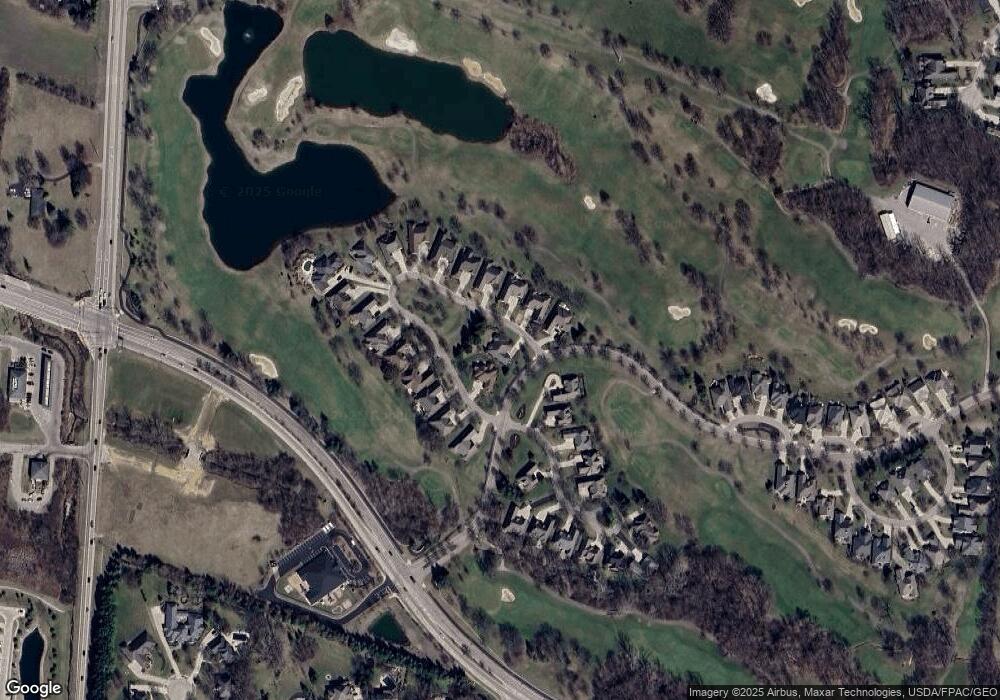

Map

Nearby Homes

- 1384 Courtyard Place

- 985 Gardenwood Place

- 981 Eagle Run Dr

- 1267 Club View Dr

- 1198 W Social Row Rd

- 10612 Falls Creek Ln

- 1248 Club View Dr

- 835 Vintage Green Way

- 1010 Villa Vista Place

- 0 Austin Pike

- 10014 Washington Glen Dr

- 1512 Dell Glen Rd

- 10030 Washington Glen Dr

- 2010 Glen Valley Dr Unit 217

- 2005 Glen Valley Dr Unit 210

- 2006 Glen Valley Dr Unit 216

- 10205 Gully Pass Dr Unit 253

- 10076 Gully Pass Dr Unit 246

- 10072 Gully Pass Dr Unit 245

- 10098 Gully Pass Dr Unit 233

- 1375 Courtyard Place

- 1487 Courtyard Place

- 1475 Courtyard Place

- 1499 Courtyard Place

- 1299 Courtyard Place

- 1463 Courtyard Place

- 1324 Courtyard Place

- 1451 Courtyard Place

- 1336 Courtyard Place

- 1312 Courtyard Place

- 1287 Courtyard Place

- 1348 Courtyard Place

- 1300 Courtyard Place

- 1439 Courtyard Place

- 1360 Courtyard Place

- 1275 Courtyard Place

- 1292 Courtyard Place

- 1427 Courtyard Place

- 1263 Courtyard Place

- 1415 Courtyard Place