1490 Us Highway 19 S Unit 210 Leesburg, GA 31763

Estimated Value: $250,000 - $279,000

3

Beds

3

Baths

2,250

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 1490 Us Highway 19 S Unit 210, Leesburg, GA 31763 and is currently estimated at $264,664, approximately $117 per square foot. 1490 Us Highway 19 S Unit 210 is a home located in Lee County with nearby schools including Lee County Primary School, Lee County Elementary School, and Lee County Middle School - West Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 14, 2024

Sold by

Bishop Freddie

Bought by

Bishop Freddie and Smith Bishop Willie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,633

Outstanding Balance

$264,546

Interest Rate

6.77%

Mortgage Type

New Conventional

Estimated Equity

$118

Purchase Details

Closed on

Jul 19, 2018

Sold by

Dremel Hazel Banks

Bought by

Martin Roy M

Purchase Details

Closed on

Jun 10, 2015

Sold by

Bell Paul G

Bought by

Dremel Frank M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

3.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 8, 2007

Sold by

Saxton Development Co

Bought by

Bell Paul G and Bell Candace H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,000

Interest Rate

6.22%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bishop Freddie | -- | -- | |

| Bishop Freddie | $262,000 | -- | |

| Martin Roy M | $215,000 | -- | |

| Dremel Frank M | $209,000 | -- | |

| Bell Paul G | $260,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bishop Freddie | $267,633 | |

| Previous Owner | Dremel Frank M | $80,000 | |

| Previous Owner | Bell Paul G | $234,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,499 | $84,668 | $10,000 | $74,668 |

| 2023 | $2,331 | $84,668 | $10,000 | $74,668 |

| 2022 | $2,331 | $84,668 | $10,000 | $74,668 |

| 2021 | $2,520 | $89,280 | $6,000 | $83,280 |

| 2020 | $2,992 | $90,400 | $14,000 | $76,400 |

| 2019 | $2,088 | $90,400 | $14,000 | $76,400 |

| 2018 | $3,047 | $90,400 | $14,000 | $76,400 |

| 2017 | $2,885 | $90,400 | $14,000 | $76,400 |

| 2016 | $2,668 | $90,400 | $14,000 | $76,400 |

| 2015 | $2,838 | $90,400 | $14,000 | $76,400 |

| 2014 | $2,848 | $90,400 | $14,000 | $76,400 |

| 2013 | -- | $90,400 | $14,000 | $76,400 |

Source: Public Records

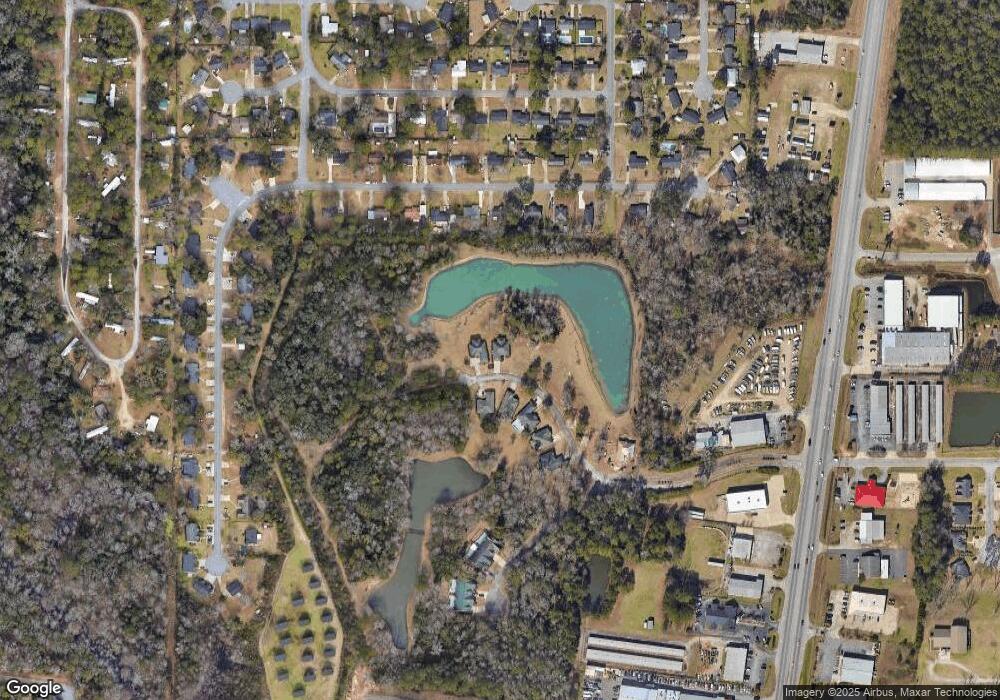

Map

Nearby Homes

- 116 Saxton Place

- 211 Saxton Place

- 110 Saxton Place

- 147 Lynwood Ln

- 235 Cedric St

- 238 Kinchafoonee Creek Rd

- 112 Hidden Cove Ln

- 707 Creekside Dr

- 124 Tuskin Oaks Ct

- 156 Old Hickory Dr

- 128 Laurelwood Ct

- 189 Mayfield Dr

- 142 Cuaneta Dr

- 164 Canuga Dr

- 128 Cuaneta Dr

- 187 Jarrett Dr

- 167 Jarrett Dr

- 529 Creekside Dr

- 192 Creekside Dr

- 127 Mcintosh Rd

- 1490 Us Highway 19 S

- 1490 Us Highway 19 S Unit 110

- 1490 Us Highway 19 S

- 1490 Us Highway 19 S Unit 208

- 1490 Us Highway 19 S

- 1490 Us Highway 19 S Unit 108

- 1490 Us Highway 19 S Unit 212

- 1490 Us Highway 19 S Unit 206

- 1490 Us Highway 19 S

- 1490 Us Highway 19 S Unit 114

- 1490 Us Highway 19 S

- 208 Saxton Place

- 1490 U S Highway 19 S

- 204 Saxton Place

- 1490-1 U S Highway 19 S

- 131 Pelham Dr

- 127 Pelham Dr

- 135 Pelham Dr

- 123 Pelham Dr

- 114 Saxton Place