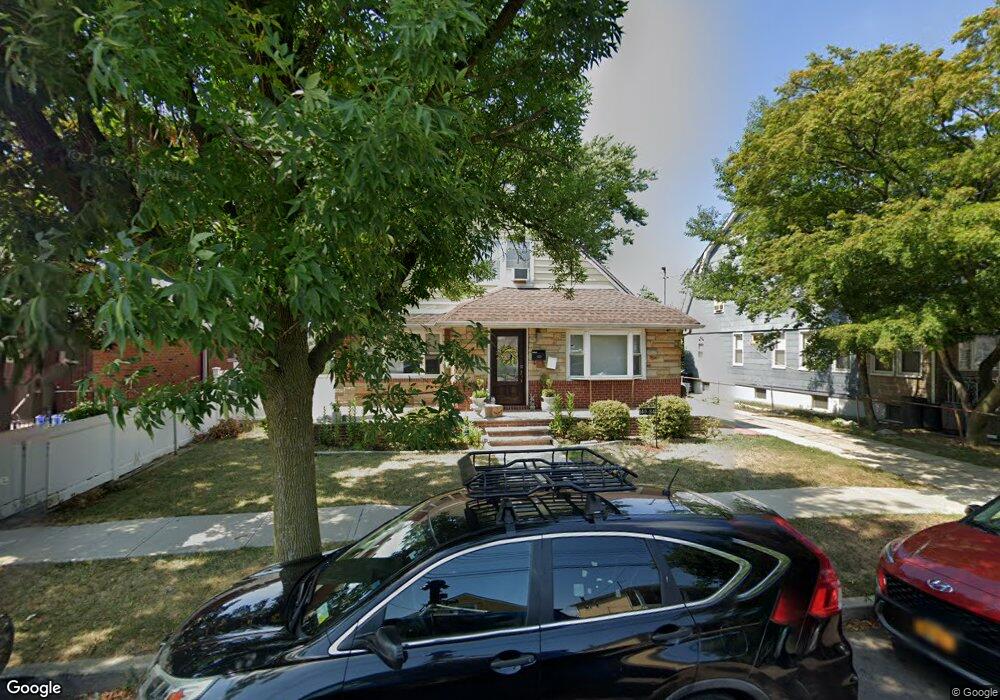

14934 114th Place South Ozone Park, NY 11420

South Ozone Park NeighborhoodEstimated Value: $985,760 - $1,266,000

--

Bed

--

Bath

1,949

Sq Ft

$600/Sq Ft

Est. Value

About This Home

This home is located at 14934 114th Place, South Ozone Park, NY 11420 and is currently estimated at $1,169,690, approximately $600 per square foot. 14934 114th Place is a home located in Queens County with nearby schools including Ps 124 Osmond A Church, J.H.S. 226 Virgil I. Grisson, and John Adams High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 10, 2017

Sold by

Ramirez Lizbet C and Ramirez Robertson A

Bought by

Ramirez Robertson A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,912

Outstanding Balance

$114,300

Interest Rate

4.15%

Mortgage Type

New Conventional

Estimated Equity

$1,055,390

Purchase Details

Closed on

Jul 26, 2000

Sold by

Lagrassa Frank and Lagrassa Jack

Bought by

Ramirez Robertson A and Ramirez Lizbet C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,500

Interest Rate

8.13%

Purchase Details

Closed on

Jul 31, 1994

Sold by

Lagrassa Rose

Bought by

Lagrassa Rose and Lagrassa Jack

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramirez Robertson A | $87,500 | -- | |

| Ramirez Robertson A | $87,500 | -- | |

| Ramirez Robertson A | $325,000 | -- | |

| Lagrassa Frank | -- | -- | |

| Ramirez Robertson A | $325,000 | -- | |

| Lagrassa Rose | -- | Commonwealth Land Title Ins | |

| Lagrassa Rose | -- | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramirez Robertson A | $137,912 | |

| Closed | Ramirez Robertson A | $137,912 | |

| Previous Owner | Ramirez Robertson A | $292,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,125 | $41,904 | $8,693 | $33,211 |

| 2024 | $8,137 | $41,854 | $10,408 | $31,446 |

| 2023 | $7,649 | $39,485 | $9,655 | $29,830 |

| 2022 | $7,545 | $57,900 | $14,040 | $43,860 |

| 2021 | $7,494 | $51,300 | $14,040 | $37,260 |

| 2020 | $7,096 | $56,100 | $14,040 | $42,060 |

| 2019 | $7,003 | $54,660 | $14,040 | $40,620 |

| 2018 | $6,410 | $32,904 | $9,846 | $23,058 |

| 2017 | $6,365 | $32,696 | $11,120 | $21,576 |

| 2016 | $5,857 | $32,696 | $11,120 | $21,576 |

| 2015 | $3,704 | $29,100 | $11,700 | $17,400 |

| 2014 | $3,704 | $29,065 | $11,686 | $17,379 |

Source: Public Records

Map

Nearby Homes

- 149-27 114th St

- 11512 135th Ave

- 11514 135th Ave

- 150-24 117th St

- 13336 114th Place

- 117-10 135th Ave

- 149-34 Lefferts Blvd

- 133-24 118th St

- 130-55 116th St

- 12104 150th Ave

- 12114 149th Ave

- 13220 114th St

- 150-33 Hawtree St

- 150-29 Hawtree St

- 150-25 Hawtree St

- 150-21 Hawtree St

- 150-17 Hawtree St

- 150-15 Hawtree St

- 135-28 122nd St

- 114-02 Sutter Ave

- 14940 114th Place

- 14930 114th Place

- 149-28 114th Place Unit 2nd fl

- 149-28 114th Place

- 14928 114th Place

- 14942 114th Place

- 14931 114th St

- 14937 114th St

- 149-27 114 St

- 149-27 114th St Unit 2

- 14927 114th St

- 14937 114th St Unit 2

- 14941 114th St

- 14922 114th Place

- 14923 114th St

- 149-45 114th St

- 14950 114th Place

- 14945 114th St

- 14935 114th Place

- 14929 114th Place