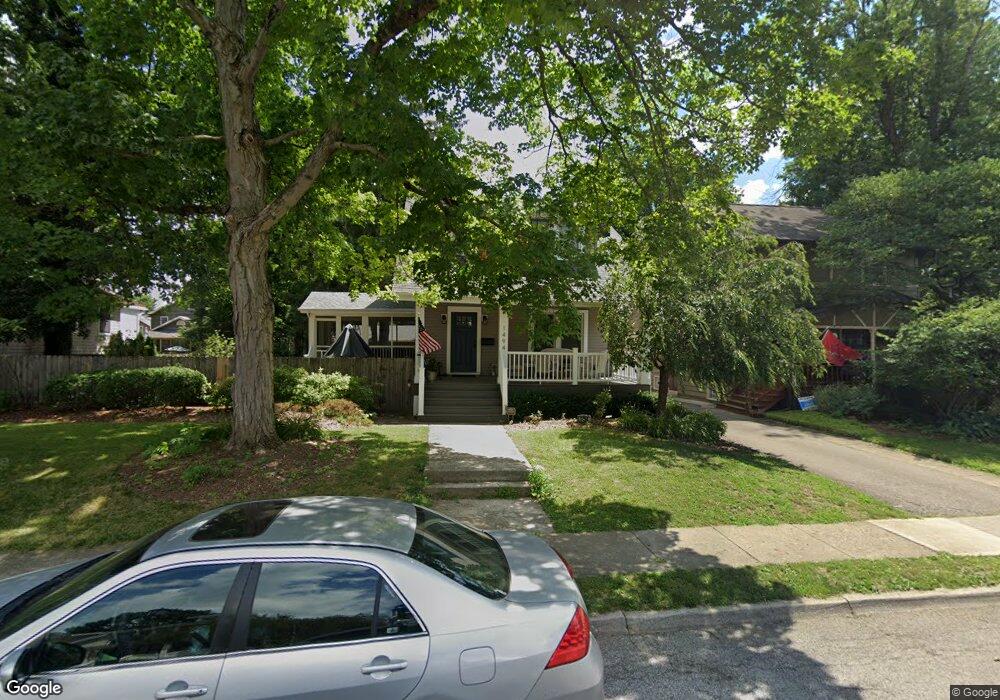

1494 Lincoln Rd Columbus, OH 43212

Estimated Value: $577,000 - $693,000

3

Beds

3

Baths

1,823

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 1494 Lincoln Rd, Columbus, OH 43212 and is currently estimated at $625,807, approximately $343 per square foot. 1494 Lincoln Rd is a home located in Franklin County with nearby schools including Robert Louis Stevenson Elementary School, Larson Middle School, and Grandview Heights High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2010

Sold by

Mainstay Llc

Bought by

Kahn Lara E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,200

Outstanding Balance

$153,682

Interest Rate

4.96%

Mortgage Type

New Conventional

Estimated Equity

$472,125

Purchase Details

Closed on

Feb 8, 2010

Sold by

Franks Melinda H and Citimortgage Inc

Bought by

Mainstay Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,200

Outstanding Balance

$153,682

Interest Rate

4.96%

Mortgage Type

New Conventional

Estimated Equity

$472,125

Purchase Details

Closed on

Aug 9, 2006

Sold by

Franks Gregg A

Bought by

Franks Melinda H

Purchase Details

Closed on

Jul 9, 1992

Bought by

Franks Gregg A

Purchase Details

Closed on

Jul 27, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kahn Lara E | $289,000 | Title First | |

| Mainstay Llc | $176,000 | None Available | |

| Franks Melinda H | -- | None Available | |

| Franks Gregg A | $101,500 | -- | |

| -- | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kahn Lara E | $231,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,164 | $174,270 | $81,170 | $93,100 |

| 2023 | $8,904 | $174,265 | $81,165 | $93,100 |

| 2022 | $10,754 | $179,240 | $79,730 | $99,510 |

| 2021 | $10,068 | $179,240 | $79,730 | $99,510 |

| 2020 | $10,027 | $179,240 | $79,730 | $99,510 |

| 2019 | $10,137 | $160,370 | $79,730 | $80,640 |

| 2018 | $8,876 | $160,370 | $79,730 | $80,640 |

| 2017 | $9,451 | $160,370 | $79,730 | $80,640 |

| 2016 | $7,660 | $111,270 | $53,100 | $58,170 |

| 2015 | $7,660 | $111,270 | $53,100 | $58,170 |

| 2014 | $7,684 | $111,270 | $53,100 | $58,170 |

| 2013 | $3,376 | $101,150 | $48,265 | $52,885 |

Source: Public Records

Map

Nearby Homes

- 1561 Glenn Ave

- 1459 Elmwood Ave Unit 1459

- 1313 Lincoln Rd

- 2015 W 5th Ave Unit 211

- 2015 W 5th Ave Unit 102

- 2015 W 5th Ave Unit 108

- 1631 Roxbury Rd Unit A1

- 1631 Roxbury Rd Unit F3

- 1631 Roxbury Rd Unit B6

- 1263 Oakland Ave

- 1655-1657 Ashland Ave

- 1661 Ashland Ave Unit 663

- 1782 Wyandotte Rd

- 1733 Elmwood Ave

- 1475 W 3rd Ave Unit 204

- 1324 Lake Shore Dr Unit B

- 1301 Lake Shore Dr Unit 199

- 1000 Urlin Ave Unit 1822

- 1000 Urlin Ave Unit 2007

- 1000 Urlin Ave Unit 520

- 1500 Lincoln Rd

- 1488 Lincoln Rd

- 1508 Lincoln Rd

- 1485 Wyandotte Rd

- 1514 Lincoln Rd

- 1477 Wyandotte Rd

- 1495 Wyandotte Rd

- 1471 Wyandotte Rd

- 1516 Lincoln Rd

- 1493 Lincoln Rd

- 1499 Lincoln Rd

- 1470 Lincoln Rd

- 1503 Lincoln Rd

- 1487 Lincoln Rd

- 1509 Lincoln Rd

- 1524 Lincoln Rd

- 1507 Wyandotte Rd

- 1511 Lincoln Rd

- 1461 Wyandotte Rd

- 1479 Lincoln Rd