15 Chablis Ct Marlton, NJ 08053

Estimated Value: $390,000 - $414,000

3

Beds

3

Baths

1,652

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 15 Chablis Ct, Marlton, NJ 08053 and is currently estimated at $400,518, approximately $242 per square foot. 15 Chablis Ct is a home located in Burlington County with nearby schools including J. Harold Vanzant Elementary School, Frances Demasi Middle School, and Cherokee High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2020

Sold by

Perry Timothy

Bought by

Perry Kathleen

Current Estimated Value

Purchase Details

Closed on

Oct 15, 2020

Sold by

Perry Timothy

Bought by

Perry Kathleen

Purchase Details

Closed on

Jul 30, 2001

Sold by

Farabaugh Ted F and Farabaugh Jeanne C

Bought by

Egbert Kathleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,320

Interest Rate

7.16%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Sep 26, 1994

Sold by

Little Bradley S and Little Melanie S Ackerman

Bought by

Farabaugh Ted F and Farabaugh Jeanne C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perry Kathleen | -- | None Available | |

| Perry Kathleen | -- | None Listed On Document | |

| Perry Kathleen | -- | None Listed On Document | |

| Egbert Kathleen | $137,900 | Weichert Title | |

| Farabaugh Ted F | $115,000 | Congress Title Division |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Egbert Kathleen | $110,320 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,830 | $200,000 | $85,000 | $115,000 |

| 2024 | $6,426 | $200,000 | $85,000 | $115,000 |

| 2023 | $6,426 | $200,000 | $85,000 | $115,000 |

| 2022 | $6,138 | $200,000 | $85,000 | $115,000 |

| 2021 | $5,994 | $200,000 | $85,000 | $115,000 |

| 2020 | $5,916 | $200,000 | $85,000 | $115,000 |

| 2019 | $5,868 | $200,000 | $85,000 | $115,000 |

| 2018 | $5,786 | $200,000 | $85,000 | $115,000 |

| 2017 | $5,718 | $200,000 | $85,000 | $115,000 |

| 2016 | $5,578 | $200,000 | $85,000 | $115,000 |

| 2015 | $5,480 | $200,000 | $85,000 | $115,000 |

| 2014 | $5,324 | $200,000 | $85,000 | $115,000 |

Source: Public Records

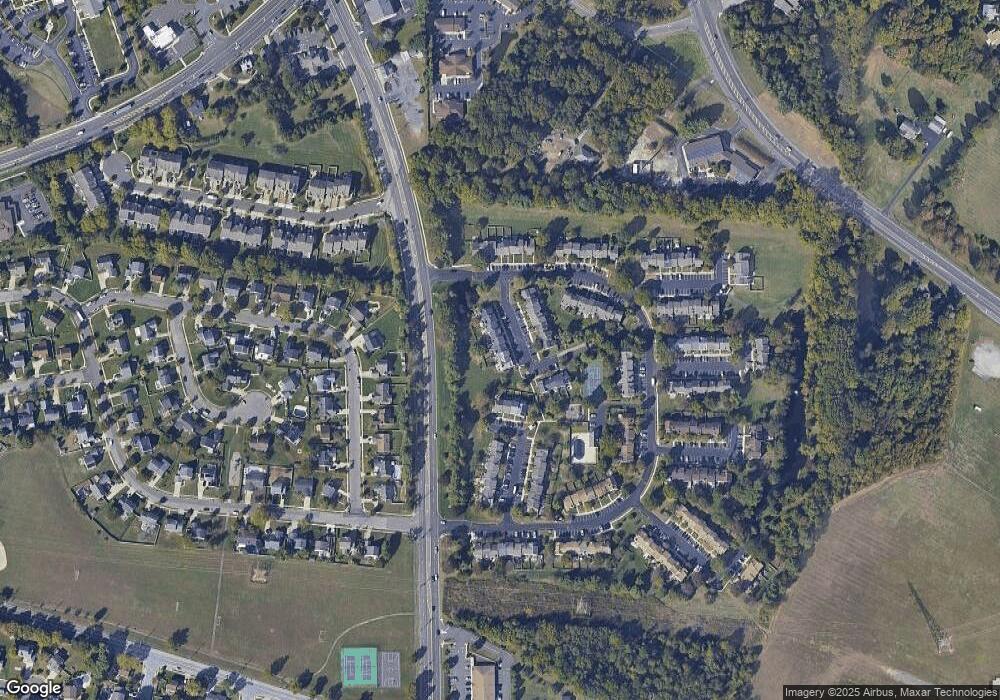

Map

Nearby Homes

- 28 Heron Pointe Ct

- 145 Hearthstone Ln

- 7 Hastings Ct

- 19 Annapolis Dr

- 5804 Red Haven Dr

- 5806 Red Haven Dr

- 6102 Red Haven Dr

- 505 Roberts Ln

- 1406 Jonathan Ln

- 12 Princess Ave

- 82 Farnwood Rd

- 208 Stallion Ct

- 300 Keatley Dr

- 128 Cambridge Ave

- 118 Cambridge Ave

- 100 Cambridge Ave

- 266 Saint David Dr

- 906 Chesterwood Ct

- 707A Cypress Point Cir

- 317 Saint David Dr