Estimated Value: $304,000 - $328,000

1

Bed

2

Baths

1,776

Sq Ft

$178/Sq Ft

Est. Value

About This Home

This home is located at 15 Court a Unit C, Brick, NJ 08724 and is currently estimated at $315,660, approximately $177 per square foot. 15 Court a Unit C is a home located in Ocean County with nearby schools including Emma Havens Young Elementary School, Lake Riviera Middle School, and Brick Township High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2016

Sold by

Bank Of America

Bought by

Macfarlane Karen L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,600

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 30, 2015

Sold by

Mastronardy Michael

Bought by

Bank Of America Na

Purchase Details

Closed on

Apr 23, 2004

Sold by

Calabrese Jeanne

Bought by

Rivera Sharon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Interest Rate

5.47%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macfarlane Karen L | $87,000 | -- | |

| Bank Of America Na | $182,671 | None Available | |

| Rivera Sharon | $155,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Macfarlane Karen L | $69,600 | |

| Previous Owner | Rivera Sharon | $105,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,458 | $141,900 | $75,000 | $66,900 |

| 2024 | $3,282 | $132,500 | $75,000 | $57,500 |

| 2023 | $3,234 | $132,500 | $75,000 | $57,500 |

| 2022 | $3,234 | $132,500 | $75,000 | $57,500 |

| 2021 | $3,167 | $132,500 | $75,000 | $57,500 |

| 2020 | $3,126 | $132,500 | $75,000 | $57,500 |

| 2019 | $3,012 | $130,000 | $75,000 | $55,000 |

| 2018 | $3,588 | $158,500 | $85,000 | $73,500 |

| 2017 | $3,492 | $158,500 | $85,000 | $73,500 |

| 2016 | $3,473 | $158,500 | $85,000 | $73,500 |

| 2015 | $3,382 | $158,500 | $85,000 | $73,500 |

| 2014 | $3,354 | $158,500 | $85,000 | $73,500 |

Source: Public Records

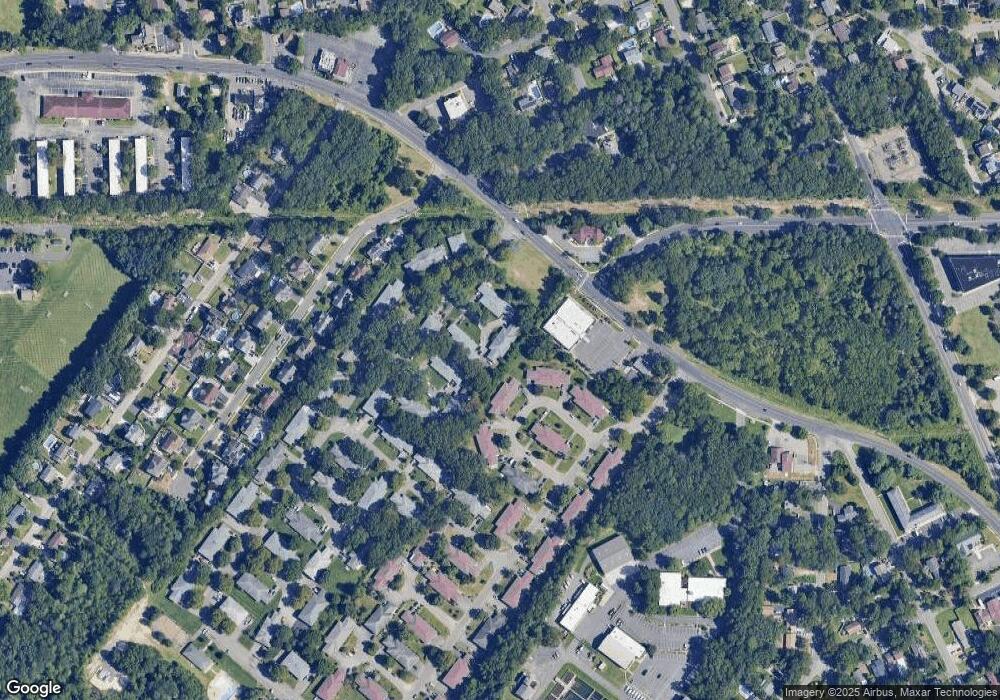

Map

Nearby Homes

- 12 D Trail

- 11C Court a

- 428 Laurel Brook Dr Unit 1704

- 1491 Davidson Ave

- 1595 Forge Pond Rd

- 60 Central Blvd

- 65 Central Blvd

- 1449 Flintoft Ave

- 1658 Burrsville Rd

- 1624 Patriot Ave

- 1430 Forest Ave

- 41 Central Blvd

- 38 Watkins Rd

- 35 Marlow Ave

- 50 Collins Ct

- 39 Marlow Ave

- 7 Robinson Rd

- 1412 Forest Ave

- 6 Heywood Ct

- 53 Albert Cucci Dr

- 15 Court a Unit B

- 15 Court a Unit B

- 15 Court a Unit D

- 15 Court a Unit B

- 15 Court a

- 15C Court a Unit 703

- 15A Court a Unit 701

- 12d Court a

- 12d Court a Unit 804

- 11d A Unit 604

- 12A Court a Unit 801

- 12a A Unit 801

- 22D Court M

- 22C Court M Unit C56

- 24B Court M

- 24B Court M Unit 5602

- 18B Court M

- 12 Court a Unit B

- 12 Court a Unit C

- 12 Court a Unit D