15 Crystal Ln North Easton, MA 02356

Estimated Value: $695,000 - $906,000

3

Beds

3

Baths

2,438

Sq Ft

$335/Sq Ft

Est. Value

About This Home

This home is located at 15 Crystal Ln, North Easton, MA 02356 and is currently estimated at $815,672, approximately $334 per square foot. 15 Crystal Ln is a home located in Bristol County with nearby schools including Easton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2022

Sold by

Clarewood Homes Inc

Bought by

Bates John

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$567,840

Outstanding Balance

$526,277

Interest Rate

3.55%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$289,395

Purchase Details

Closed on

Aug 30, 1999

Sold by

Brian J Mclaughlin Irt and Mclaughlin

Bought by

Fitzgerald Bernard J and Fitzgerald Sheila A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

7.53%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 19, 1996

Sold by

Douglas A King Bldrs

Bought by

Brian J Mclaughlin Irt

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bates John | $660,000 | None Available | |

| Bates John | $660,000 | None Available | |

| Fitzgerald Bernard J | $325,000 | -- | |

| Fitzgerald Bernard J | $325,000 | -- | |

| Brian J Mclaughlin Irt | $265,000 | -- | |

| Brian J Mclaughlin Irt | $265,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bates John | $567,840 | |

| Closed | Bates John | $567,840 | |

| Previous Owner | Brian J Mclaughlin Irt | $125,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,879 | $791,600 | $396,000 | $395,600 |

| 2024 | $9,281 | $695,200 | $300,700 | $394,500 |

| 2023 | $8,966 | $614,500 | $292,700 | $321,800 |

| 2022 | $8,829 | $573,700 | $263,800 | $309,900 |

| 2021 | $8,690 | $561,400 | $251,500 | $309,900 |

| 2020 | $8,424 | $547,700 | $246,800 | $300,900 |

| 2019 | $8,149 | $510,600 | $224,300 | $286,300 |

| 2018 | $7,985 | $492,600 | $224,300 | $268,300 |

| 2017 | $7,696 | $474,500 | $224,300 | $250,200 |

| 2016 | $7,486 | $462,400 | $224,300 | $238,100 |

| 2015 | $7,838 | $467,100 | $229,000 | $238,100 |

| 2014 | $7,123 | $427,800 | $192,700 | $235,100 |

Source: Public Records

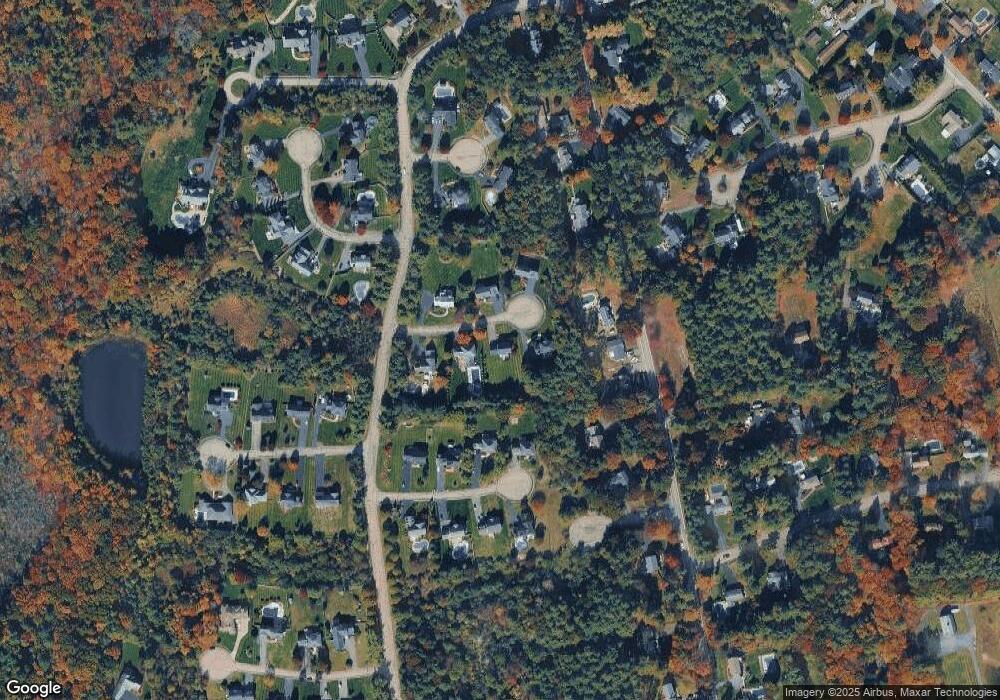

Map

Nearby Homes

- 6 Kingsley Rd

- 37 Kingsley Rd

- 15 Randall Farm Dr

- 45 Randall St

- 89 Massapoag Ave

- 79 Summer St

- 1 Whittier Ln Unit 1

- 18 Prudence Crandall Ln Unit 18

- 73 Summer St

- 32 Spooner St

- 9 Oak Ridge Dr

- 98 Massapoag Ave

- 11 Olde Stable Ln

- 8 Hobart Way

- 67 Center St

- 29 Owl Ridge Rd

- 221 Center St

- 56 Williams St

- 218 Massapoag Ave

- 30 King Arthur Rd