15 Elmtree Dr Unit 8 Sharpsburg, GA 30277

Estimated Value: $507,000 - $561,000

4

Beds

4

Baths

3,238

Sq Ft

$164/Sq Ft

Est. Value

About This Home

This home is located at 15 Elmtree Dr Unit 8, Sharpsburg, GA 30277 and is currently estimated at $530,510, approximately $163 per square foot. 15 Elmtree Dr Unit 8 is a home located in Coweta County with nearby schools including Thomas Crossroads Elementary School, Lee Middle School, and Northgate High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2006

Sold by

Lindgren Christine

Bought by

Dick James H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,000

Outstanding Balance

$111,737

Interest Rate

6.48%

Mortgage Type

New Conventional

Estimated Equity

$418,773

Purchase Details

Closed on

Oct 17, 2003

Sold by

Naschke Paul R

Bought by

Naschke Paul R and Naschke Christine

Purchase Details

Closed on

Jul 17, 2002

Sold by

Naschke Paul R

Bought by

Naschke Paul R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,000

Interest Rate

6.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 28, 2002

Sold by

Dahlberg Robert E and Dahlberg Juanita R

Bought by

Nachke Paul R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,000

Interest Rate

6.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 31, 1988

Bought by

Dahlberg Robert E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dick James H | $119,500 | -- | |

| Dick James H | $119,500 | -- | |

| Naschke Paul R | -- | -- | |

| Naschke Paul R | -- | -- | |

| Nachke Paul R | $235,000 | -- | |

| Dahlberg Robert E | $20,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dick James H | $189,000 | |

| Previous Owner | Nachke Paul R | $219,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,301 | $186,874 | $30,000 | $156,874 |

| 2024 | $4,284 | $189,152 | $30,000 | $159,152 |

| 2023 | $4,284 | $183,390 | $26,000 | $157,390 |

| 2022 | $3,927 | $164,133 | $26,000 | $138,133 |

| 2021 | $3,340 | $131,544 | $18,000 | $113,544 |

| 2020 | $3,361 | $131,544 | $18,000 | $113,544 |

| 2019 | $3,249 | $115,792 | $16,000 | $99,792 |

| 2018 | $3,255 | $115,792 | $16,000 | $99,792 |

| 2017 | $3,277 | $111,800 | $16,000 | $95,800 |

| 2016 | $2,914 | $100,624 | $16,000 | $84,624 |

| 2015 | $2,524 | $88,648 | $16,000 | $72,648 |

| 2014 | $2,362 | $83,648 | $11,000 | $72,648 |

Source: Public Records

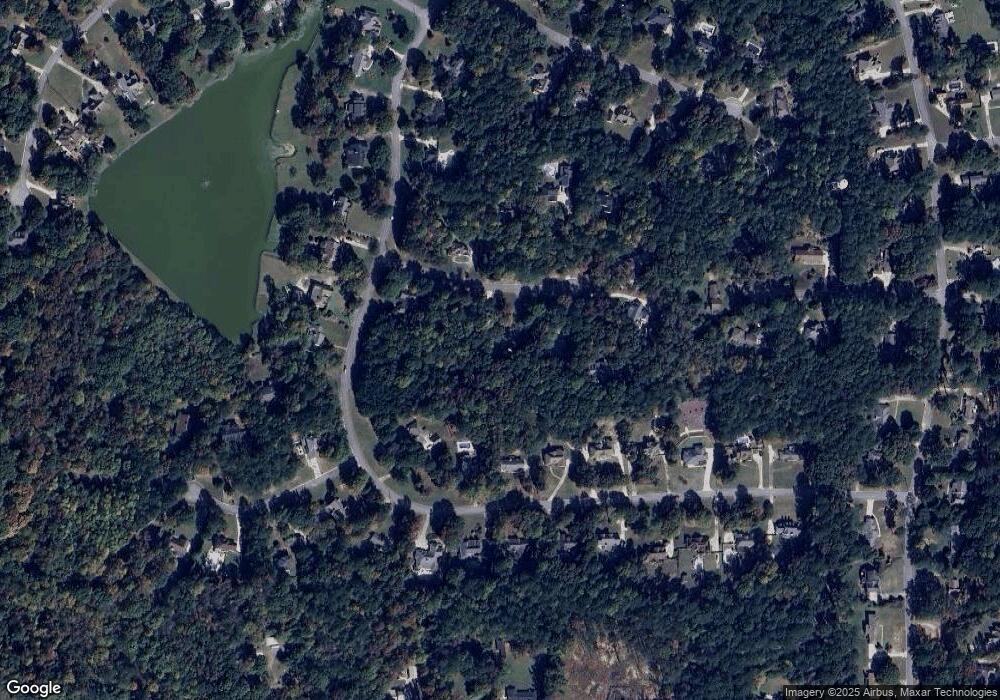

Map

Nearby Homes

- 435 Mapledale Trail

- 430 Mapledale Trail

- 190 Willow Lake Ln

- 135 Willow Lake Ln

- 195 Mapledale Trail Unit 4

- 4791 Highway 34 E

- 160 Old Field Rd

- 5 Timber Walk Place

- 757 Fischer Rd

- 90 Spring Forest Trail

- 374 Beaumont Farms Dr

- 395 Beaumont Farms Dr

- 0 Spring Forest Way Unit LOT 2-1 10483749

- 20 Platinum Ridge

- 2800 Highway 54

- 2940 Highway 54

- 0 Pinegate Way Unit 10436279

- 150 Park Timbers Dr

- 7 Barrington Ct

- Spring Forest Way Lot: 2-1

- 25 Elmtree Dr

- 35 Elmtree Dr Unit VIII

- 500 Mapledale Trail

- 10 Elmtree Dr

- 420 Mapledale Trail Unit 50

- 420 Mapledale Trail

- 510 Mapledale Trail

- 490 Mapledale Trail Unit 54

- 490 Mapledale Trail

- 520 Mapledale Trail

- 460 Mapledale Trail

- 45 Elmtree Dr Unit 8

- 20 Elmtree Dr Unit 8

- 50 Elmtree Dr Unit 8

- 30 Elmtree Dr

- 530 Mapledale Trail

- 40 Elmtree Dr

- 390 Mapledale Trail

- 120 Laurel Ln

- 425 Mapledale Trail