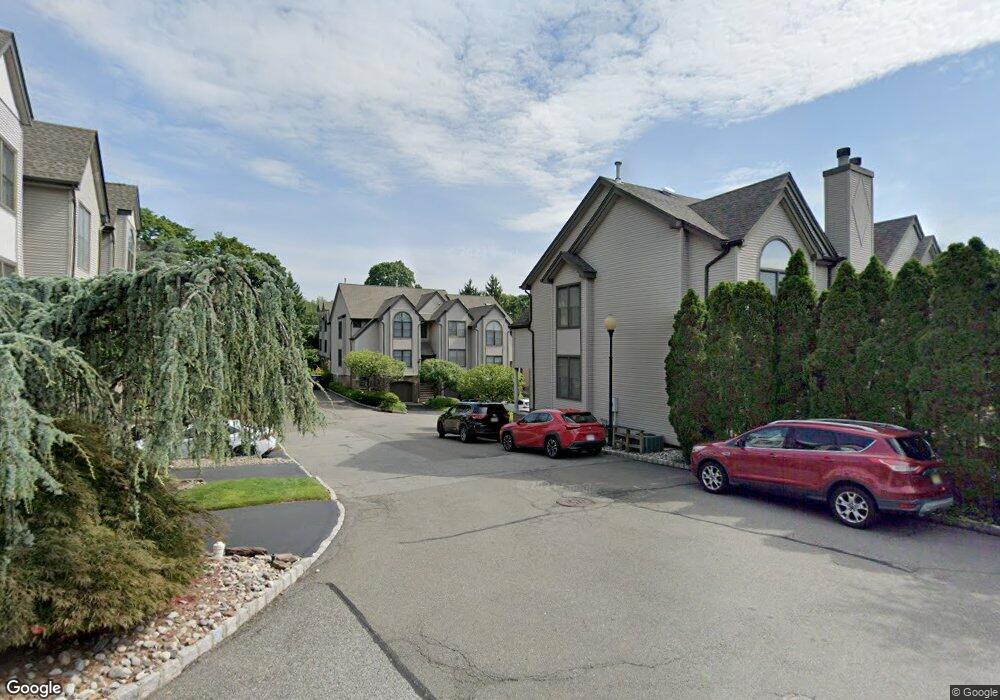

15 Jordan Dr River Edge, NJ 07661

Estimated Value: $665,000 - $741,000

2

Beds

3

Baths

1,701

Sq Ft

$416/Sq Ft

Est. Value

About This Home

This home is located at 15 Jordan Dr, River Edge, NJ 07661 and is currently estimated at $708,350, approximately $416 per square foot. 15 Jordan Dr is a home located in Bergen County with nearby schools including Roosevelt Elementary School, River Dell Middle School, and River Dell Regional High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2004

Sold by

Park Kyeong Hwa

Bought by

Ko Bong Kyun and Ko Seung Hee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,000

Outstanding Balance

$149,750

Interest Rate

5.82%

Estimated Equity

$558,600

Purchase Details

Closed on

May 30, 2002

Sold by

Kerr Marianne

Bought by

Park Kyeong H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,000

Interest Rate

6.81%

Purchase Details

Closed on

Sep 21, 2000

Bought by

Kerr Marianne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

7.81%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ko Bong Kyun | $435,000 | -- | |

| Park Kyeong H | $355,000 | -- | |

| Kerr Marianne | -- | -- | |

| Kerr Marianne | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ko Bong Kyun | $322,000 | |

| Previous Owner | Park Kyeong H | $284,000 | |

| Previous Owner | Kerr Marianne | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,962 | $517,600 | $275,000 | $242,600 |

| 2024 | $12,638 | $326,900 | $150,000 | $176,900 |

| 2023 | $12,095 | $326,900 | $150,000 | $176,900 |

| 2022 | $12,095 | $326,900 | $150,000 | $176,900 |

| 2021 | $11,857 | $326,900 | $150,000 | $176,900 |

| 2020 | $11,670 | $326,900 | $150,000 | $176,900 |

| 2019 | $11,337 | $326,900 | $150,000 | $176,900 |

| 2018 | $11,098 | $326,900 | $150,000 | $176,900 |

| 2017 | $10,990 | $326,900 | $150,000 | $176,900 |

| 2016 | $10,742 | $326,900 | $150,000 | $176,900 |

| 2015 | $10,516 | $326,900 | $150,000 | $176,900 |

| 2014 | $10,536 | $326,900 | $150,000 | $176,900 |

Source: Public Records

Map

Nearby Homes

- 33 Lincoln Ave

- 140 River Edge Ave

- 855 Kinderkamack Rd

- 668 River Rd

- 784 Millbrook Rd

- 712 6th Ave

- 168 Voorhis Ave

- 761 6th Ave

- 276 Greenway Terrace

- 227 Cedar Rd

- 766 7th Ave

- 378 Windsor Rd

- 321 Henley Ave

- 215 Kensington Rd

- 211 Madison Ave

- 374 E Midland Ave

- 204 Woodland Rd

- 394 James Woods Ct

- 195 River Ln

- 331 Ellen Place