150 Brewster St Browns Mills, NJ 08015

Estimated Value: $302,787 - $351,000

--

Bed

--

Bath

1,300

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 150 Brewster St, Browns Mills, NJ 08015 and is currently estimated at $324,447, approximately $249 per square foot. 150 Brewster St is a home located in Burlington County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2007

Sold by

Madaio Michael J

Bought by

Moran Patrick D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,197

Outstanding Balance

$104,456

Interest Rate

6.3%

Mortgage Type

FHA

Estimated Equity

$219,991

Purchase Details

Closed on

May 30, 2001

Sold by

Grabert Raymond R and Grabert Carol S

Bought by

Madaio Michael J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,500

Interest Rate

7.09%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 31, 1994

Sold by

Hernandez Mirna

Bought by

Grabert Raymond and Grabert Carol

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

7.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moran Patrick D | $174,900 | Global Title Agency Partners | |

| Madaio Michael J | $87,900 | -- | |

| Grabert Raymond | $87,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Moran Patrick D | $172,197 | |

| Previous Owner | Madaio Michael J | $86,500 | |

| Previous Owner | Grabert Raymond | $84,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,564 | $148,900 | $38,000 | $110,900 |

| 2024 | $4,282 | $148,900 | $38,000 | $110,900 |

| 2023 | $4,282 | $148,900 | $38,000 | $110,900 |

| 2022 | $3,964 | $148,900 | $38,000 | $110,900 |

| 2021 | $3,801 | $148,900 | $38,000 | $110,900 |

| 2020 | $3,658 | $148,900 | $38,000 | $110,900 |

| 2019 | $3,504 | $148,900 | $38,000 | $110,900 |

| 2018 | $3,385 | $148,900 | $38,000 | $110,900 |

| 2017 | $3,315 | $148,900 | $38,000 | $110,900 |

| 2016 | $3,237 | $86,600 | $19,600 | $67,000 |

| 2015 | $3,211 | $86,600 | $19,600 | $67,000 |

| 2014 | $3,070 | $86,600 | $19,600 | $67,000 |

Source: Public Records

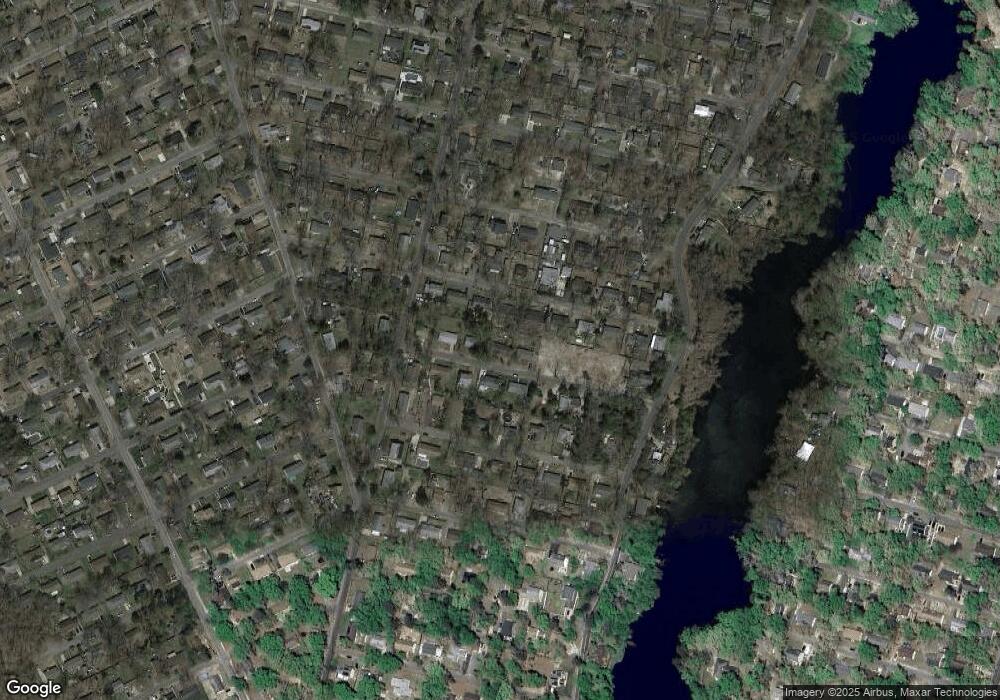

Map

Nearby Homes

- 142 Brewster St

- 158 Brewster St

- 143 Medford St

- 151 Medford St

- 135 Medford St

- 137 Brewster St

- 161 Medford St

- 140 Brewster St

- 145 Brewster St

- 166 Brewster St

- 163 Medford St

- 153 Brewster St

- 127 Medford St

- 146 Medford St

- 138 Brewster St

- 142 Blanche St

- 172 Brewster St

- 156 Medford St

- 134 Blanche St

- 121 Brewster St