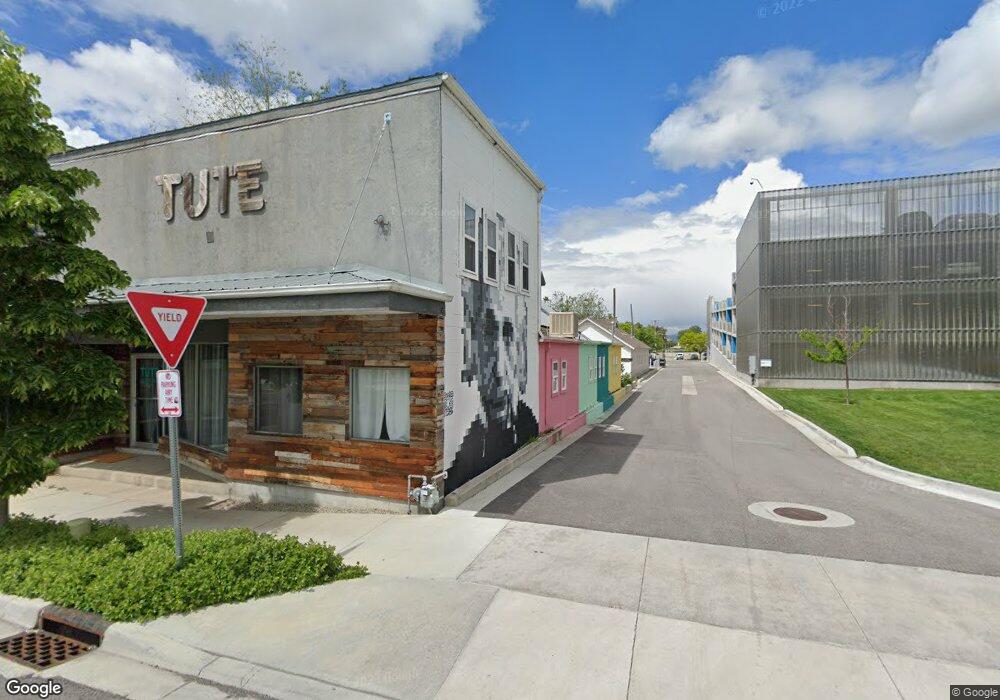

150 S 100 St W Provo, UT 84601

Downtown Provo Neighborhood

Studio

--

Bath

--

Sq Ft

3,049

Sq Ft Lot

About This Home

This home is located at 150 S 100 St W, Provo, UT 84601. 150 S 100 St W is a home located in Utah County with nearby schools including Franklin Elementary School, Dixon Middle School, and Provo High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,635 | $390,005 | -- | -- |

| 2024 | $4,635 | $456,200 | $0 | $0 |

| 2023 | $4,101 | $398,000 | $0 | $0 |

| 2022 | $3,906 | $382,200 | $150,500 | $231,700 |

| 2021 | $3,049 | $286,200 | $77,700 | $208,500 |

| 2020 | $3,353 | $295,000 | $77,700 | $217,300 |

| 2019 | $3,145 | $287,800 | $70,500 | $217,300 |

| 2018 | $3,030 | $281,200 | $67,100 | $214,100 |

| 2017 | $2,641 | $244,900 | $0 | $0 |

| 2016 | $2,366 | $204,500 | $0 | $0 |

| 2015 | $2,080 | $181,700 | $0 | $0 |

| 2014 | $1,894 | $172,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes