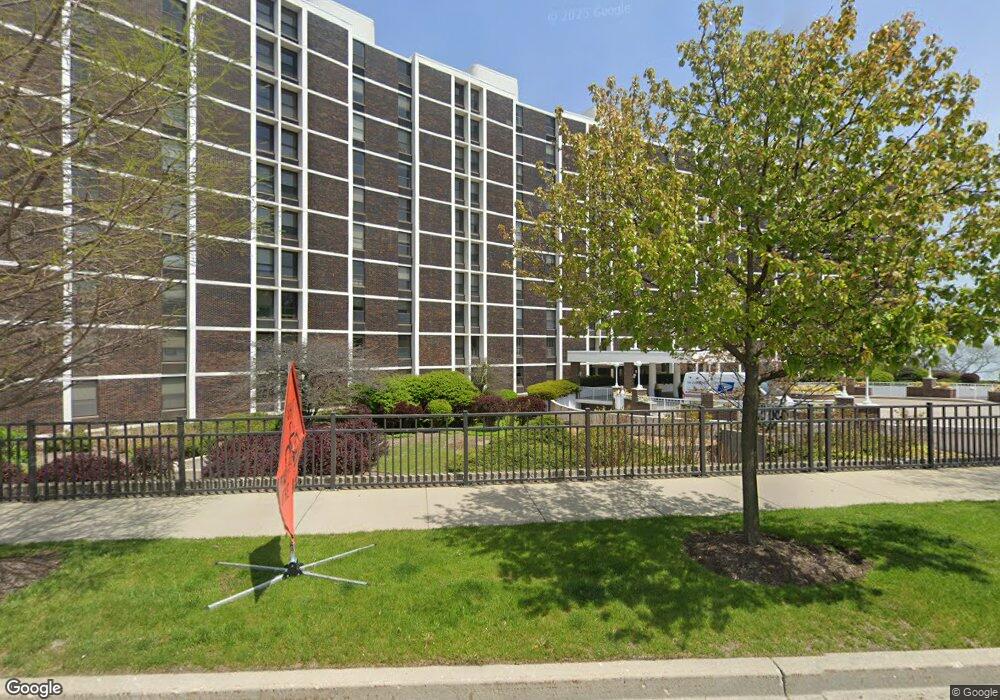

1500 Sheridan Rd, Unit 4L Wilmette, IL 60091

Estimated Value: $554,822 - $740,000

2

Beds

2

Baths

1,647

Sq Ft

$392/Sq Ft

Est. Value

About This Home

This home is located at 1500 Sheridan Rd Unit 4L, Wilmette, IL 60091 and is currently estimated at $645,706, approximately $392 per square foot. 1500 Sheridan Rd Unit 4L is a home located in Cook County with nearby schools including Central Elementary School, Highcrest Middle School, and Wilmette Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2019

Sold by

Denemark Steven and Denemark Steven M

Bought by

Denemark Steven M

Current Estimated Value

Purchase Details

Closed on

Apr 3, 2012

Sold by

Saphir Gizel

Bought by

Denemark Steven

Purchase Details

Closed on

Dec 14, 2011

Sold by

Saphir Gizel

Bought by

Saphir Gizel and Gizel Saphir Revocable Trust

Purchase Details

Closed on

Apr 29, 2004

Sold by

Gassert Mary Elizabeth

Bought by

Saphir Kurt and Saphir Gizel

Purchase Details

Closed on

Sep 18, 1995

Sold by

Gassert Mary Elizabeth

Bought by

Gassert Mary Elizabeth and Elizabeth Gassert Trust

Purchase Details

Closed on

Oct 29, 1992

Sold by

Arnold Leslie and Chill Lauren

Bought by

Gassert Mary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Denemark Steven M | -- | Attorney | |

| Denemark Steven | $272,000 | Chicago Title | |

| Saphir Gizel | -- | None Available | |

| Saphir Kurt | $535,000 | -- | |

| Gassert Mary Elizabeth | -- | -- | |

| Gassert Mary | $280,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,770 | $40,212 | $4,647 | $35,565 |

| 2023 | $7,314 | $40,212 | $4,647 | $35,565 |

| 2022 | $7,314 | $40,212 | $4,647 | $35,565 |

| 2021 | $7,715 | $35,693 | $6,084 | $29,609 |

| 2020 | $8,809 | $40,055 | $6,084 | $33,971 |

| 2019 | $7,829 | $40,491 | $6,084 | $34,407 |

| 2018 | $6,097 | $31,813 | $4,867 | $26,946 |

| 2017 | $6,578 | $31,813 | $4,867 | $26,946 |

| 2016 | $6,372 | $31,813 | $4,867 | $26,946 |

| 2015 | $6,193 | $27,571 | $4,425 | $23,146 |

| 2014 | $6,735 | $27,571 | $4,425 | $23,146 |

| 2013 | $5,819 | $27,571 | $4,425 | $23,146 |

Source: Public Records

About This Building

Map

Nearby Homes

- 1616 Sheridan Rd Unit 9H

- 901 Westerfield Dr

- 1630 Sheridan Rd Unit 5K

- 1630 Sheridan Rd Unit 2F

- 1630 Sheridan Rd Unit 2N

- 1630 Sheridan Rd Unit 2J

- 512 Elmwood Ave

- 141 Kenilworth Ave

- 900 Sheridan Rd

- 501 Sheridan Rd

- 724 12th St Unit 105

- 1025 Central Ave

- 528 Roslyn Rd

- 527 Warwick Rd

- 621 Green Bay Rd

- 315 Washington Ave

- 517 Cumnor Rd

- 526 Linden Ave

- 1142 Oakwood Ave

- 410 Prairie Ave

- 1500 Sheridan Rd Unit TA

- 1500 Sheridan Rd Unit 4E

- 1500 Sheridan Rd Unit 3H

- 1500 Sheridan Rd Unit TC

- 1500 Sheridan Rd Unit 7E

- 1500 Sheridan Rd Unit 7J

- 1500 Sheridan Rd Unit 5G

- 1500 Sheridan Rd Unit TF

- 1500 Sheridan Rd Unit 10I

- 1500 Sheridan Rd Unit 4J

- 1500 Sheridan Rd Unit 6B

- 1500 Sheridan Rd Unit 9H

- 1500 Sheridan Rd Unit 8D

- 1500 Sheridan Rd Unit 9C

- 1500 Sheridan Rd Unit 81

- 1500 Sheridan Rd Unit 7C

- 1500 Sheridan Rd Unit 7H

- 1500 Sheridan Rd Unit 5L

- 1500 Sheridan Rd Unit 2B

- 1500 Sheridan Rd Unit 5F