15046 W Fm 455 Decatur, TX 76234

Estimated Value: $263,000 - $886,000

3

Beds

2

Baths

2,409

Sq Ft

$227/Sq Ft

Est. Value

About This Home

This home is located at 15046 W Fm 455, Decatur, TX 76234 and is currently estimated at $547,116, approximately $227 per square foot. 15046 W Fm 455 is a home located in Denton County with nearby schools including Slidell Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2018

Sold by

Miller Marsha Ann and Miller Charles Randal

Bought by

Newcomb Donald and Paulus Newcomb Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,032

Outstanding Balance

$276,669

Interest Rate

4.8%

Mortgage Type

VA

Estimated Equity

$270,447

Purchase Details

Closed on

Jun 28, 2016

Sold by

Miller Genise M and Miller Lee Daniel

Bought by

Miller Marsha Ann and Miller Charles Randall

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,750

Interest Rate

3.64%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newcomb Donald | -- | Allegiance Title | |

| Miller Marsha Ann | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newcomb Donald | $314,032 | |

| Previous Owner | Miller Marsha Ann | $144,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,961 | $386,881 | $77,594 | $309,287 |

| 2024 | $729 | $388,286 | $77,594 | $310,692 |

| 2023 | $2,876 | $376,722 | $77,594 | $299,128 |

| 2022 | $4,043 | $346,739 | $71,502 | $301,649 |

| 2021 | $3,798 | $317,888 | $37,215 | $280,673 |

| 2020 | $3,628 | $280,081 | $49,964 | $230,117 |

| 2019 | $3,825 | $282,667 | $49,964 | $232,703 |

| 2018 | $3,411 | $247,602 | $49,869 | $197,733 |

| 2017 | $2,948 | $213,117 | $14,633 | $198,484 |

| 2016 | $2,969 | $214,632 | $8,008 | $206,624 |

| 2015 | -- | $196,070 | $2,555 | $193,515 |

| 2013 | -- | $158,738 | $2,501 | $156,237 |

Source: Public Records

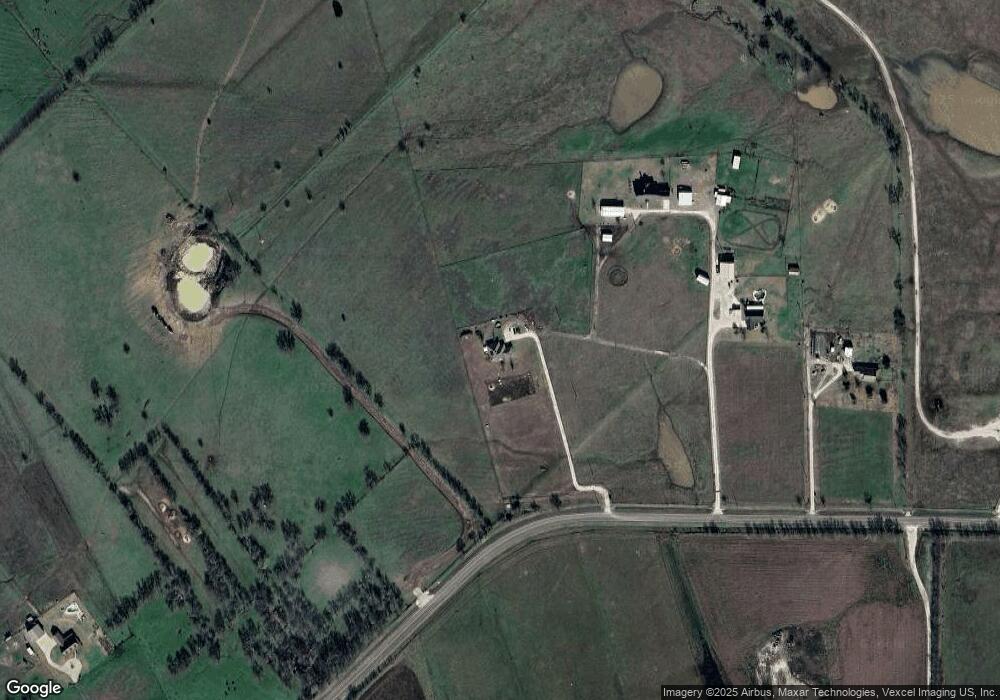

Map

Nearby Homes

- 14410 W Fm 455

- 0 Fm 455 Unit 21033431

- 9725 Atcheson Rd

- n/a Pruett Rd

- 13257 W Fm 455

- 12890 Pruett Rd

- 12880 Pruett Rd

- 171 Cr-2825

- Highway 51

- 12370 Fortenberry Rd

- 16384 Farm To Market Road 1173

- 7244 N Hickory Rd

- 7225 N Hickory Rd

- TBD N Hickory Rd

- 12480 Doyle Rd

- 12530 Doyle Rd

- TBD 7 County Road 2830

- 7220 Tom Trail

- 7220 Christina Ct

- 7257 Tom Trail

- 14964 W Fm 455

- 14950 W Fm 455

- 14904 W Fm 455

- 14711 W Fm 455

- 15400 Farm To Market 455

- 14660 Farm To Market 455

- 14668 W Fm 455 Unit 455

- 15400 W Fm 455

- 14405 W Fm 455

- 0 Fm 455 Unit 14695812

- 0 Fm 455 Unit 13817757

- 0 Fm 455 Unit 455

- 14303 W Fm 455 Unit 455

- 14303 W Fm 455

- 11089 County Line Rd

- 14241 W Fm 455

- 14389 Pruett Rd

- 14333 Pruett Rd

- 17711 Fm 455

- 16092 W Fm 455