1505 S Marshview Rd Unit 1505 Stewartstown, PA 17363

Estimated Value: $282,582 - $309,000

2

Beds

2

Baths

1,512

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 1505 S Marshview Rd Unit 1505, Stewartstown, PA 17363 and is currently estimated at $295,896, approximately $195 per square foot. 1505 S Marshview Rd Unit 1505 is a home located in York County with nearby schools including South Eastern Intermediate School, South Eastern Middle School, and Kennard-Dale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2009

Sold by

Wilson George W and Wilson Margaret Jane

Bought by

Wilson George W and Wilson Margaret Jane

Current Estimated Value

Purchase Details

Closed on

Mar 6, 2008

Sold by

Wilson George W and Wilson Margaret Jane

Bought by

Jarboe Karen Jane and Wilson Jeffrey Bryan

Purchase Details

Closed on

Apr 19, 2007

Sold by

The Villas At Bailey Springs Lp

Bought by

Wilson George W and Wilson Margaret Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Outstanding Balance

$69,837

Interest Rate

6.23%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$226,059

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilson George W | -- | None Available | |

| Jarboe Karen Jane | -- | None Available | |

| Wilson George W | $229,900 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilson George W | $115,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,684 | $159,520 | $0 | $159,520 |

| 2024 | $4,684 | $159,520 | $0 | $159,520 |

| 2023 | $4,684 | $159,520 | $0 | $159,520 |

| 2022 | $4,684 | $159,520 | $0 | $159,520 |

| 2021 | $4,524 | $159,520 | $0 | $159,520 |

| 2020 | $4,524 | $159,520 | $0 | $159,520 |

| 2019 | $4,508 | $159,520 | $0 | $159,520 |

| 2018 | $4,508 | $159,520 | $0 | $159,520 |

| 2017 | $4,508 | $159,520 | $0 | $159,520 |

| 2016 | $0 | $159,520 | $0 | $159,520 |

| 2015 | -- | $159,520 | $0 | $159,520 |

| 2014 | -- | $159,520 | $0 | $159,520 |

Source: Public Records

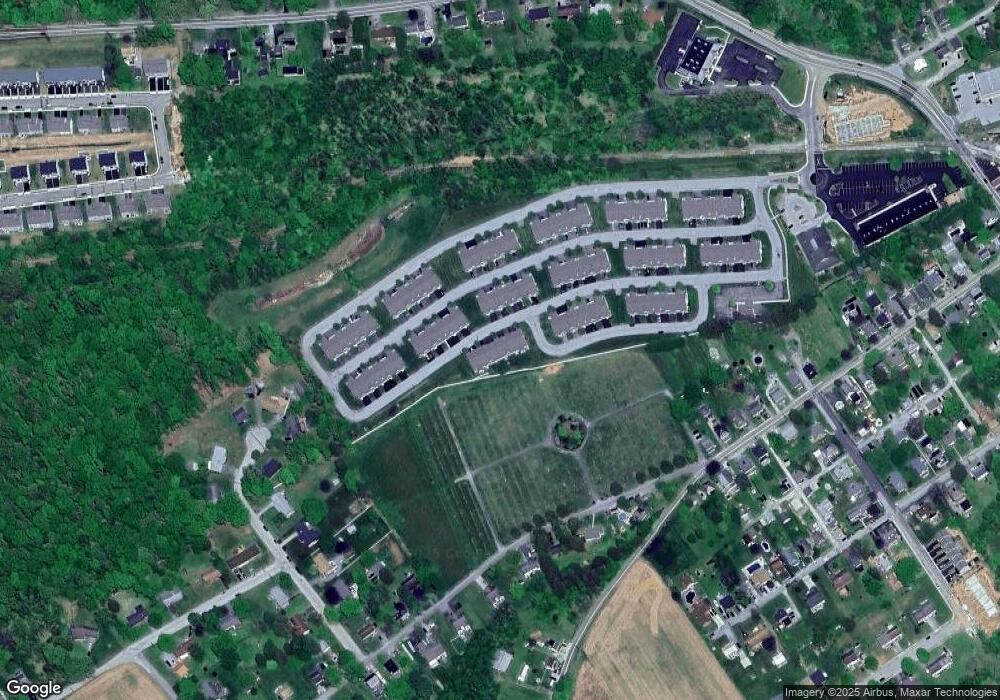

Map

Nearby Homes

- 4341 Forbes Dr

- 231 Cool Spring Ln

- 13 Baneberry St

- 4303 Forbes Dr

- 9 W Pennsylvania Ave

- 2 S Main St

- 103 Hershey Cir

- 82 Piston Ct

- 94 Piston Ct

- 17 Charles Ave

- 150 Patterson Dr Unit 47

- 10 Black Oak Ct

- 160 Patterson Dr Unit 48

- 180 Patterson Dr Unit 50

- 0 Five Forks Rd Unit PAYK2095070

- 0 Five Forks Rd Unit PAYK2095050

- 18007 Dave Anne Cir

- 18010 Dave Anne Cir

- 18183 Piedmont Rd

- 0 Bridgeview Rd Unit PAYK2080146

- 1509 S Marshview Rd Unit 1509

- 1503 S Marshview Rd Unit 1503

- 1501 S Marshview Rd Unit 1501

- 1409 Thistlewood Ln Unit 1409

- 1408 S Marshview Rd Unit 1408

- 1407 Thistlewood Ln Unit 1407

- 1405 Thistlewood Ln Unit 1405

- 1404 S Marshview Rd Unit 1404

- 1403 Thistlewood Ln Unit 1403

- 1401 Thistlewood Ln Unit 1401

- 1209 S Marshview Rd Unit 1209

- 1207 S Marshview Rd Unit 1202

- 1206 Crestview Ln Unit 1206

- 1205 S Marshview Rd Unit 1205

- 1204 Crestview Ln Unit 1204

- 1203 S Marshview Rd Unit 1203

- 1202 Crestview Ln Unit 1202

- 1201 S Marshview Rd Unit 1

- 1109 S Marshview Rd Unit 1109

- 1108 Crestview Ln Unit 1108