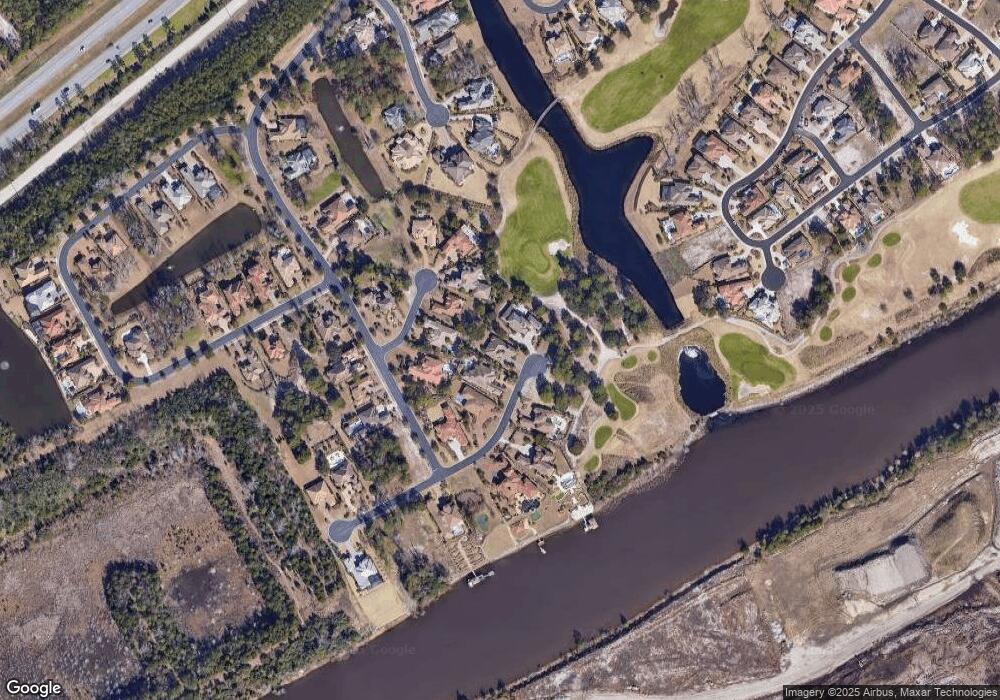

1509 Pachino Dr Unit 44 Palermo Myrtle Beach, SC 29579

Grande Dunes NeighborhoodEstimated Value: $945,037 - $1,274,000

3

Beds

3

Baths

2,770

Sq Ft

$401/Sq Ft

Est. Value

About This Home

This home is located at 1509 Pachino Dr Unit 44 Palermo, Myrtle Beach, SC 29579 and is currently estimated at $1,110,679, approximately $400 per square foot. 1509 Pachino Dr Unit 44 Palermo is a home located in Horry County with nearby schools including Myrtle Beach Child Development Center, Myrtle Beach Elementary School, and Myrtle Beach Primary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2020

Sold by

Mayer Joachim

Bought by

Mayer Joachim H and Mayer Living Trust

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2014

Sold by

Nations Homes Ii Llc

Bought by

Mayer Joachim and Mayer Doris

Purchase Details

Closed on

Jun 20, 2013

Sold by

Daniels George F

Bought by

Nations Homes

Purchase Details

Closed on

Jan 26, 2013

Sold by

Ettinger George

Bought by

Daniels George F

Purchase Details

Closed on

Aug 26, 2005

Sold by

Grande Dunes Development Co Llc

Bought by

Ettinger George and Ettinger Jill

Purchase Details

Closed on

Mar 4, 2005

Sold by

Myrtle Beach Farms Co Inc

Bought by

Grande Dunes Development Co Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mayer Joachim H | -- | -- | |

| Mayer Joachim | $639,000 | -- | |

| Nations Homes | $120,000 | -- | |

| Daniels George F | $70,000 | -- | |

| Ettinger George | $154,900 | -- | |

| Grande Dunes Development Co Llc | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,726 | $56,946 | $24,000 | $32,946 |

| 2023 | $2,726 | $28,313 | $6,081 | $22,232 |

| 2021 | $2,423 | $74,321 | $15,962 | $58,359 |

| 2020 | $2,094 | $74,321 | $15,962 | $58,359 |

| 2019 | $2,168 | $74,321 | $15,962 | $58,359 |

| 2018 | $1,968 | $65,739 | $13,302 | $52,437 |

| 2017 | $1,913 | $37,565 | $7,601 | $29,964 |

| 2016 | -- | $37,565 | $7,601 | $29,964 |

| 2015 | $1,895 | $37,566 | $7,602 | $29,964 |

| 2014 | $1,282 | $5,068 | $5,068 | $0 |

Source: Public Records

Map

Nearby Homes

- 9387 Venezia Cir

- 7129 Spoleto Dr

- 7040 Belancino Blvd

- 1211 Arezzo Ave

- 317 St Julian Ln

- 7210 Sarteano Dr

- 338 St Julian Ln

- 337 St Julian Ln Unit 337 Saint Julian Ln.

- 6620 Pozzallo Place

- 350 Saint Julian Ln

- 369 St Julian Ln

- 373 St Julian Ln

- 8332 Leone Cir

- 6680 Anterselva Dr

- 6892 Belancino Blvd

- 6586 Brindisi St

- 6652 Anterselva Dr

- 378 St Julian Ln

- 414 St Julian Ln

- 420 St Julian Ln

- 1509 Pachino Dr

- 1509 Pachino Dr Unit Lot 44 Pachino

- Lot 44 Pachino Dr

- Lot 44 Pachino Dr Unit Lot 44 Palermo

- 1515 Pachino Dr

- 1515 Pachino Dr Unit 45 Palermo

- 1515 Pachino Dr Unit Lot 45 Palermo

- 1505 Pachino Dr

- 1505 Pachino Dr Unit 43 Palermo

- 1501 Pachino Dr Unit 42 Palermo

- 1501 Pachino Dr

- 1501 Pachino Dr Unit Lot 42 Palermo

- 1501 Pachino Dr Unit Lot 42

- 1518 Alameda Ct

- Lot 41 Pachino Dr

- 1510 Alameda Ct

- 1529 Pachino Dr

- 1529 Pachino Dr Unit Palermo Lot 46

- 1529 Pachino Dr Unit 46 Palermo

- 1504 Alameda Ct Unit 51 Palermo