151 Palisades Point Unit 1512 Cincinnati, OH 45238

Riverside Sedamsville NeighborhoodEstimated Value: $199,000 - $244,240

3

Beds

3

Baths

1,391

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 151 Palisades Point Unit 1512, Cincinnati, OH 45238 and is currently estimated at $217,810, approximately $156 per square foot. 151 Palisades Point Unit 1512 is a home located in Hamilton County with nearby schools including Sayler Park Elementary School, Gilbert A. Dater High School, and Western Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2020

Sold by

Ruberg Donald G and Ruberg Gail M

Bought by

Ruberg Donald G and Ruberg Gail M

Current Estimated Value

Purchase Details

Closed on

Mar 1, 2017

Sold by

Bassett Betty A

Bought by

Ruberg Donald G and Ruberg Gail M

Purchase Details

Closed on

Jul 21, 2015

Sold by

Weber Eileenb C

Bought by

Bassett Betty A

Purchase Details

Closed on

Oct 18, 2013

Sold by

Weber Eileen C

Bought by

Weber Eileen C and Eileen C Weber Revocable Trust

Purchase Details

Closed on

Apr 1, 2008

Sold by

Hamblet Hope G

Bought by

Weber Eileen C

Purchase Details

Closed on

Nov 3, 1999

Sold by

Hamblet Hope G and Hamblet John B

Bought by

Hamblet Hope G

Purchase Details

Closed on

Oct 27, 1998

Sold by

Palisades Ltd

Bought by

Hamblet John B and Hamblet Hope G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ruberg Donald G | -- | None Available | |

| Ruberg Donald G | $140,000 | -- | |

| Bassett Betty A | -- | Chicago Title Company Llc | |

| Weber Eileen C | -- | Attorney | |

| Weber Eileen C | $190,000 | Attorney | |

| Hamblet Hope G | -- | -- | |

| Hamblet John B | $180,000 | L & D Title Agency Inc | |

| Hamblet Hope G | $180,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,042 | $44,233 | $8,050 | $36,183 |

| 2023 | $2,135 | $44,233 | $8,050 | $36,183 |

| 2022 | $2,735 | $49,018 | $6,650 | $42,368 |

| 2021 | $2,626 | $49,018 | $6,650 | $42,368 |

| 2020 | $2,714 | $49,018 | $6,650 | $42,368 |

| 2019 | $2,965 | $49,000 | $6,650 | $42,350 |

| 2018 | $2,970 | $49,000 | $6,650 | $42,350 |

| 2017 | $3,444 | $49,000 | $6,650 | $42,350 |

| 2016 | $3,937 | $55,266 | $6,773 | $48,493 |

| 2015 | $2,975 | $55,266 | $6,773 | $48,493 |

| 2014 | $2,997 | $55,266 | $6,773 | $48,493 |

| 2013 | $3,642 | $64,264 | $7,875 | $56,389 |

Source: Public Records

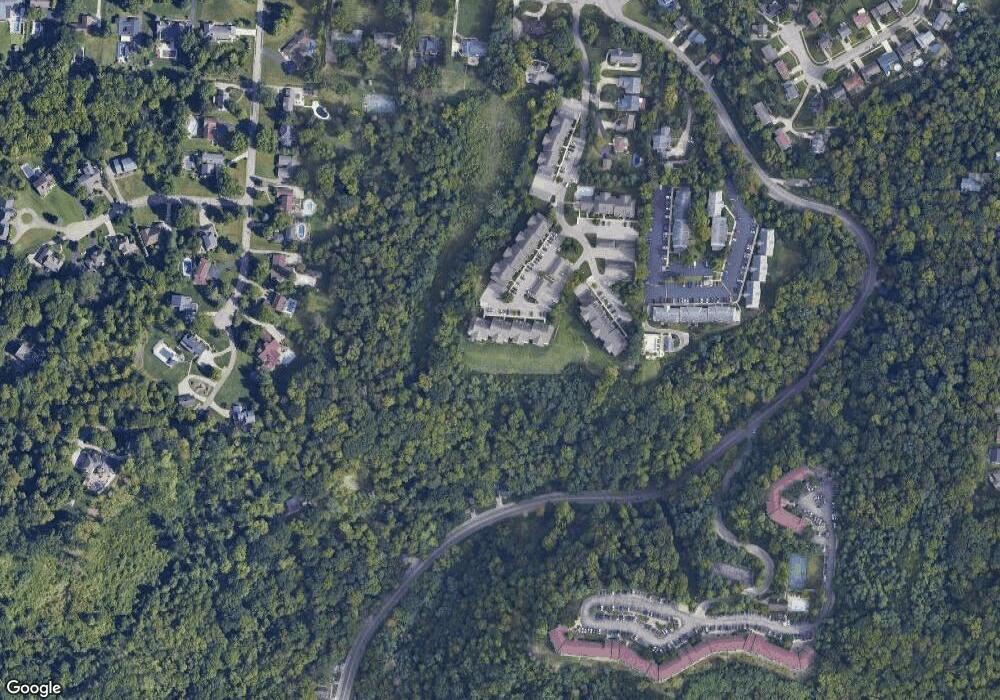

Map

Nearby Homes

- 155 Palisades Point

- 190 Anderson Ferry Rd

- 5062 Orangelawn Dr

- 311 Anderson Ferry Rd

- 5084 Francisvalley Ct

- 207 Greenwell Ave

- 5027 Giles Ct

- 263 Clareknoll Ct

- 5424 Delhi Rd

- 3938 Hillside Ave

- 3377 Hillside Ave

- 3389 Hillside Ave

- 309 Greenwell Ave

- 4189 River Rd

- 4231 River Rd Unit Parcel-A-B-C

- 4231 River Rd Unit Parcel-B

- 4231 River Rd Unit Parcel-A

- 4231 River Rd Unit Parcel-C

- 3018 Observatory Hill Ct

- 461 Happy Dr

- 151 Palisades Point

- 151 Palisades Point

- 155 Palisades Point

- 151 Palisades Point

- 155 Palisades Point Unit 1552

- 155 Palisades Point Unit 1553

- 155 Palisades Point

- 151 Palisades Point

- 155 Palisades Point Unit 1555

- 151 Palisades Point Unit 6

- 155 Palisades Point Unit 2

- 155 Palisades Point Unit 5

- 151 Palisades Point Unit POINTE

- 157 Palisades Point

- 157 Palisades Point

- 157 Palisades Point

- 157 Palisades Point

- 157 Palisades Point

- 157 Palisades Point Unit 1574

- 157 Palisades Point Unit 1