Estimated Value: $190,000 - $252,000

3

Beds

2

Baths

1,410

Sq Ft

$159/Sq Ft

Est. Value

About This Home

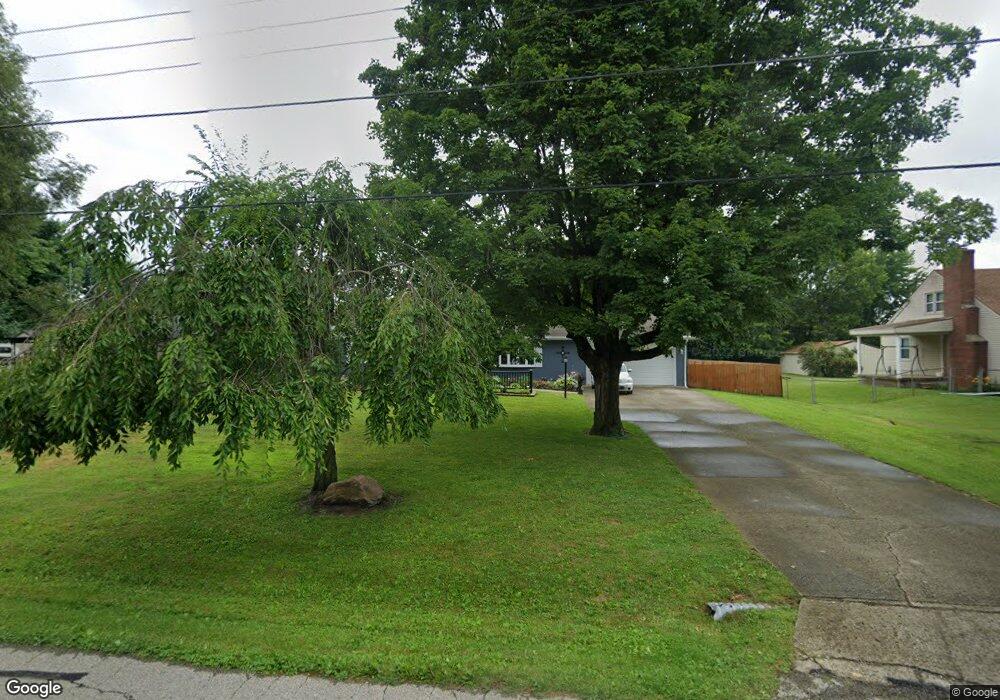

This home is located at 151 Robert Ln, Xenia, OH 45385 and is currently estimated at $224,405, approximately $159 per square foot. 151 Robert Ln is a home located in Greene County with nearby schools including Xenia High School, Summit Academy Community School for Alternative Learners - Xenia, and Legacy Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2015

Sold by

Ryder Peter M

Bought by

Liming Donald W and Liming Peggy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,080

Outstanding Balance

$78,554

Interest Rate

3.73%

Mortgage Type

VA

Estimated Equity

$145,851

Purchase Details

Closed on

Sep 4, 2008

Sold by

King Moana J and Stevens Kendra P

Bought by

Ryder Properties Llc

Purchase Details

Closed on

Sep 25, 2007

Sold by

Estate Of Paul Kendall Stevens

Bought by

King Moana J and Stevens Kendra P

Purchase Details

Closed on

May 11, 2007

Sold by

Estate Of Sara Jane Stevens

Bought by

Stevens Paul Kendall

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Liming Donald W | $100,300 | None Available | |

| Ryder Properties Llc | $86,000 | None Available | |

| King Moana J | -- | Attorney | |

| Stevens Paul Kendall | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Liming Donald W | $102,080 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,635 | $65,370 | $11,220 | $54,150 |

| 2023 | $2,635 | $65,370 | $11,220 | $54,150 |

| 2022 | $2,285 | $52,460 | $10,590 | $41,870 |

| 2021 | $2,314 | $52,460 | $10,590 | $41,870 |

| 2020 | $2,221 | $52,460 | $10,590 | $41,870 |

| 2019 | $2,366 | $43,700 | $7,410 | $36,290 |

| 2018 | $2,374 | $43,700 | $7,410 | $36,290 |

| 2017 | $2,247 | $43,700 | $7,410 | $36,290 |

| 2016 | $2,248 | $40,700 | $7,410 | $33,290 |

| 2015 | $2,315 | $40,700 | $7,410 | $33,290 |

| 2014 | $1,256 | $40,700 | $7,410 | $33,290 |

Source: Public Records

Map

Nearby Homes

- 91 Tackett Dr

- 1351 Omard Dr

- 1283 June Dr

- 145 Cato Dr

- 343 Sheelin Rd

- 1211 June Dr

- 121 S Progress Dr

- 1342 Kylemore Dr

- 1144 Rockwell Dr

- 883 Omard Dr

- 509 Antrim Rd

- 1362 Arrowhead Trail

- 1010 Bellbrook Ave

- 161 Montana Dr

- 1731 Navajo Dr

- 305-325 Bellbrook Ave

- 1272 Bellbrook Ave

- 1772 Maumee Dr

- 219 Kansas Dr

- 1874 Pennsylvania Dr