15104 Vicars Way Gaithersburg, MD 20878

Estimated Value: $1,181,666 - $1,269,000

--

Bed

4

Baths

4,132

Sq Ft

$295/Sq Ft

Est. Value

About This Home

This home is located at 15104 Vicars Way, Gaithersburg, MD 20878 and is currently estimated at $1,216,917, approximately $294 per square foot. 15104 Vicars Way is a home located in Montgomery County with nearby schools including Gudith Elementary School, Darnestown Elementary School, and Emerson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 5, 2019

Sold by

Carter William B and Carter Carol E

Bought by

Carter William Bradley and Carter Carol Elizabeth

Current Estimated Value

Purchase Details

Closed on

Jun 23, 2004

Sold by

Equity Homes L P

Bought by

Carter William B and Carter Carol E

Purchase Details

Closed on

Jun 15, 2004

Sold by

Equity Homes L P

Bought by

Carter William B and Carter Carol E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carter William Bradley | -- | None Available | |

| Carter William B | $907,900 | -- | |

| Carter William B | $907,900 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,266 | $902,967 | -- | -- |

| 2024 | $10,266 | $841,000 | $307,100 | $533,900 |

| 2023 | $9,390 | $827,667 | $0 | $0 |

| 2022 | $6,564 | $814,333 | $0 | $0 |

| 2021 | $8,611 | $801,000 | $292,500 | $508,500 |

| 2020 | $8,583 | $801,000 | $292,500 | $508,500 |

| 2019 | $8,562 | $801,000 | $292,500 | $508,500 |

| 2018 | $9,162 | $854,600 | $292,500 | $562,100 |

| 2017 | $9,533 | $854,600 | $0 | $0 |

| 2016 | -- | $854,600 | $0 | $0 |

| 2015 | $8,745 | $869,300 | $0 | $0 |

| 2014 | $8,745 | $864,400 | $0 | $0 |

Source: Public Records

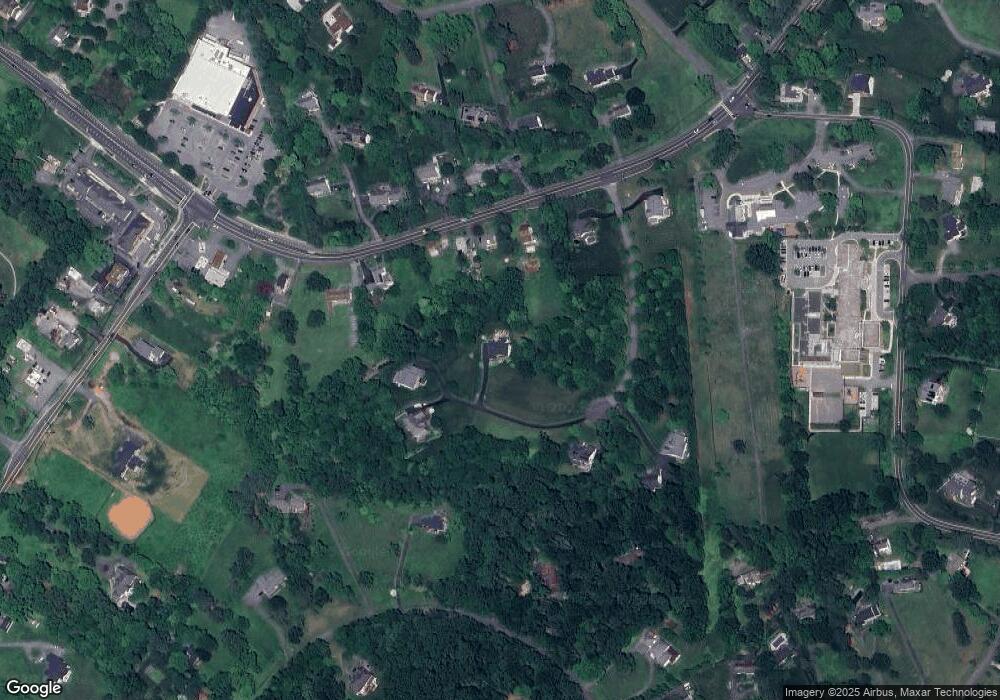

Map

Nearby Homes

- 14209 Seneca Rd

- 14824 Turkey Foot Rd

- 14239 Seneca Rd

- 13300 Wye Oak Dr

- 0 Darnestown Rd

- 14503 Falling Leaf Ct

- 14427 Seneca Rd

- 15205 Quail Run Dr

- Hampton Plan at Seneca Farms

- Hampton II Plan at Seneca Farms

- 12907 Quail Run Ct

- 12902 Quail Run Ct

- 14413 Weathered Barn Ct

- 14516 Pioneer Hills Dr

- 15613 Ancient Oak Dr

- 14051 Esworthy Rd

- 14421 Brookmead Dr

- 14430 Jones

- 12709 War Admiral Way

- 14303 Jones

- 15100 Vicars Way

- 15105 Vicars Way

- 13904 Darnestown Rd

- 13908 Darnestown Rd

- 13900 Darnestown Rd

- 13912 Darnestown Rd

- 15116 Vicars Way

- 15113 Vicars Way

- 15101 Vicars Way

- 13920 Darnestown Rd

- 15109 Vicars Way

- 13509 Shearwater

- 14813 Mockingbird Dr

- 13901 Darnestown Rd

- 15117 Vicars Way

- 14000 Darnestown Rd

- 13905 Darnestown Rd

- 13909 Darnestown Rd

- 14809 Mockingbird Dr

- 14805 Mockingbird Dr