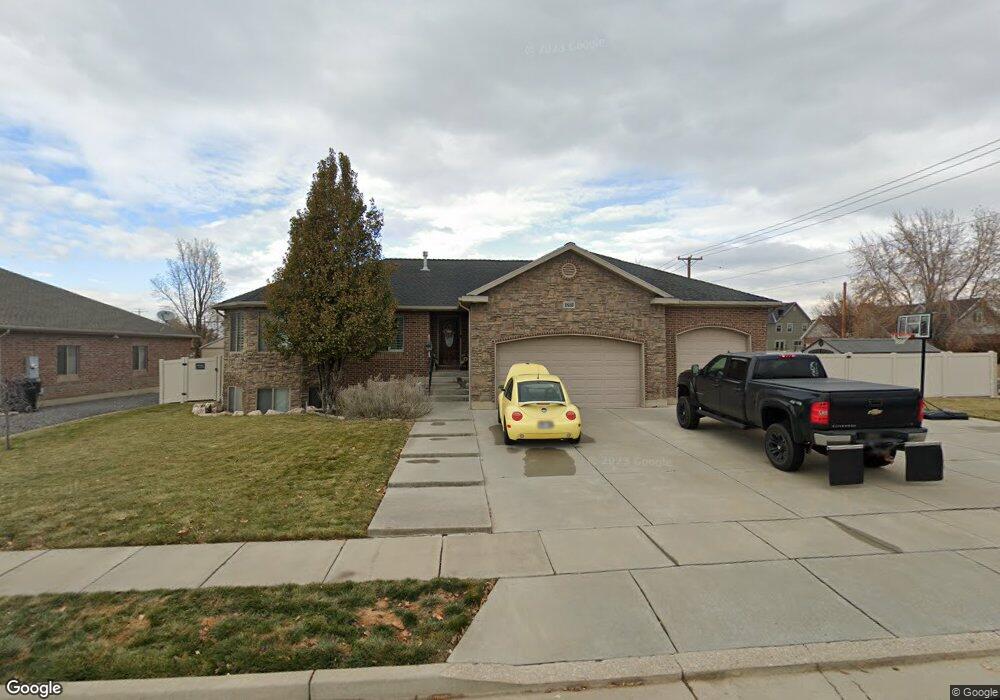

1516 W 1520 N Clearfield, UT 84015

Estimated Value: $474,000 - $600,000

3

Beds

2

Baths

3,592

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 1516 W 1520 N, Clearfield, UT 84015 and is currently estimated at $562,972, approximately $156 per square foot. 1516 W 1520 N is a home located in Davis County with nearby schools including Clinton Elementary School, Sunset Junior High School, and Clearfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2008

Sold by

Ken Mitchell Development Company Inc

Bought by

Long Christopher Paul and Long Michelle Rae

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$349,804

Outstanding Balance

$226,611

Interest Rate

5.9%

Mortgage Type

VA

Estimated Equity

$336,361

Purchase Details

Closed on

Mar 31, 2008

Sold by

Kecher Development Llc

Bought by

Ken Mitchell Development Co Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Long Christopher Paul | -- | Founders Title Co L | |

| Ken Mitchell Development Co Inc | -- | Founders Title Co Layton |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Long Christopher Paul | $349,804 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,158 | $311,850 | $105,198 | $206,652 |

| 2024 | $2,044 | $298,650 | $113,452 | $185,198 |

| 2023 | $1,933 | $520,000 | $132,924 | $387,076 |

| 2022 | $2,450 | $299,200 | $76,677 | $222,523 |

| 2021 | $2,226 | $427,000 | $103,907 | $323,093 |

| 2020 | $1,929 | $379,000 | $92,762 | $286,238 |

| 2019 | $1,804 | $353,000 | $100,230 | $252,770 |

| 2018 | $1,666 | $327,000 | $83,640 | $243,360 |

| 2016 | $1,611 | $166,595 | $33,459 | $133,136 |

| 2015 | $2,313 | $158,345 | $33,459 | $124,886 |

| 2014 | $1,551 | $157,460 | $33,459 | $124,001 |

| 2013 | -- | $155,743 | $29,647 | $126,096 |

Source: Public Records

Map

Nearby Homes