Estimated Value: $114,289 - $143,000

2

Beds

1

Bath

1,184

Sq Ft

$109/Sq Ft

Est. Value

About This Home

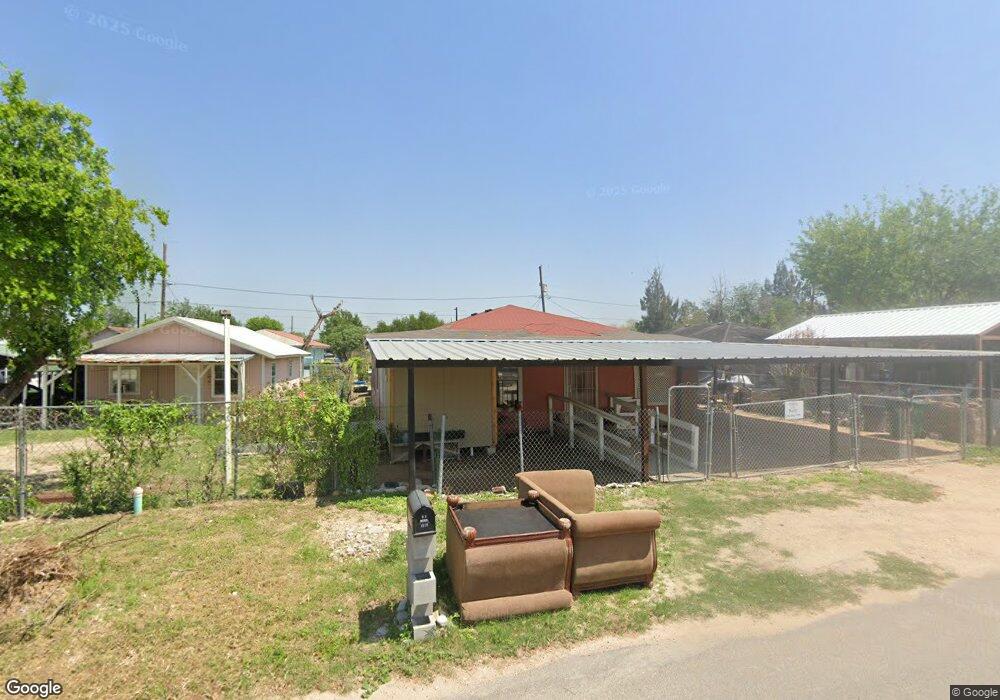

This home is located at 1518 Cathy St, Alamo, TX 78516 and is currently estimated at $128,572, approximately $108 per square foot. 1518 Cathy St is a home located in Hidalgo County with nearby schools including Marcia R. Garza Elementary, Jesus "Jesse" Vela Jr. Middle School, and PSJA Memorial Early College High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2025

Sold by

Hernandez Hilaria

Bought by

Los Vecindades Rgv Lp

Current Estimated Value

Purchase Details

Closed on

Aug 19, 2016

Sold by

Cordoba Heights Rgv Lp

Bought by

Llanas Laura Nayeli

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,950

Interest Rate

3.42%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Sep 1, 2005

Sold by

Mota Maria and Quirino Andres

Bought by

Azteca Proyecto

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$8,147

Interest Rate

5.65%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Los Vecindades Rgv Lp | -- | Corporation Service | |

| Llanas Laura Nayeli | -- | None Available | |

| Azteca Proyecto | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Llanas Laura Nayeli | $40,950 | |

| Previous Owner | Azteca Proyecto | $8,147 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $814 | $93,114 | -- | -- |

| 2024 | $814 | $84,649 | -- | -- |

| 2023 | $1,489 | $76,954 | $0 | $0 |

| 2022 | $1,150 | $54,472 | $0 | $0 |

| 2021 | $1,071 | $49,520 | $16,827 | $35,297 |

| 2020 | $991 | $45,018 | $16,827 | $31,307 |

| 2019 | $944 | $40,925 | $13,462 | $27,463 |

| 2018 | $966 | $41,560 | $13,462 | $28,098 |

| 2017 | $990 | $42,193 | $13,462 | $28,731 |

| 2016 | $802 | $34,189 | $11,908 | $22,281 |

| 2015 | $651 | $34,718 | $11,908 | $22,810 |

Source: Public Records

Map

Nearby Homes

- 332 Alazan Ln

- 907 Loma Linda St

- 1315 Carlos Dr

- 1339 Middle St

- 1310 S 9th St

- 321 Rancho Blanco Rd

- 530 Jaguar Dr

- 324 San Vicente Dr

- 1410 S Alamo Rd

- 1314 Carlos Dr

- 323 San Angelo Dr

- 910 Trinity St

- 917 Trinity St

- 1311 Carlos Dr

- 1309 Carlos Dr

- 1315 Middle St

- 607 Tower Oak Dr

- 514 Tower Oak Dr

- 519 Tower Oak Dr

- 507 Tower Oak Dr