1519 Lafayette Dr Unit 159A Columbus, OH 43220

Estimated Value: $205,434 - $292,000

2

Beds

2

Baths

1,075

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 1519 Lafayette Dr Unit 159A, Columbus, OH 43220 and is currently estimated at $240,859, approximately $224 per square foot. 1519 Lafayette Dr Unit 159A is a home located in Franklin County with nearby schools including Greensview Elementary School, Hastings Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 29, 2009

Sold by

Adams Christopher B

Bought by

Courtney Kristine A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$63,386

Interest Rate

4.83%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$177,473

Purchase Details

Closed on

Jun 30, 2004

Sold by

Meyer Leslie A

Bought by

Adams Christopher B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,600

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 24, 1999

Sold by

Clausing William E

Bought by

Meyer Leslie A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,300

Interest Rate

6.92%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 11, 1996

Sold by

Janice B Pardi Trst

Bought by

Clausing John G

Purchase Details

Closed on

May 1, 1979

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Courtney Kristine A | $135,000 | Attorney | |

| Adams Christopher B | $122,000 | Peak Title | |

| Meyer Leslie A | $86,300 | -- | |

| Clausing John G | $65,000 | -- | |

| -- | $49,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Courtney Kristine A | $100,000 | |

| Previous Owner | Adams Christopher B | $97,600 | |

| Previous Owner | Meyer Leslie A | $66,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,123 | $53,940 | $15,050 | $38,890 |

| 2023 | $3,084 | $53,940 | $15,050 | $38,890 |

| 2022 | $2,996 | $42,880 | $11,830 | $31,050 |

| 2021 | $2,652 | $42,880 | $11,830 | $31,050 |

| 2020 | $2,629 | $42,880 | $11,830 | $31,050 |

| 2019 | $2,202 | $31,750 | $8,750 | $23,000 |

| 2018 | $1,886 | $31,750 | $8,750 | $23,000 |

| 2017 | $2,185 | $31,750 | $8,750 | $23,000 |

| 2016 | $1,584 | $23,950 | $5,780 | $18,170 |

| 2015 | $1,582 | $23,950 | $5,780 | $18,170 |

| 2014 | $1,584 | $23,950 | $5,780 | $18,170 |

| 2013 | $924 | $26,600 | $6,405 | $20,195 |

Source: Public Records

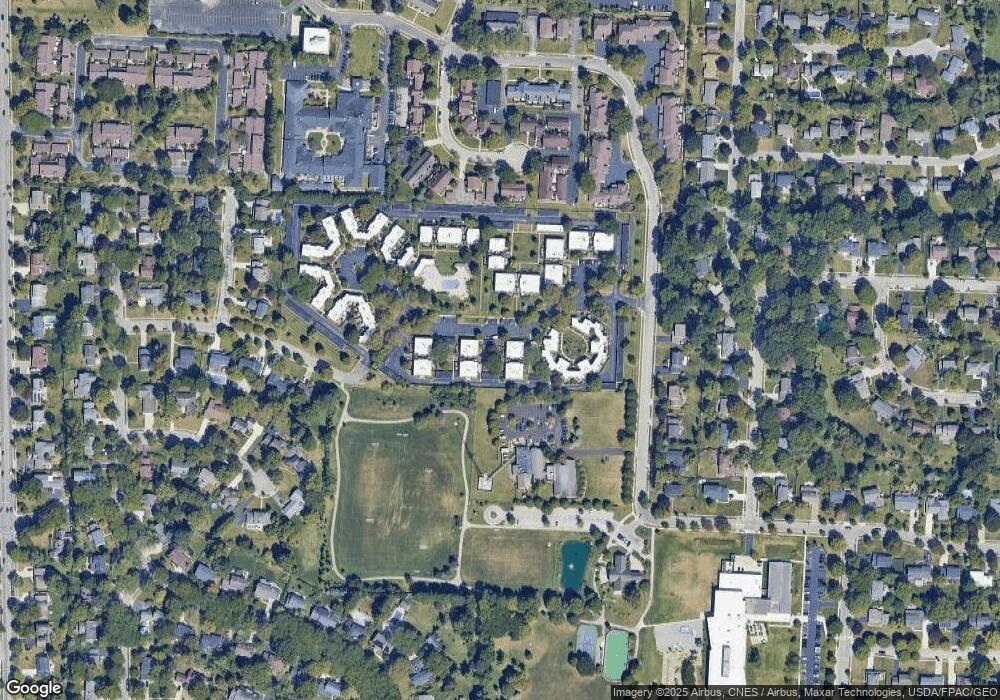

Map

Nearby Homes

- 1512 Lafayette Dr Unit B

- 1514 Lafayette Dr Unit B

- 1594 Lafayette Dr Unit 1594

- 1610 Lafayette Dr Unit 1610

- 1424 Havencrest Ct

- 1360 Langston Dr

- 1501 Bridgeton Dr

- 4543 Ducrest Dr

- 4714-4716 Arthur Ct

- 4818 -4820 Winterset Dr

- 4094 Lyon Dr

- 4326 Kenny Rd

- 4720 Merrifield Place Unit 67

- 1466 Weybridge Rd

- 4924 Reed Rd Unit B

- 1033 Folkestone Rd

- 1835 Willoway Cir N

- 4692 Charecote Ln Unit E

- 2060 Fontenay Place

- 1865 Willoway Cir N Unit 1865

- 1519 Lafayette Dr Unit 1519B

- 1517 Lafayette Dr

- 1511 Lafayette Dr

- 1517 Lafayette Dr Unit 1517B

- 1511 Lafayette Dr Unit 1511A

- 1511 Lafayette Dr Unit A

- 1519 Lafayette Dr

- 1519 Lafayette Dr Unit A

- 1519 Lafayette Dr Unit B

- 1517 Lafayette Dr Unit B

- 1515 Lafayette Dr

- 1515 Lafayette Dr Unit 1515B

- 1515 Lafayette Dr Unit B

- 1515 Lafayette Dr Unit A

- 1539 Lafayette Dr Unit 1539B

- 1535 Lafayette Dr Unit 1535B

- 1537 Lafayette Dr Unit 1537A

- 1539 Lafayette Dr Unit 1539A

- 1535 Lafayette Dr

- 1537 Lafayette Dr Unit 1537B