152 Fincharn Ln Unit 59 Inverness, IL 60067

Estimated Value: $591,744 - $721,000

3

Beds

--

Bath

2,507

Sq Ft

$263/Sq Ft

Est. Value

About This Home

This home is located at 152 Fincharn Ln Unit 59, Inverness, IL 60067 and is currently estimated at $660,186, approximately $263 per square foot. 152 Fincharn Ln Unit 59 is a home located in Cook County with nearby schools including Thomas Jefferson Elementary School, Marion Jordan Elementary School, and Nielson Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2017

Sold by

Cordell Sandra S

Bought by

Ishak Noreen M and Ishak Noreen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$208,050

Interest Rate

3.95%

Mortgage Type

New Conventional

Estimated Equity

$452,136

Purchase Details

Closed on

Oct 27, 1995

Sold by

Nelson Richard E and Nelson Beverly

Bought by

Hermanek Donald J and Hermanek Pamela J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$274,000

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ishak Noreen M | $489,500 | Atorney | |

| Hermanek Donald J | $360,000 | Intercounty Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ishak Noreen M | $250,000 | |

| Previous Owner | Hermanek Donald J | $274,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,134 | $44,452 | $3,460 | $40,992 |

| 2023 | $10,806 | $44,452 | $3,460 | $40,992 |

| 2022 | $10,806 | $44,452 | $3,460 | $40,992 |

| 2021 | $10,514 | $39,410 | $2,306 | $37,104 |

| 2020 | $10,466 | $39,410 | $2,306 | $37,104 |

| 2019 | $10,396 | $43,843 | $2,306 | $41,537 |

| 2018 | $10,251 | $40,821 | $1,922 | $38,899 |

| 2017 | $10,081 | $40,821 | $1,922 | $38,899 |

| 2016 | $9,917 | $40,821 | $1,922 | $38,899 |

| 2015 | $8,784 | $34,333 | $1,537 | $32,796 |

| 2014 | $9,107 | $35,775 | $1,537 | $34,238 |

| 2013 | $8,809 | $35,775 | $1,537 | $34,238 |

Source: Public Records

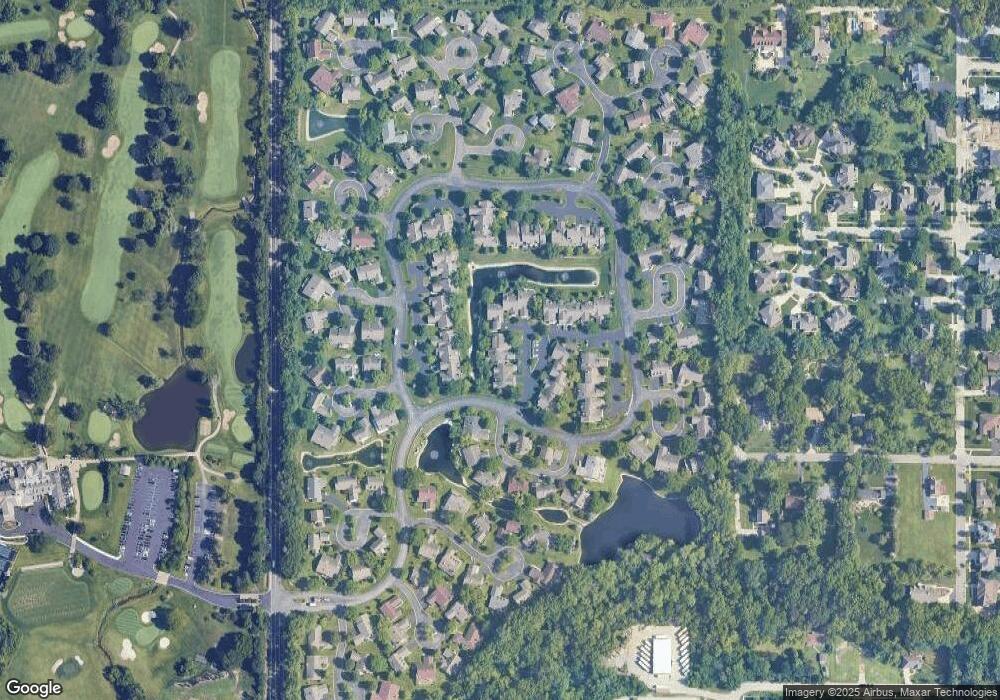

Map

Nearby Homes

- 192 Glamis Ln Unit 131

- 105 Craigie Ln Unit 22

- 130 Warkworth Ln Unit 83

- 43 Ravenscraig Ln Unit 34

- 558 Saint Andrews Ln

- 1596 W Palatine Rd

- 951 W Willow St

- 1124 W Colfax St

- 667 N Morrison Ave

- 1842 Thomas Atkinson Rd

- 886 W Palatine Rd

- 550 N Quentin Rd

- 580 N Quentin Rd

- 77 N Quentin Rd Unit 414

- 1379 W Deer Ct

- 842 N Maple Ave Unit 44

- 848 W Kenilworth Ave

- 882 N Franklin Ave

- 1068 N Coolidge Ave

- 1048 N Palos Ave

- 154 Fincharn Ln Unit 60

- 146 Crichton Ln Unit 58

- 144 Crichton Ln Unit 57

- 143 Aberdour Ln Unit 109

- 158 Fincharn Ln Unit 61

- 166 Fincharn Ln Unit 64

- 142 Crichton Ln Unit 56

- 145 Aberdour Ln Unit 110

- 160 Fincharn Ln Unit 62

- 162 Fincharn Ln Unit 63

- 139 Strome Ln Unit 108

- 147 Aberdour Ln Unit 111

- 137 Strome Ln

- 137 Strome Ln Unit 107

- 172 Blair Ln Unit 122

- 138 Crichton Ln Unit 55

- 135 Strome Ln Unit 106

- 136 Crichton Ln Unit 54

- 136 Crichton Ln Unit 136

- 133 Strome Ln Unit 105